【Steel】Why Is China's Steel Export Recovery Still Weak Despite Eased U.S.-China Tariffs?

Graphite electrodes are key materials for EAF steelmaking, mainly used for arc heating. With excellent conductivity and high-temperature resistance, they are crucial for improving EAF production efficiency and quality.

【Steel】Why Is China's Steel Export Recovery Still Weak Despite Eased U.S.-China Tariffs?

Tariff Tensions Ease: Market Sentiment Warms and Steel Prices Rebound

On May 12, a joint statement was released by senior officials from China and the U.S. in Geneva, announcing significant reductions in bilateral tariff rates effective May 14. The de-escalation of the U.S.-China tariff dispute notably eased pessimism surrounding exports and domestic demand, prompting a rapid rebound in steel prices.

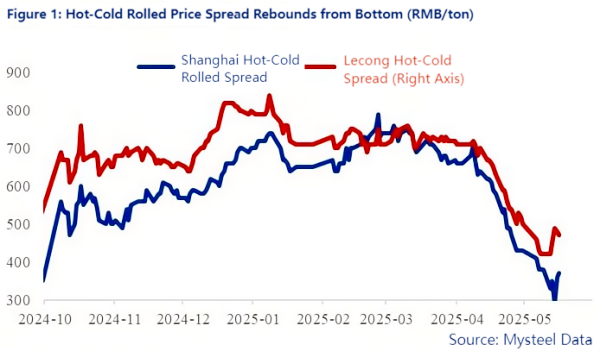

Meanwhile, a survey found that some home appliance manufacturers in certain regions increased steel raw material restocking. As one of the most concentrated home appliance production regions, Guangdong's primary sheet market in Lecong saw a notable widening of the hot-cold rolled price spread by RMB 50/ton compared to early May (Figure 1).

Survey Results and Analysis: No Significant Improvement in Steel Export Orders

1. Survey Findings

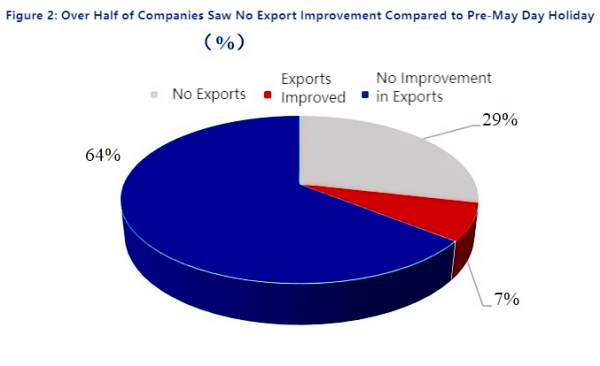

Overall, both direct and indirect steel exports showed only limited improvement, visible only in isolated cases—insufficient to confirm a broader recovery trend.

According to the latest survey of 56 sheet producers, although overseas inquiries increased after the easing of U.S.-China tariff tensions and foreign buyer sentiment improved, more than half of the surveyed companies reported no significant improvement in export orders. Among those seeing improvement, only one company's export orders returned to pre-May Day holiday levels.

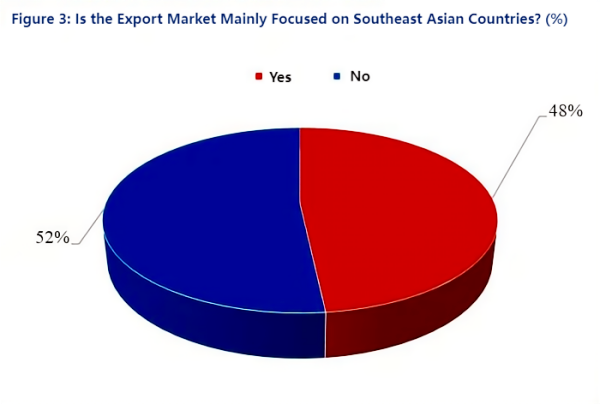

Among sheet producers with export plans, nearly half targeted Southeast Asian markets. While most reported a warming in overseas inquiry sentiment, the majority continued to fulfill existing orders, with no notable improvement in actual order volumes.

2. Analysis of Underlying Causes

The actual demand for Chinese steel exports has not significantly improved alongside market sentiment and expectations, likely due to two main reasons:

1) Weakened Price Advantage and Continued Port Inventory Accumulation

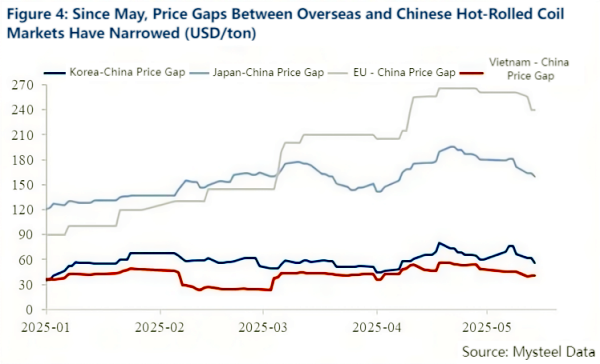

Following the Geneva negotiations, a rebound in domestic hot-rolled coil prices pushed up Chinese export quotes, squeezing export profit margins. As of May 15, we monitored that China's FOB hot-rolled coil export prices increased by USD 10/ton compared to late April. The price spread between China and major overseas markets narrowed to early April levels (Figure 4).

For example, the Vietnam-China hot-rolled coil price spread dropped by USD 12.5/ton from late April to USD 41/ton.

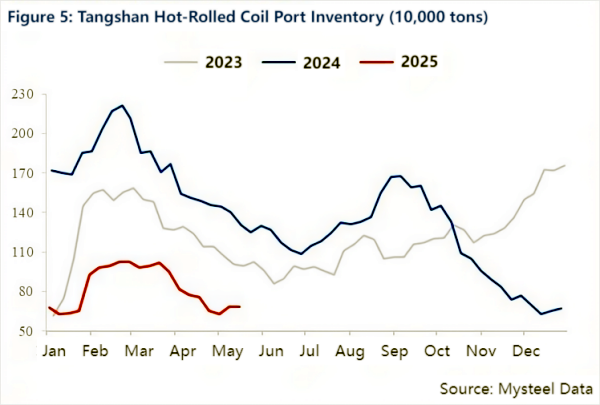

In addition, hot-rolled coil inventories at Tangshan Port have increased for two consecutive weeks since May, indirectly reflecting weak export demand.

2) Non-Tariff Barriers on U.S. Steel Imports Remain Unchanged

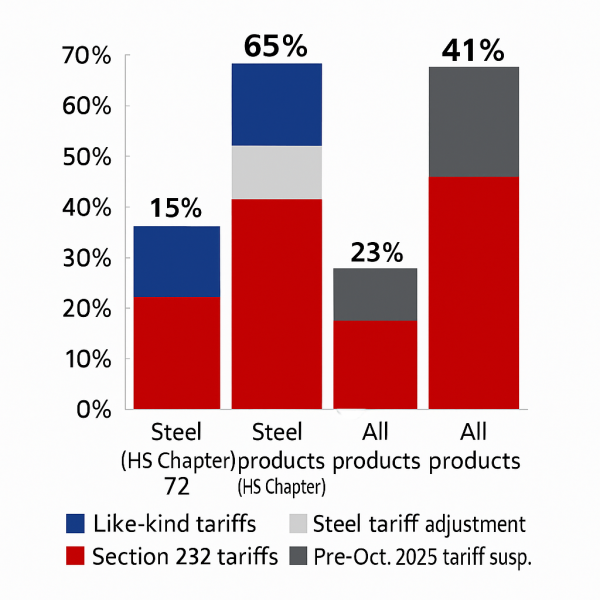

Although the Geneva statement indicated that U.S. and Chinese tariff rates would significantly drop, the U.S. has not relaxed long-standing Section 232 measures and anti-dumping/countervailing investigations on Chinese steel.

Even after the Geneva talks, the cumulative tariff rate on Chinese steel exports to the U.S. under HS Chapter 72 remains at 65% (Figure 6).

Figure 6: Cumulative Tariffs on Steel and Steel Products Exports After Geneva Negotiations

Limited Long-Term Impact of Tariff Suspension on Steel Demand

The current uptick in manufacturing exports appears more related to overseas buyers front-loading orders due to concern over the 90-day tariff suspension period, offering limited long-term support for steel demand and potentially cannibalizing future demand.

Domestic demand for steel from the manufacturing sector is also expected to weaken. Surveys indicate that raw material inventories among downstream home appliance manufacturers hit a year-to-date high in May, which may delay restocking activity from some downstream enterprises.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies