【Ultra-High Power Graphite Electrodes】 July Price Trends and Market Outlook

【Ultra-High Power Graphite Electrodes】July Price Trends and Market Outlook

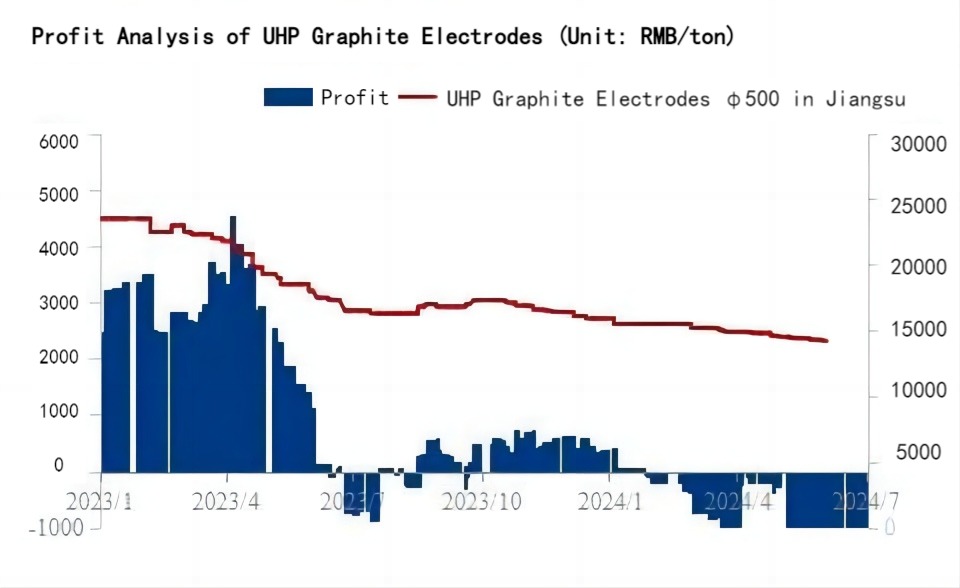

In June, Chinese domestic market for ultra-high power graphite electrodes exhibited a weak trend, with prices decreasing by 200 RMB/ton month-on-month. Competitive pricing pressures persisted but decreased compared to earlier periods. Due to long-term losses, manufacturers of graphite electrodes showed low enthusiasm for production, with most operating on a "made-to-order" basis.

I. Review - Gradual Price Decline

In June, Chinese domestic ultra-high power graphite electrode prices weakened, with fewer instances of proactive price reductions. The state of losses showed no significant improvement, and the enthusiasm for production among enterprises remained low.

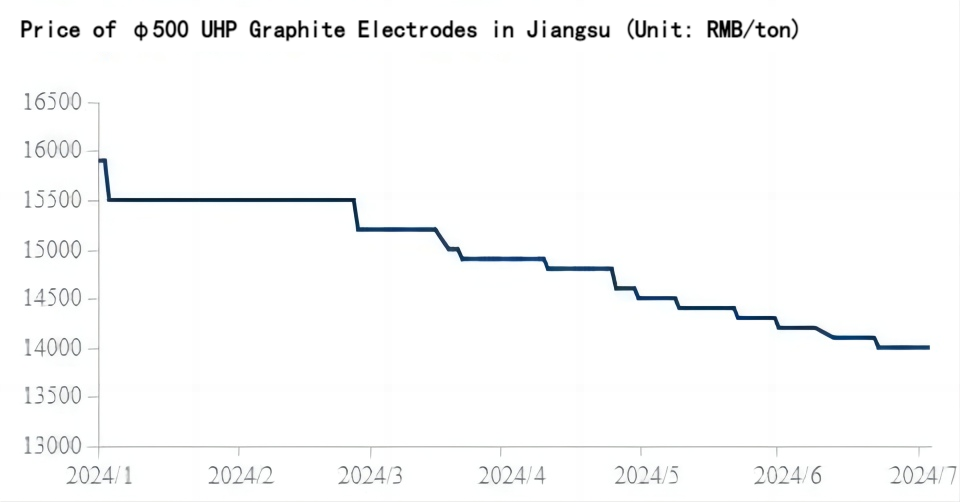

Using the example of ultra-high power graphite electrodes with a diameter of 500 mm in Jiangsu Province, the current price is 14,000 RMB/ton, reflecting a decrease of 200 RMB/ton month-on-month. Due to the impact of payment terms and purchase volumes, market price differences remain significant, with a maximum variation of 100 RMB/ton.

II. Costs - Raw Material Declines, Reduced Cost Pressure

· Petroleum Coke: Mainly focusing on low-sulfur coke, the price decreased by 290 RMB/ton month-on-month. Although there will be a slight decline in petroleum coke imports in the second half of the year, the current large inventory at ports means that supply-demand conflicts in the petroleum coke market persist, making it difficult for prices to rise.

· Coal Tar Pitch: The price of medium-temperature coal tar pitch decreased by 400 RMB/ton month-on-month. As the end of the month approaches, coal tar pitch prices show an upward trend, primarily due to the rising coal tar market, which strongly supports coal tar pitch prices. Production rates are weak, but there is still an expectation of price increases in the future.

· Needle Coke: The market remains stable with full orders, and the costs for needle coke enterprises are still high. The downstream anode material market is performing well, with growing demand, keeping needle c

oke prices high.

From a cost perspective, according to statistics, at a market price of 14,200 RMB/ton for ultra-high power graphite electrodes with a diameter of 500 mm, the loss is 1,552 RMB/ton.

III. Demand - Downward Trend in Downstream Demand

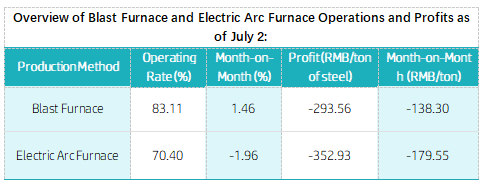

In June, the operating rate of blast furnaces increased, while that of electric arc furnaces decreased. The state of losses worsened compared to May, with the steel market showing a downward trend. The comprehensive steel price index dropped by 157 points, with high raw material prices and weak downstream demand leading to reduced production in steel mills.

IV. Market Outlook for July - Demand Down, Prices Likely Stable to Weak

(1)Demand: The steel market faces downward pressure, with high raw material prices possibly forcing steel mills to reduce production, leading to weakened demand for graphite electrodes.

(2)Supply: Graphite electrode manufacturers are entering a period of production cuts, maintaining basic operations and reducing output and inventory to adapt to industry needs. Most manufacturers have already entered a low production phase, making significant further reductions unlikely.

(3)Costs: Raw material prices are expected to remain weak, allowing for further compression of graphite electrode costs and alleviating some loss pressures.

In summary, Chinese domestic ultra-high power graphite electrode market in July is expected to remain stable to weak, with profits continuing to recover, and prices likely fluctuating with changes in raw material costs.

Feel free to contact us anytime for more information about the graphite electrode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies