【Anode Materials】Weak Expectations for Raw Materials and Demand; Anode Material Prices Lack Support

The rapid growth of electric vehicles and energy storage systems is boosting demand for high-performance lithium batteries, driving the need for high-quality petroleum coke and synthetic graphite. High-quality calcined petroleum coke is essential for producing reliable lithium battery anode materials.

【Anode Materials】Weak Expectations for Raw Materials and Demand; Anode Material Prices Lack Support

The anode materials market has recently lacked strong price support, due to both continuous raw material price declines and weak downstream demand expectations.

1. Price Trend of Artificial Graphite Anode Materials Remains Weak

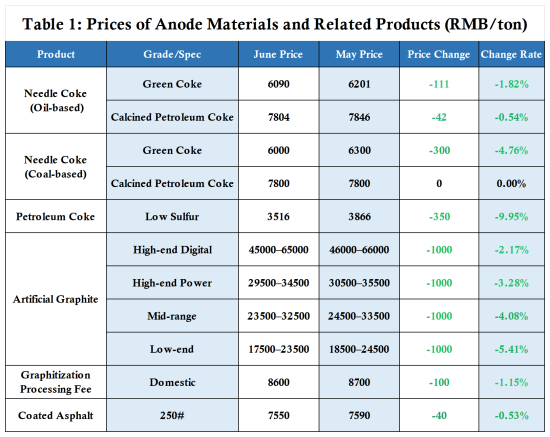

Data Source: Oilchem

Prices in the artificial graphite anode materials market have declined for some orders. According to June data, on the raw material side, both needle coke and petroleum coke average prices showed downward trends. The average price of oil-based green coke was 6,090 RMB/ton, down 111 RMB/ton; low-sulfur petroleum coke averaged 3,516 RMB/ton, down 350 RMB/ton. In southern regions, as the flood season began, graphitization processing fees were reduced by 100 RMB/ton. Due to the decline in costs, downstream battery manufacturers exerted pricing pressure in negotiations with anode material producers, resulting in a lack of price support for anodes, with some orders seeing price cuts of around 1,000 RMB/ton.

2. Anode Material Output in June Remained Cautious; Capacity Utilization Decreased

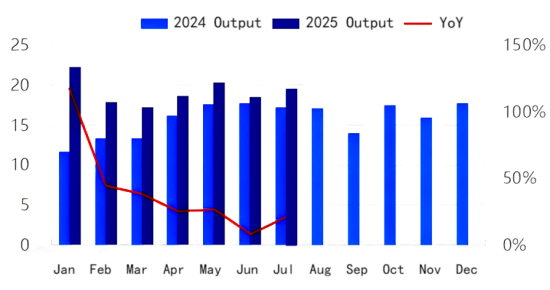

Figure 1: Monthly Anode Material Output (10,000 tons)

Data Source: Oilchem

In June, new orders for anode materials had not yet been secured. Under this situation, anode factories primarily focused on digesting plant inventory and temporarily slowed production. June anode material output was 185,600 tons, an 8.13% year-on-year increase but an 8.71% month-on-month decrease. Capacity utilization was 58.17%, down 18.52% year-on-year and 5.54% month-on-month. It is expected that in July, anode material output will rise to 195,000 tons as downstream orders gradually land. Anode factories will begin fulfilling new contract orders, and since factory inventories are low, output is expected to rebound.

3. Stable Demand for Anode Materials in July

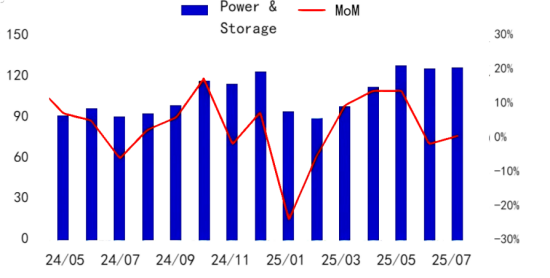

Figure 2: Monthly Production of Power and Energy Storage Batteries (GWh)

Data Source: Oilchem

In July, the production of power and energy storage batteries slightly increased by 0.8%, and overall downstream demand for anode materials remained stable. By product segment, power battery demand has recently been weak, as automakers are still digesting inventory with limited new orders. The energy storage market has stabilized, and during the suspension window of reciprocal tariffs from the U.S., export orders for energy storage batteries increased significantly, offsetting the decline in power battery demand. The consumer battery market has not yet entered its peak season, and demand remains stable.

As downstream demand enters a stable period, anode material production will steadily recover. With new orders gradually being fulfilled, the anode materials market is expected to remain stable in the short term.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies