【CPC】Prices Increase! Raw Material Rebound Positively Impacts the Market

【CPC】Prices Increase! Raw Material Rebound Positively Impacts the Market

Market Overview

On September 3, the average price of calcined petroleum coke (CPC) remained steady at 2,148 yuan/ton compared to the previous working day. The overall market remains stable, with prices for CPC made from Fushun green coke slightly rising due to increased raw material costs, while prices for CPC made from Jinxi green coke showed little change. Although the cost of low-sulfur CPC is rising, downstream demand has not significantly improved, making it difficult for prices to rise further. The mid-to-high sulfur CPC market remains relatively stable, and after previous price reductions, sales of general-grade CPC have slightly improved. The recent rebound in raw material prices has positively impacted the market, while high-grade CPC prices remain stable.

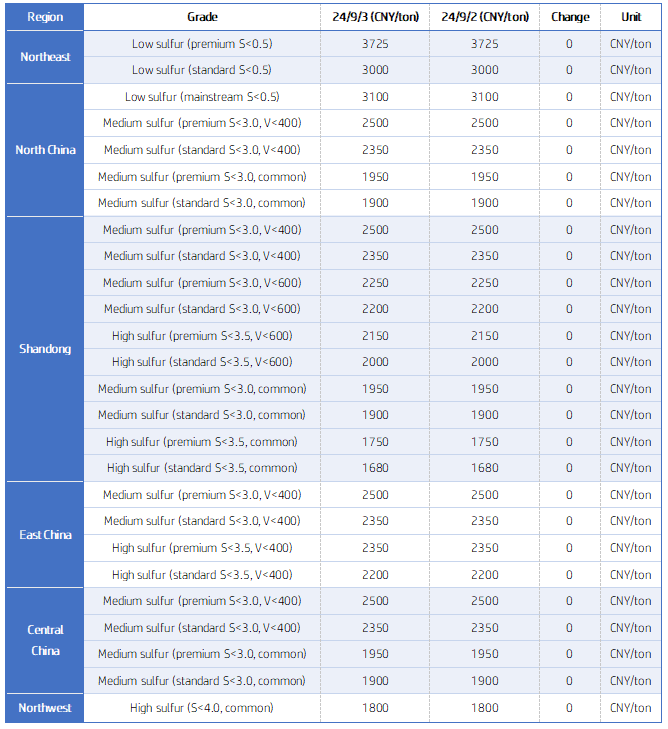

Key Regional Market Transaction Prices

Market Prices

Market Prices for Calcined Petroleum Coke:

Low-Sulfur Calcined Coke (using Jinxi and Jinzhou petroleum coke): The mainstream market transaction price is 3000-3200 RMB/ton.

Low-Sulfur Calcined Coke (using Fushun petroleum coke): The factory gate price is 3400-3725 RMB/ton.

Low-Sulfur Calcined Coke (using Liaohe and Binzhou Zhonghai petroleum coke): The mainstream market transaction price is around 2850-2950 RMB/ton.

Medium-High Sulfur Calcined Coke (Sulfur 3.0%, trace elements not specified): The previous factory gate price was 1950 RMB/ton. Current negotiation prices are 1900-1950 RMB/ton.

Medium-High Sulfur Calcined Coke (Sulfur 3.5%, trace elements not specified): The previous factory gate price was 1680-1750 RMB/ton. Current negotiation prices are 1680-1750 RMB/ton.

Medium-High Sulfur Calcined Coke (Sulfur 3.0%, Vanadium 400): The previous contract price was 2400 RMB/ton. Current negotiation prices are 2400 RMB/ton.

Supply

The current national daily supply of commercial CPC is 26,554 tons, with an operating rate of 62.39%, remaining stable compared to the previous working day.

Upstream Market

Petroleum Coke: Sinopec refineries are mainly stabilizing prices and focusing on steady shipments. In the Yangtze River region, petroleum coke for anode use is largely sold on demand. Anqing Petrochemical plans to start maintenance and shutdown this Friday, while Hunan Petrochemical's prices remain stable for now. In North China, Yanshan Petrochemical has recently increased supply and reduced prices by 30 RMB/ton. Cangzhou Refinery is currently shut down for maintenance and has no inventory for sale. PetroChina refineries generally maintain stable prices. In Northeast China, low-sulfur coke primarily serves steel carbon materials, aluminum carbon materials, and anode materials. The graphite electrode market is driven by basic demand, and Liaohua Petrochemical increased auction prices by 100 RMB/ton yesterday. In Northwest China, refineries are currently stabilizing prices and focusing on steady shipments, mainly supplying aluminum carbon materials and silicon plants. CNOOC has raised asphalt prices by 30 RMB/ton this week, while Taizhou Petrochemical has reduced prices by 50 RMB/ton due to pre-holiday promotions. Zhoushan Petrochemical's prices remain stable this week.

Downstream Markets

Graphite Electrodes: New orders for graphite electrodes are limited, and downstream market demand remains stable, primarily driven by essential purchases. With subdued demand, there is insufficient upward momentum in the graphite electrode market, and prices lack supportive factors. Frequent discounting has been observed, and mainstream enterprises are maintaining stable prices. Overall, the graphite electrode market remains steady.

Electrolytic Aluminum: The Caixin Manufacturing PMI for China in August rebounded into the expansion zone, indicating a recovery in new orders and a slight increase in spot aluminum prices.

Negative Materials: The lithium battery negative material market in China is currently weak and stable. Market feedback shows a decline in shipment volumes this week, and downstream battery manufacturers have not shown significant improvement in procurement demand. Order volumes are slightly decreasing, and due to an oversupply of negative materials, competition among enterprises for orders is intensifying.

Market Outlook

The price of low-sulfur CPC is expected to fluctuate slightly with market trends tomorrow, while mid-to-high sulfur calcined petroleum coke prices are anticipated to remain stable.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies