【Graphite Electrodes】July Market Outlook for Ultra-High Power Graphite Electrodes in China

【Graphite Electrodes】July Market Outlook for Ultra-High Power Graphite Electrodes in China

In June, China's ultra-high power graphite electrode market showed a trend of initially low prices followed by a rise. Under the dual pressure of rising raw material costs and shrinking downstream demand, graphite electrode suppliers became differentiated in supply. As profits declined, supplier quotations remained firm, and transaction prices rebounded in late June. Entering July, the supply-demand conflict remains prominent. With petroleum coke prices starting the month on an upward trend, how will the ultra-high power graphite electrode market develop?

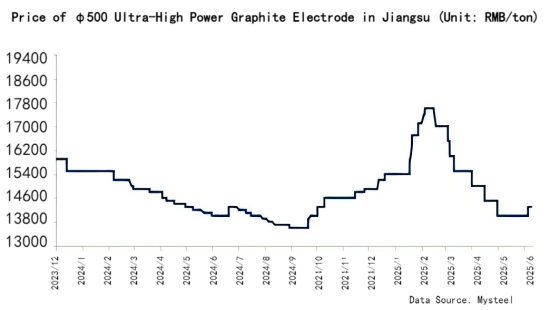

Ⅰ. Price Trend of Ultra-High Power Graphite Electrodes

In June, the market experienced a steady-then-rising trend. In mid-June, supplier quotations increased significantly, with major producers leading the rise and smaller producers following closely. Towards late June, steel mill tenders began gradually, and prices of ultra-high power graphite electrodes for electric furnaces rose, especially φ450 and φ500 specifications. According to investigations, by June 30, ultra-high power graphite electrode prices had increased by about 300 RMB/ton, mainly φ500, with mainstream prices currently at 14,300 RMB/ton.

Ⅱ. Raw Material Prices Remain High, Providing Strong Cost Support

Regarding electrode raw materials, June saw a mainly downward trend, with petroleum coke prices fluctuating first down then up. By the end of June, driven by procurement demand for anode materials, petroleum coke prices rebounded. Entering July, delayed maintenance at domestic coke plants postponed coking unit restarts, and imported petroleum coke continued arriving at ports. Spot supply of petroleum coke is relatively abundant. Although short-term replenishment demand boosted price sentiment, petroleum coke prices remain at a high level year-on-year, so July petroleum coke prices are expected to fluctuate in a narrow range.

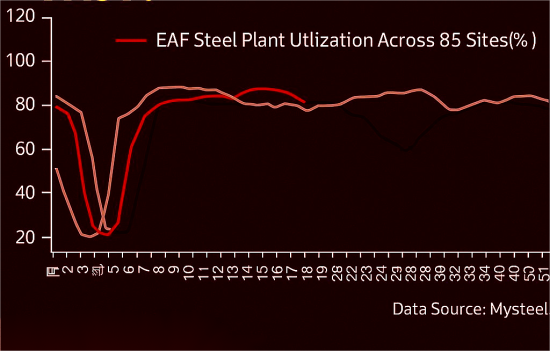

Ⅲ. Increasing Downward Demand Expectations

From the electrode application side, in June, the operating rate of 85 independent electric arc furnace (EAF) steel enterprises declined by 2.22% month-on-month compared to May. Influenced by EAF steel profits, further operating rate decline is expected.

On the export side, many countries and regions continue anti-dumping policies. On June 20, Japan's Ministry of Finance announced a formal 95.2% anti-dumping tariff on graphite electrodes exported from China to Japan starting July 3, valid for five years. Export data shows that in 2024, China's graphite electrode exports to Japan totaled 13,400 tons, accounting for 3.96% of total exports. From January to May 2025, exports to Japan were 2,800 tons, 1.86% of total exports. Export volumes are expected to decline further.

Ⅳ. Improved Production Positivity Among Electrode Producers but Some Medium-Small Specifications Still Tight

With declining graphite electrode prices and narrowing supplier profits alongside continuous raw material price declines, production enthusiasm has decreased, with some enterprises reducing or suspending output. Coupled with long electrode production cycles, φ450 and φ500 specifications are expected to remain relatively tight in supply during July. However, with prices rising, production enthusiasm is likely to improve.

Ⅴ. Summary and Outlook

China's ultra-high power graphite electrode market is influenced by a stage of raw material price increases, keeping supplier quotations firm. Steel mill tender sentiment has improved, and replenishment demand has slightly released, while downstream market demand is expected to decline. The supply-demand fundamentals have slightly improved. Overall, the ultra-high power graphite electrode market in China is expected to likely rise first and then stabilize in July.

(Source: My Steel Network)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies