【EAF Steel】Macro Expectations Stagnate, Blast Furnace Production Cuts Raw Material Price Declines

【EAF Steel】 Macro Expectations Stagnate, Blast Furnace Production Cuts Lead to Raw Material Price Declines

This week, China's construction steel prices continued to bottom out. Following widespread shutdowns and maintenance among electric arc furnace (EAF) steel mills, many long-process steel mills have also begun to reduce production, leading to a significant decrease in rebar output and a slight easing of market supply pressure, with both social and factory inventories declining for two consecutive weeks. The Chinese graphite electrode market prices remained stable, and trading was steady. As of August 8th, the average price of rebar in China was 3,257 yuan, down 38 yuan from the previous weekend.

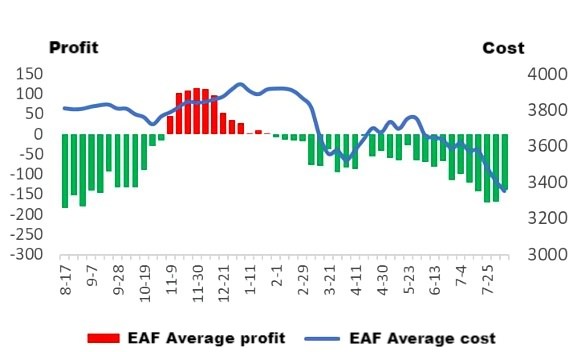

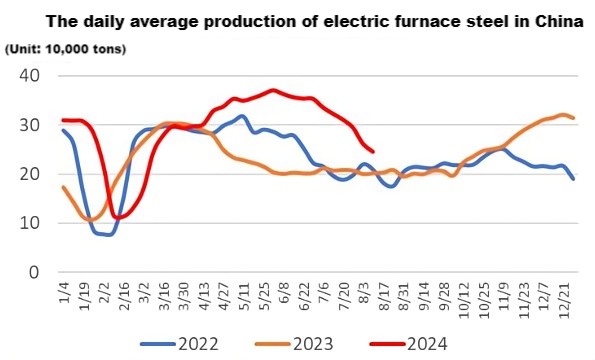

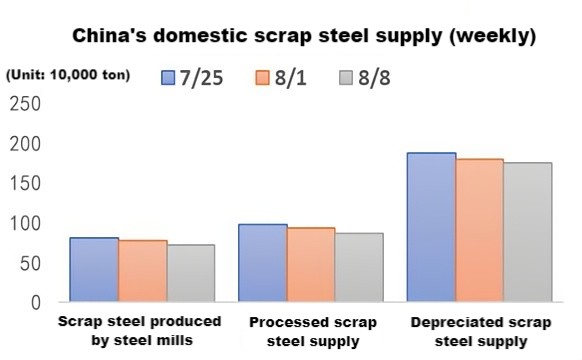

Scrap steel prices continued to drop this week, with the average procurement price at EAF steel mills down 40 yuan from last week to 2,206 yuan (excluding tax), slightly improving steel mill profits. Some EAF steel mills in South China that had ceased operations earlier have shown signs of resuming production, though most are expected to resume by late August. As of August 8th, the capacity utilization rate of 135 EAF steel mills nationwide was 39.2%, down 2.73% week-on-week, with EAF steel production at 245,700 tons per day, marking a ten-week consecutive decline.

In July, China's issuance of special bonds was slow, delaying the recovery of infrastructure demand. Additionally, with Vietnam launching anti-dumping measures against China's hot-rolled coils and the yuan strengthening, concerns about steel exports in the second half of the year have increased.

Given the relatively weak macroeconomic support, the reduction in steel production has yet to significantly boost the market. In the short term, both steel and scrap prices are expected to continue to face downward pressure. Based on the current pace of production cuts at long-process steel mills and the decline in raw material prices, if EAF steel mills resume production collectively in late August, they could see improved profitability.

Feel free to contact us anytime for more information about the EAF steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies