【Needle Coke】 An Overview of Needle Coke Capacity and Production in China

【Needle Coke】 An Overview of Needle Coke

Capacity and Production in China

1. Needle Coke Capacity

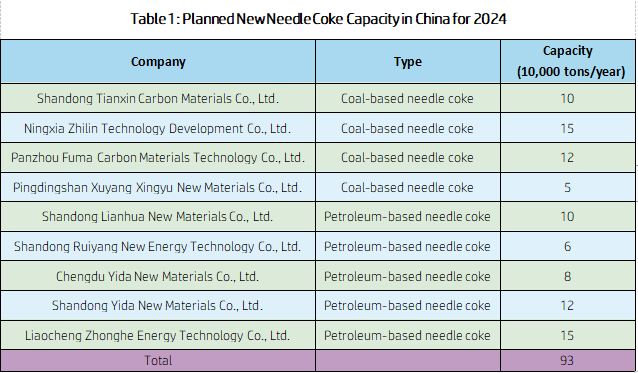

In 2023, the global needle coke capacity reached 4.848 million ton/year, with China's needle coke capacity accounting for 3.798 million ton/year, representing 78.3% of the global capacity. The proportion of China's needle coke capacity in the global total has been increasing annually. Overseas needle coke capacity remains stable at 1.05 million tons per year. In China, the total needle coke capacity comprises 1.35 million tons per year for coal-based needle coke (35.5%) and 2.448 million tons per year for Petroleum-based needle coke (64.5%). Overseas needle coke capacity is concentrated in the UK, the US, Japan, and South Korea. China's needle coke capacity is mainly concentrated in Shandong, Liaoning, and Shanxi, accounting for 73.9% of the total, with Shanxi entirely producing coal-based needle coke. In 2024, China plans to add 930,000 tons per year of needle coke capacity, mainly distributed in Shandong (56.9%). The new capacity will predominantly be Petroleum-based needle coke, accounting for 54.8% (see Table 1). Needle coke is used to produce ultra-high power graphite electrodes for short-process electric arc furnace steelmaking.

2. Needle Coke Production

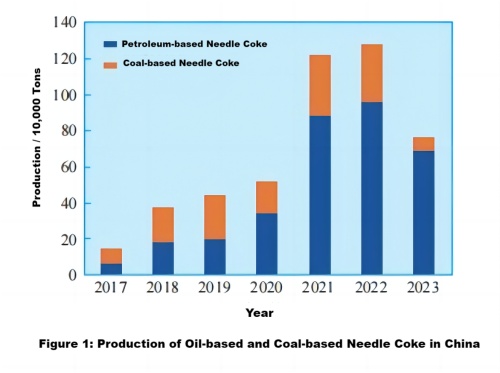

In 2023, China's needle coke production was 764,000 tons, a year-on-year decrease of 40.6%, primarily due to high inventory levels in 2022 and the growing demand for medium and low sulfur petroleum coke. Of this, Petroleum-based needle coke production was 683,000 tons, accounting for 89.4%, with major producers including Shandong Qinyang Technology, Shandong Yida New Materials, and Jinzhou Petrochemical. Coal-based needle coke production was 81,000 tons, accounting for 10.6% (see Figure 1), with major producers including Baowu Carbon and Anshan Zhongte. Overall, the capacity utilization rates for oil-based and coal-based needle coke were 28.1% and 6.1%, respectively, down 30.0 and 19.1 percentage points from 2022, indicating a significant decrease in utilization. Additionally, coal-based needle coke production decreased by 74.5% from 2022, primarily due to high raw material costs for coal tar, affecting the operational rate of the coal-based needle coke industry and resulting in a production decline.

Feel free to reach out to us at any time for more information regarding the needle coke market. Our team is dedicated to providing you with in-depth insights and tailored assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to assist you with the utmost dedication.

No related results found

0 Replies