【Graphite Electrodes】 Demand Off-Season, Significant Divergence in High and Low-End Markets

【Graphite Electrodes】 Demand Off-Season, Significant Divergence in High and Low-End Markets

Market Overview

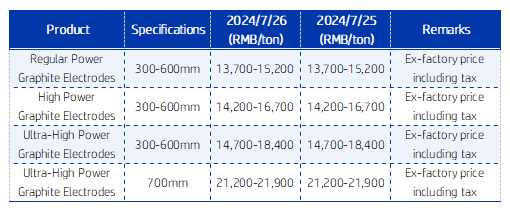

On August 7, 2024, the market prices for RP/HP/UHP graphite electrodes were between 13,700 and 21,900 RMB/ton, remaining stable compared to the previous working day. The average market price for graphite electrodes was 15,313 RMB/ton, also stable from the previous working day. The market shows a clear split between high and low-end products, but due to the current off-season in demand, graphite electrode companies are struggling with shipments. To maintain premium customers and capture market share, companies are offering discounts, resulting in actual transaction prices often being lower. However, the mainstream prices still hold their bottom line, keeping the market temporarily stable.

Price Range:

· Diameter 300-600mm Graphite Electrodes:

o Regular Power: 13,700-15,200 RMB/ton

o High Power: 14,200-16,700 RMB/ton

o Ultra-High Power: 14,700-18,400 RMB/ton

· Ultra-High Power 700mm Graphite Electrodes: 21,200-21,900 RMB/ton

Market Prices

Upstream Market

Low-Sulfur Petroleum Coke: The price of petroleum coke from PetroChina's refineries in Northeast China has been uniformly adjusted downwards. Prices at Daqing and Fushun Petrochemical were lowered by 150 RMB/ton, while prices at Jinxi and Jinzhou Petrochemical were lowered by 100 RMB/ton. Daqing Petrochemical, Fushun Petrochemical, Jinxi Petrochemical, and Jinzhou Petrochemical continue to maintain stable prices. The main reason for the price decline in the Northeast region is weakened demand, with fewer restocking operations for anode materials and continued sluggishness in the graphite electrode market, leading to primarily just-in-time deliveries.

Low-Sulfur Calcined Coke:

o Market mainstream transaction price: 3,150-3,350 RMB/ton (using Jinxi and Jinzhou petroleum coke as raw material).

o Factory mainstream transaction price: 3,730-4,200 RMB/ton (using Fushun petroleum coke as raw material).

o Market mainstream transaction price: 2,900-3,000 RMB/ton (using Liaohe and Binzhou CNOOC petroleum coke as raw material).

Needle Coke: Due to decreased demand and ample supply, needle coke companies find it difficult to maintain prices, leading some companies to offer slight discounts to facilitate sales.

Downstream Market

Steel: The operating rate of steel mills continues to decline, resulting in fewer bids for graphite electrodes, and the actual demand remains weak.

Market Outlook

Due to the prolonged downturn in the graphite electrode market, production is primarily based on long-term customer orders, with cautious order acceptance. In the short term, it is expected that the graphite electrode market will remain weak and stagnant.

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies