【Calcined Petroleum Coke】March 17 Price Update: Weak Demand for Low-Sulfur Coke...

【Calcined Petroleum Coke】March 17 Price Update: Weak Demand for Low-Sulfur Coke

On March 17, the average market price of calcined petroleum coke was 3,597 yuan/ton, down 5 yuan/ton from the previous trading day, a decrease of 0.19%. Currently, the low-sulfur calcined petroleum coke market is experiencing weak sales, with sluggish demand from the electrode industry. To reduce cost pressures, downstream buyers continue to purchase low-sulfur calcined petroleum coke primarily on a just-in-time basis. The mid-high sulfur calcined petroleum coke market remains generally stable, with limited new tenders for mid-high sulfur premium-grade calcined petroleum coke. For general mid-high sulfur calcined petroleum coke, market transactions remain lackluster, and corporate pricing remains weakly stable.

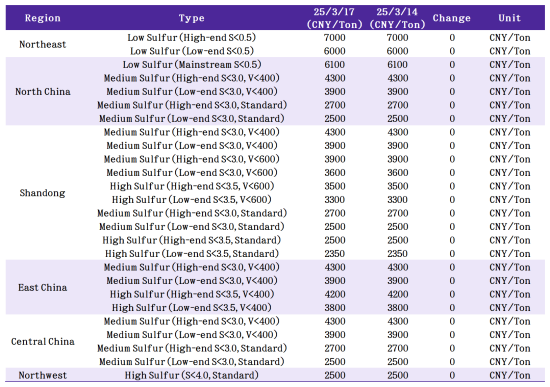

Main Regional Market Transaction Prices

Market Prices

Low-Sulfur Calcined Petroleum Coke:

o (Sourced from Jinxi and Jinzhou petroleum coke): 6,000-6,500 yuan/ton

o (Sourced from Fushun petroleum coke): 6,500-7,000 yuan/ton

o (Sourced from Liaohe and Binzhou CNOOC petroleum coke): 5,000-6,100 yuan/ton

Mid-High Sulfur Calcined Petroleum Coke:

o (Sulfur 3.0%, no microelement requirements): Previous contract price 2,500-2,700 yuan/ton (cash), current negotiation price remains 2,500-2,700 yuan/ton (cash)

o (Sulfur 3.5%, no microelement requirements): Previous contract price 2,350-2,500 yuan/ton (cash), current negotiation price remains 2,350-2,500 yuan/ton (cash)

o (Sulfur 3.0%, vanadium 400): Previous contract price 3,900-4,300 yuan/ton (cash), current negotiation price remains 3,900-4,300 yuan/ton (cash)

Supply Situation

As of now, the daily commercial calcined petroleum coke supply in China stands at 25,969 tons, with an operating rate of 56.81%, unchanged from the previous trading day.

Upstream Market

Petroleum Coke:

o Sinopec refineries are mostly shipping based on demand. In the Yangtze River region, Jiujiang Petrochemical started shutdown maintenance yesterday, with small inventories still available for sale until March 15, while other refineries continue normal production.

o In South China, Maoming Petrochemical uses all its own petroleum coke, while Guangzhou Petrochemical and Beihai Refining maintain steady shipments. Qingdao Petrochemical in Shandong has a planned shutdown for the second half of the year, with the exact schedule yet to be determined.

o PetroChina's Northeast refineries are observing the market and selling based on demand, while the Northwest refineries primarily supply aluminum carbon producers under price protection agreements. Yunnan Petrochemical in the Southwest alternates between producing mid-sulfur and high-sulfur coke.

o CNOOC refineries are shipping based on orders.

Downstream Market

Graphite Electrodes: Downstream demand remains weak. Although steel mills are gradually resuming production, some enterprises have reduced operating hours, leading to slower electrode consumption. Given the recent price instability, steel mills are adopting a wait-and-see attitude. The graphite electrode market remains weakly stable, with transactions mostly negotiated case by case.

Electrolytic Aluminum: The aluminum market is influenced by external factors. Additionally, data from China's National Bureau of Statistics shows that real estate investment in January-February declined by 9.8% year-on-year, reflecting continued weakness in the real estate sector, leading to a decline in aluminum prices.

Anode Materials: Market transactions remain stable. Most anode material enterprises continue producing based on existing orders, operating at a sell-as-produced model. With the market highly concentrated, leading enterprises maintain high capacity utilization, while small and medium-sized enterprises receive fewer orders, operating at mid-to-low capacity levels. The overall anode material operating rate is approximately 50%.

Market Outlook

· Low-Sulfur Calcined Petroleum Coke: Expected to stabilize following recent raw material price declines, though market sales remain weak.

· Mid-High Sulfur Calcined Petroleum Coke: Downstream support remains insufficient, and prices may adjust slightly in line with petroleum coke price movements.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies