【Steel】The Deadlock of Output and the Rebirth of Market Liquidity Under Weakening Steel Mill Profits

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel】The Deadlock of Output and the Rebirth of Market Liquidity Under Weakening Steel Mill Profits

At present, China's domestic steel market is in a deeply intertwined phase of supply-demand imbalance and profit game. High inventories contrast sharply with weakening demand, while price pressure and liquidity shrinkage are overlapping. The core contradiction lies in the fact that, although steel mills have not yet fallen into losses, the continuous weakening of profits has trapped the market in a vicious cycle of "high output, low prices, and insufficient liquidity."

I. Steel Market Dilemma: Triple Contradictions Intertwined

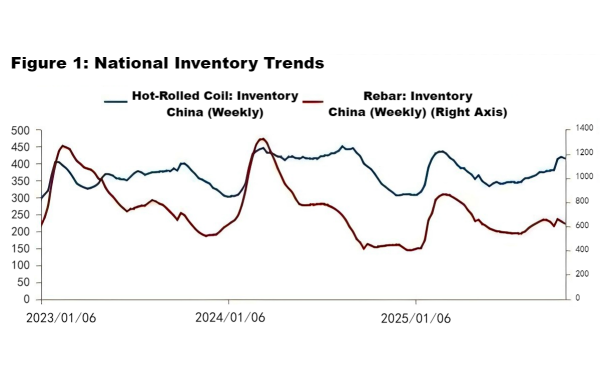

From a market fundamentals perspective, the imbalance between supply and demand continues to intensify. In early September, inventories of five major steel products across 21 cities nationwide rose to 9.2 million tons, up 4.1% year-on-year. Inventory pressure has remained above last year's level for three consecutive months. On the demand side, the sluggish real estate sector continues to drag down consumption — from January to August, real estate development investment fell 12.9% year-on-year, and the phenomenon of a "weak peak season" for terminal steel consumption has become normalized.

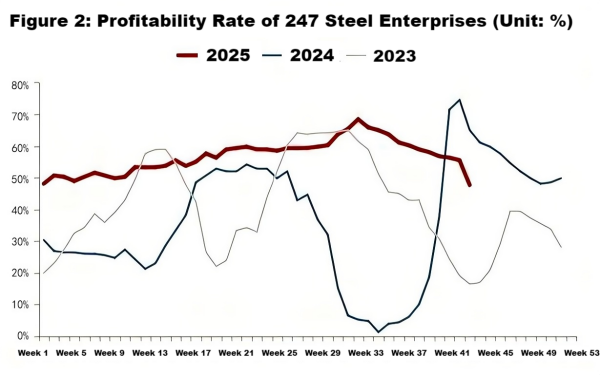

Even so, steel mills still lack the incentive to voluntarily cut production. As of October 27, the blast furnace operating rate among 247 surveyed steel plants was 84.71%, up 0.44 percentage points from the previous week and 2.57 percentage points year-on-year. The blast furnace ironmaking capacity utilization rate was 89.94%, down 0.39 percentage points week-on-week but up 1.46 percentage points year-on-year. The steel mill profitability rate was 47.62%, down 7.79 percentage points week-on-week and 17.32 percentage points year-on-year. Daily average hot metal output reached 2.399 million tons, down 10,500 tons from the previous week but up 42,100 tons year-on-year.

The average per-ton profit of profitable steel enterprises fell 18.3% compared with August, and the profit peak since Q2 has gradually faded. Leading steelmakers, with advantages in low-cost raw material procurement and high-end product structures, maintain relatively resilient profitability but are also facing slowing order growth. In contrast, small and medium-sized steel mills, primarily producing rebar and other common building materials, are trapped in a vicious cycle of "insufficient orders – price cuts to grab orders – narrowing profits." The per-ton profit of rebar for some small and medium-sized mills has dropped below 30 yuan, down more than 80% from the Q2 peak. Although not yet in the red, they are close to the break-even point.

Figure 1: National Inventory Trends

Data Source: Steel Union Data

Figure 2: Profitability Rate of 247 Steel Enterprises

Data Source: Steel Union Data

This seemingly contradictory operating pattern actually stems from the deep entanglement of the three contradictions among "output – price – liquidity." These can be broken down into the following three aspects:

(1) The Divergence Between Output and Orders

Although weak demand has led to a shortage of orders, and small and medium-sized mills frequently cut prices to compete for limited demand, the industry has yet to enter a substantial production reduction phase. Leading enterprises, relying on stronger profitability resilience, maintain production capacity. Small mills, even with thin profits, are reluctant to shut down furnaces due to the high cost of restart, resulting in persistently abundant steel supply. The differentiation of order structures further exacerbates the imbalance, leaving steelmakers in a dilemma — wanting to reduce output but unable to fully do so, or wanting to expand but lacking sufficient orders.

(2) The Entanglement Between Price and Liquidity

Prices show relative weakness in finished products: on October 23, the main rebar futures price was 3,069 yuan/ton, down 2.4% from the September high. The widening contango structure reflects the market's weak reality but strong expectations. Spot prices remain under inventory pressure and fail to rise, while futures prices for longer maturities, despite policy support expectations, lack fundamental backing, widening the price spread further.

Liquidity has also shrunk simultaneously. Long basis positions are difficult to unwind due to the lack of counterparties. On one hand, investors are reluctant to enter the market amid weak prices; on the other hand, steel mills and traders have reduced hedging operations due to declining profits. This has further worsened trading activity, forming a chain reaction of "weak prices – reduced liquidity – difficulty in closing long positions."

(3) The Misalignment Between Costs and Profits

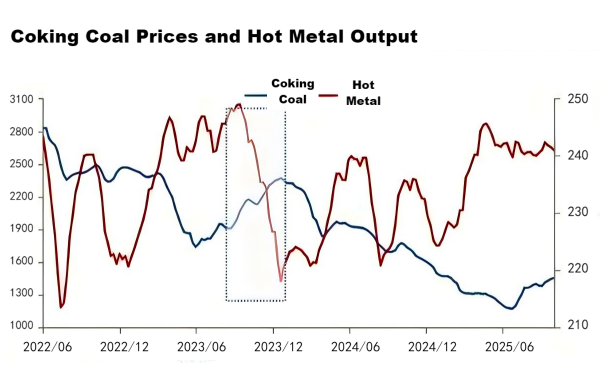

In the first half of the year, collapsing coking coal and coke prices provided a cushion for steel mill profits, but after September, raw material prices began to diverge. Thermal coal stabilized and rebounded due to reduced production in major areas; iron ore prices rose slightly, supported by lower shipments from Australian mines; and the prices of scrap and other auxiliary materials also climbed. As a result, the average raw material cost per ton of steel increased by 95 yuan compared with August.

Meanwhile, finished steel prices declined by 3.1% from September as companies cut prices to maintain order volumes amid high inventories. The narrowing price spread — "raw materials rising, finished steel lagging" — directly weakened steel mill profitability. Per-ton profits for leading mills have fallen 22.5% from Q2 peaks, with even sharper compression for small and medium-sized mills.

Data Source: Steel Union Data

(II) Production Cuts Triggered by the Breakthrough of the Profit Threshold

The industry has already shown localized signs of production cuts, mainly due to continued profit erosion. Independent electric arc furnace (EAF) mills, being more sensitive to raw material costs, have experienced sharper profit compression. Some EAF producers' per-ton profits have approached the breakeven line, resulting in a capacity utilization rate of 53.2%, down 6.3 percentage points from August. Nearly half of total capacity now operates at low load (daily output down 12,000 tons from August).

With raw material price increases expected to continue, the pace of profit decline is accelerating. Although more than half of steel enterprises remain profitable, the share has fallen by 7.2 percentage points week-on-week. The second round of coke price hikes is expected to take effect Monday. After implementation, coke supply is expected to remain stable, but steel mill profits will further shrink. However, hot metal output is unlikely to fall sharply in the short term, keeping the coke market in tight balance. Coking coal fundamentals remain relatively healthy, and coal prices are expected to stay supported in the near term. If finished steel profits fall below cost, blast furnace mills will gradually enter a production reduction cycle, marking the beginning of a substantial contraction in supply.

(III) Production Cuts Leading to Basis Recovery and Liquidity Release

Basis recovery: Production cuts leading to inventory reduction will optimize stock structures and drive futures spreads from backwardation to contango. As spreads narrow, previously trapped long-basis positions (especially intermonth hedges held by traders) will gradually have opportunities to be unwound.

Liquidity restoration: The expectation of price stabilization will attract capital back into the market. As long-basis positions are closed, market trading activity will increase, alleviating the current liquidity stagnation and further accelerating basis position liquidation.

III. Outlook: A Resonance Window Between Policy and Market

In the short term, the steel market will remain in a transitional phase of profit compression and brewing production cuts, with two key signals to monitor:

Whether per-ton steel profits fall below the cost threshold; and

Whether blast furnace capacity utilization drops below 80%.

Although infrastructure investment may provide some policy support, seasonal demand remains weak. From a balance sheet perspective, maintaining inventory stability requires cutting supply, and the necessary condition for that remains lower prices and squeezed profits.

In the long term, industry differentiation will intensify further. Leading enterprises with strong cost control and high-end product portfolios, though pressured by weakening profits, will still maintain relatively stable earnings. In contrast, small and medium-sized mills — focused on ordinary steel with weak cost control — will gradually exit under continued profit erosion. Since 2024, 12 small and medium-sized common steel producers have suspended operations, involving 8 million tons of capacity.

This process of survival of the fittest is not only the result of spontaneous market adjustment but also an inevitable trend in the industry's transformation from a "volume-based profit" to a "value-based profit" model, which will ultimately optimize the steel industry's profit structure and improve market liquidity.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies