【Carbon Materials】China Carbon New Materials Market Review (Nov. 8–Nov. 14)

【Carbon Materials】China Carbon New Materials Market Review (Nov. 8–Nov. 14)

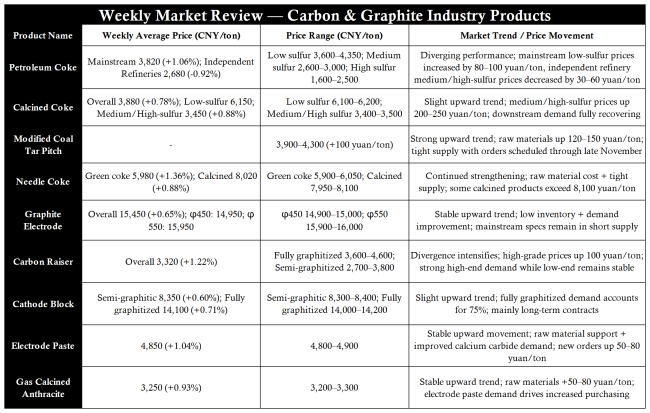

Petroleum Coke Market

During this week (Nov. 8–Nov. 14), China's petroleum coke market continued to show a "strong performance for state-owned refineries and weaker performance for independent refineries." The average price of state-owned refinery petcoke was 3,820 CNY/ton, up 1.06% WoW; the average price of independent refinery petcoke was 2,680 CNY/ton, down 25 CNY/ton WoW. Low-sulfur coke remained firm due to tight supply. Prices at Fushun Petrochemical in Northeast China and Yangzi Petrochemical in East China increased by 80–100 CNY/ton, bringing the mainstream price range to 3,600–4,350 CNY/ton. Medium- and high-sulfur coke saw price reductions driven by selling pressure from independent refineries: Shandong Jingbo and Hebei Xinhai lowered prices by 30–60 CNY/ton, giving mainstream levels of 2,600–3,000 CNY/ton for medium-sulfur grades and 1,600–2,500 CNY/ton for high-sulfur grades. Downstream performance diverged: anode material producers maintained full-rate production and supported low-sulfur coke procurement, while prebaked anode producers replenished only as needed, keeping demand for medium- and high-sulfur coke weak. Next week, low-sulfur petcoke from state-owned refineries is expected to remain firm to slightly upward, while medium-/high-sulfur petcoke from independent refineries may see further mild downward adjustment due to inventory pressure.

Calcined Petroleum Coke Market

This week (Nov. 8–Nov. 14), China's calcined petroleum coke market trended steadily upward. The overall average price was 3,880 CNY/ton, up 0.78% WoW. Low-sulfur calcined petroleum coke rose to 6,150 CNY/ton, driven by price increases in low-sulfur green coke. Orders remained strong, and production was strictly order-based with no inventory pressure. Demand for medium-/high-sulfur calcined petroleum coke exceeded expectations: Shandong Xinfang and Henan Xinlianxin raised prices by 200–250 CNY/ton, with the average price increasing to 3,450 CNY/ton, up 30 CNY/ton WoW. Downstream demand comprehensively recovered: operating rate of anode material graphitization plants rose to 90%, pushing up procurement of commercial calcined petroleum coke by 15% MoM; prebaked anode plants maintained a high operating rate of 95%, keeping aluminum-grade calcined petroleum coke on rigid-demand footing; graphite electrode producers also slightly increased procurement of low-sulfur calcined petroleum coke. Next week, the calcined petroleum coke market is expected to continue trending upward, especially medium-/high-sulfur products due to tight supply.

Coal Tar Pitch Market

This week (Nov. 8–Nov. 14), China's coal tar pitch market saw a strong upward trend. Modified pitch mainstream prices increased to 3,900–4,300 CNY/ton, up 100 CNY/ton WoW. Feedstock coal tar surged significantly, with prices in Shandong rising 120–150 CNY/ton, providing strong cost support. Deep-processing enterprises maintained an operating rate of 65%, and tight supply intensified holding-back sentiment. Downstream demand increased in tandem: prebaked anode production rose 8% MoM, boosting pitch procurement; electrode paste producers increased stocking interest, and graphite electrode producers maintained balanced supply and sales. New order transactions were active, with some orders scheduled into late November. Next week, coal tar pitch prices are expected to continue rising, with an additional increase of 50–80 CNY/ton possible due to tight supply and cost pressure.

Needle Coke Market

This week (Nov. 8–Nov. 14), China's needle coke market continued strengthening. The average price of green coke was 5,980 CNY/ton, up 1.36% WoW; the average price of calcined needle coke was 8,020 CNY/ton, up 0.88% WoW. Upstream raw materials increased across the board: slurry oil prices rose 80–100 CNY/ton and coal tar pitch rose 100 CNY/ton, creating heavier cost pressure for both petroleum- and coal-based producers. Coal-based needle coke operating rates climbed to 50% but still could not satisfy demand, leading to tight supply in the market. Downstream demand remained strong: graphite electrode plants increased calcined needle coke procurement by 12% MoM for winter stockpiling, and anode material producers extended order schedules to December, keeping green needle coke consumption high. Producers broadly held back supply to support prices, with some calcined needle coke trades surpassing 8,100 CNY/ton. Next week, the needle coke market is expected to remain strong with further upside potential.

Graphite Electrode Market

This week (Nov. 8–Nov. 14), China's graphite electrode market continued a steady upward trend. The overall average price reached 15,450 CNY/ton, up 0.65% WoW, including 14,950 CNY/ton for φ450mm electrodes and 15,950 CNY/ton for φ550mm products. Upstream cost support was strong, with needle coke and coal tar pitch both seeing significant price rises, adding 100–150 CNY/ton to production cost. Downstream demand exceeded expectations: electric arc furnace operating rate increased to 58.5%, up 1.7 percentage points WoW; electrolytic aluminum plants ran at full capacity, increasing electrode replacement demand. Inventories remained at historical lows, and mainstream large-diameter specifications such as φ550/φ600 continued to be in short supply. Some previously idle plants were preparing to restart. Next week, the graphite electrode market is forecast to rise further, with mainstream specifications possibly gaining 100–200 CNY/ton.

Recarburizer Market

This week (Nov. 8–Nov. 14), China's recarburizer market saw intensified price divergence. The overall average price reached 3,320 CNY/ton, up 1.22% WoW. High-grade, low-sulfur graphite recarburizers rose significantly, with fully graphitized products priced at 3,600–4,600 CNY/ton, up 100 CNY/ton WoW. Medium- to low-grade products remained stable, with semi-graphitized recarburizers at 2,700–3,800 CNY/ton. Upstream cost support strengthened: Calcined petroleum coke rose 0.78%, and low-sulfur petroleum coke rose 1.06%. Downstream demand diverged: precision casting plants increased procurement by 10% MoM for high-end products, while steel plants maintained steady operating rates and showed modest interest in medium-/low-grade recarburizers. The market presented a "tight high-end, stable low-end" structure, where high-grade supply remained insufficient. In the short term, the recarburizer market is expected to maintain this divergence, with continued increases for high-grade products.

Cathode Carbon Block Market

This week (Nov. 8–Nov. 14), China's cathode carbon block market trended steadily upward. Semi-graphitic blocks averaged 8,350 CNY/ton, up 0.60% WoW; fully graphitized blocks averaged 14,100 CNY/ton, up 0.71% WoW. Upstream price rises offered strong cost support: coal tar pitch rose 100 CNY/ton, and electrically calcined anthracite (ECA) showed a steady upward trend, pushing costs up by 50–80 CNY/ton. Downstream demand grew steadily: electrolytic aluminum plants maintained full-rate operations, increasing cathode block procurement by 5% MoM and showing a stronger preference for fully graphitized blocks, whose share reached 75%. Production remained stable at manufacturers, with long-term contracts accounting for more than 80% of sales. New order offers generally increased. Short-term price trends are expected to remain firmly upward, with larger increases likely for fully graphitized products.

Electrode Paste Market

This week (Nov. 8–Nov. 14), China's electrode paste market saw steady increases, with the average price rising to 4,850 CNY/ton, up 1.04% WoW. Upstream cost pressures intensified: coal tar pitch rose 100 CNY/ton, calcined petroleum coke rose 0.78%, pushing production costs up 80–100 CNY/ton. Downstream demand improved significantly: calcium carbide plant operating rates rose to 75%, up 3 percentage points WoW; ferro-silicon and silicon-manganese producers saw rebounds in utilization, increasing procurement of electrode paste by 12% MoM. Manufacturers sold mainly on a production-to-order basis with low inventories, while new order offers were generally 50–80 CNY/ton higher. Although steel mills continued to operate at a loss, improved carbide demand helped offset some pressure. The electrode paste market is expected to continue trending upward, with prices likely to increase another ~50 CNY/ton.

Electrically Calcined Anthracite Market

This week (Nov. 8–Nov. 14), China's ECA market experienced steady upward movement, with the average price reaching 3,250 CNY/ton, up 0.93% WoW. Upstream raw anthracite prices surged sharply, with gains of 50–80 CNY/ton in Shanxi, creating strong cost-push pressure. Downstream demand improved marginally: electrode paste plant operating rates rose to 75%, increasing ECA procurement by 8% MoM; the calcium carbide sector's demand remained weak but showed improvement from previous levels; cathode carbon block procurement was steady. Inventory levels at producers remained low, while offers generally increased by 30–50 CNY/ton and trading activity improved from earlier weeks. Next week, the ECA market is expected to continue a steady upward trend, driven by further raw material price strength.

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies