【CPC】Endless Drop? Cost Inversion & Inventory Pressure – Market Insights Inside

【CPC】Endless Drop? Cost Inversion & Inventory Pressure – Market Insights Inside

Cost & Profit Overview This Week

Petroleum coke trading remained weak this week, with limited downstream support. Major refiners continued to lower low-sulfur coke prices, while buyers stayed cautious amid a "wait-for-lower" sentiment. Low-sulfur coke inventories rose; although it's maintenance season for medium-high sulfur coke, weak demand and falling low-sulfur prices kept the market flat to weak.

Local refineries also saw weak trades and falling prices. Imported coke arrivals were concentrated, and port inventories continued to rise.

1. Low-sulfur CPC made from Fushun, Jinzhou, and Jinxi feedstock incurred losses of about 300 RMB/ton.

2. Medium-high sulfur CPC posted average losses of around 70 RMB/ton due to downstream price pressure.

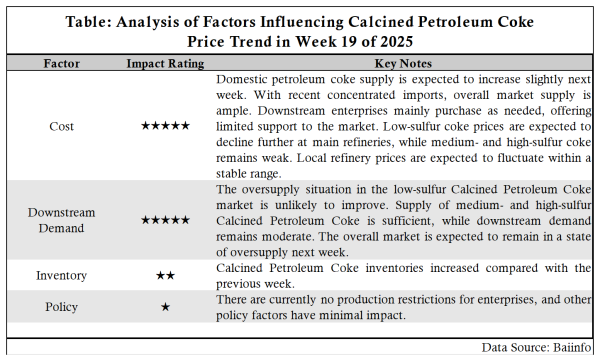

Price Forecast for Next Week

1. Raw Materials: Petroleum coke supply is expected to increase slightly. With more imported coke arriving and downstream buyers only purchasing as needed, support remains weak. Major refiners’ low-sulfur coke may continue to fall; medium-high sulfur coke will likely stay weak but stable.

2. Supply & Demand: Oversupply of low-sulfur CPC is unlikely to improve. Medium-high sulfur CPC supply remains sufficient, with average demand. Overall, supply will still outpace demand.

Outlook Summary

1. Low-Sulfur CPC: Weak demand and falling green coke prices in Northeast China may push prices further down. Companies that already lowered prices may hold steady; others may cut prices by 100–200 RMB/ton.

2. Medium-High Sulfur CPC: Weak raw material trend and cautious downstream demand suggest stable-to-weak prices, with potential reductions of 50–100 RMB/ton for some producers.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies