[Needle Coke] Sep. 18th: Intense Competition! Post-Holiday Needle Coke Prices Revealed

![[Needle Coke] Sep. 18th: Intense Competition! Post-Holiday Needle Coke Prices Revealed](/uploads/article/20240919/f389f402022ae58b92bb255f1533b448.jpg?6265)

[Needle Coke] September 18th Market Update: Intense Competition! Post-Holiday Needle Coke Prices Revealed

Market Overview

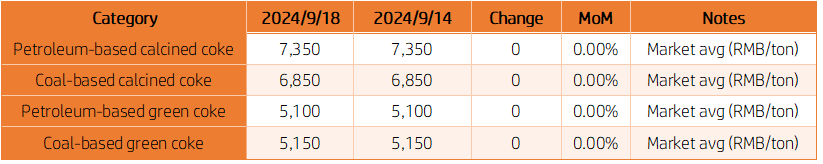

As of September 18, 2024, China's needle coke market remains stable. Domestic needle coke prices range from 4,900-5,300 RMB/ton for green coke and 6,500-8,200 RMB/ton for calcined coke. The mainstream transaction prices for imported petroleum-based needle coke are 500-1,200 USD/ton for green coke and 750-1,250 USD/ton for calcined coke. Imported coal-based needle coke calcined coke transactions are between 800-1,000 USD/ton.

The average domestic needle coke price is 7,585 RMB/ton, unchanged from the previous working day. Today, the market continues to operate steadily, with most companies fulfilling previous orders. According to company feedback, the anode material market is experiencing weak restocking, with green coke primarily focused on executing orders. The graphite electrode market remains sluggish, and calcined coke sales are primarily driven by essential demand.

Market Prices

Upstream Market

Oil slurry: On September 18, oil slurry prices remained stable with fluctuations between 20-130 RMB/ton. The mainstream price range for medium-high sulfur oil slurry is 3,400-4,000 RMB/ton, while low-sulfur oil slurry is quoted at 3,680-5,000 RMB/ton. International crude oil prices closed higher, providing some positive market guidance. However, the market atmosphere remains calm, with refineries prioritizing order fulfillment. Oil slurry prices remain stable today.

Coal tar pitch: On September 18, the coal tar pitch market remained stable, with modified pitch from major production areas priced between 4,300-4,500 RMB/ton. The raw material coal tar market's mainstream bidding remains in a wait-and-see mode, with a generally steady trend and little room for fluctuation, offering weak support for coal tar pitch negotiations. Meanwhile, statistics show that coal tar deep-processing companies are gradually resuming production, raising operational levels, which adds some bearish sentiment to the market. Although there is some restocking sentiment before the holidays, overall, inventory levels remain high, with most downstream buyers replenishing stocks only as needed. As a result, the coal tar pitch market is expected to experience minor adjustments.

Downstream Market

Graphite Electrodes: Post-Mid-Autumn Festival, trading activity in the graphite electrode market remains limited. Downstream markets are cautious with their bids, and the graphite electrode market continues to be dragged down by weak downstream demand. Combined with recent price instability in upstream raw materials, positive market support for graphite electrodes is limited, with prices remaining stable for now.

Anode Materials: Feedback from the market suggests that post-holiday anode material trading is weak. Production in anode material companies continues to be based on current sales, as limited orders and intense market competition persist. Some companies report operating rates below 50%, and with no clear positive signals for the market, anode material production may continue to decline this week.

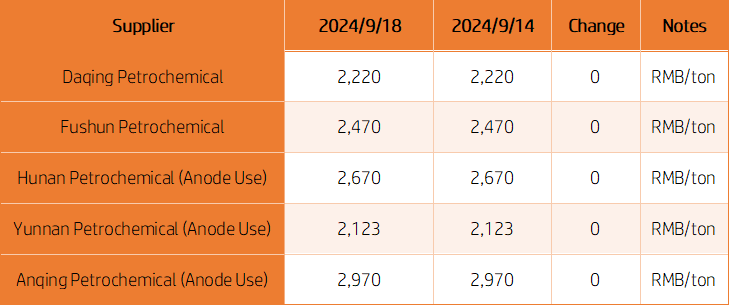

Petroleum Coke Prices

Market Outlook

Currently, needle coke market demand remains lackluster, with insufficient positive factors to boost the market. Companies are largely adopting a wait-and-see approach, maintaining stable prices. In the short term, needle coke prices are expected to remain steady, with calcined coke ranging between 6,500-8,200 RMB/ton and green coke between 4,900-5,250 RMB/ton.

(Source: Baiinfou)

Feel free to contact us anytime for more information about the needle coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies