【Anode】Latest Anode Industry Chain Market Overview (10.11)

【Anode】Latest Anode Industry Chain Market Overview (10.11)

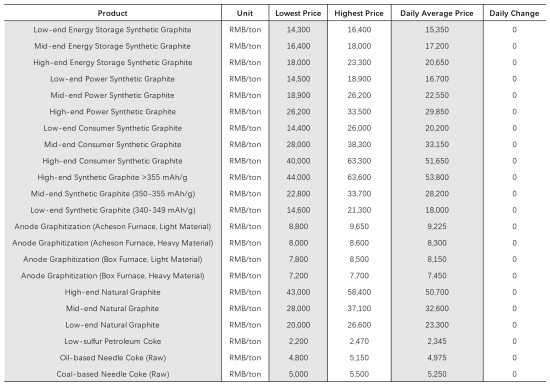

Leading anode enterprises saw an increase in downstream orders before the National Day holiday, with most anode companies producing according to sales orders. Production volumes at leading companies have increased overall. In September, some major players received orders for C-grade energy storage batteries from downstream companies, requiring a gradual increase in production to full capacity starting in October. Currently, battery factories are overwhelmed with orders, with numerous suppliers of raw materials and semi-finished products visiting companies for further cooperation talks. It is expected that the inventory of anode raw materials and semi-finished products will see a certain increase in October.

As of October 10, 2024, prices for regular, high-power, and ultra-high-power graphite electrodes range between RMB 13,500-21,900 per ton, with the lower end of the market price up by RMB 300 per ton compared to the previous working day. The average market price of graphite electrodes stands at RMB 15,213 per ton, reflecting a 1% increase. The market is experiencing a rise in prices driven by improved business confidence, with downstream acceptance being satisfactory. However, the price increase remains limited, with mainstream transaction prices up by about RMB 150 per ton.

This week, the petroleum coke market has improved, with downstream companies actively purchasing, and demand for anode materials showing a slight recovery. Sales at PetroChina's affiliated refineries are doing well, with stable demand for medium and low-sulfur coke. Purchases of graphite electrodes have increased, and there is a higher enthusiasm for carbon materials used in aluminum production. Anode materials remain steady, and with low inventory levels at refineries, the market is generally positive. Prices for low-sulfur coke have increased by RMB 30-90 per ton.

Flake graphite prices have remained stable. In Heilongjiang, mainstream quotes for -194 flake graphite are RMB 2,600 per ton, for -195 flake graphite starting at RMB 2,800 per ton, and for -190 flake graphite at RMB 2,200 per ton. In Shandong, mainstream quotes for -195 flake graphite are RMB 3,200 per ton, -194 flake graphite is RMB 2,900 per ton, and -190 flake graphite is RMB 3,000 per ton. All prices include tax and are ex-factory prices. Despite the traditional peak season of September and October, downstream demand remains sluggish, with no significant improvement in demand for flake graphite from the refractory and anode markets. Most companies are focusing on maintaining relationships with existing clients, resulting in stable prices. The natural graphite market remains in a state of oversupply.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies