【Anode Materials】Overall Supply–Demand Balance Expected in 2026; Energy Storage Market...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Overall Supply–Demand Balance Expected in 2026; Energy Storage Market to See Strong Growth

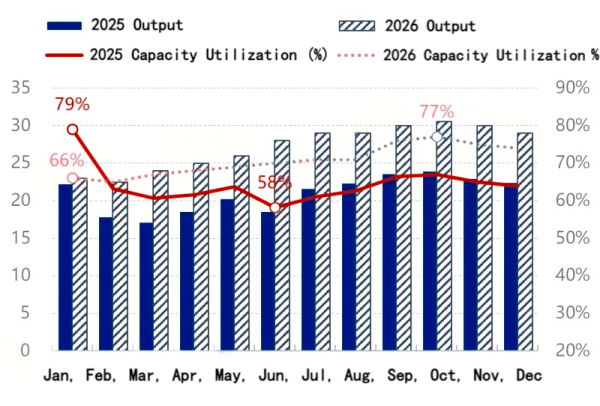

Significant Increase in Anode Material Output and Capacity Utilization in 2026

It is estimated that the average monthly output of anode materials in 2026 will reach 270,000 tons, representing an increase of 28.6% compared with 2025. Average monthly capacity utilization is expected to reach 71%, up 7 percentage points year on year.

Figure 1: Comparison of Monthly Output and Capacity Utilization in 2026 (10,000 tons)

China's monthly anode material output in 2026 is expected to be relatively low in the first quarter, rise in the second and third quarters, and decline slightly in the fourth quarter. Monthly output is estimated to range between 230,000 and 310,000 tons, with total annual output projected at approximately 3.26 million tons.

In the first quarter of 2026, demand from the power battery sector is expected to decline due to the impact of the vehicle purchase tax reduction policy, combined with the traditional off-season during the Spring Festival, resulting in relatively low monthly output at anode material enterprises. In the second and third quarters, anode demand is expected to gradually recover, with the third quarter being the traditional peak season. Demand from both power batteries and energy storage batteries will continue to drive anode material consumption, leading to a significant increase in output. Overall, anode material output in the second half of the year is expected to be higher than in the first half.

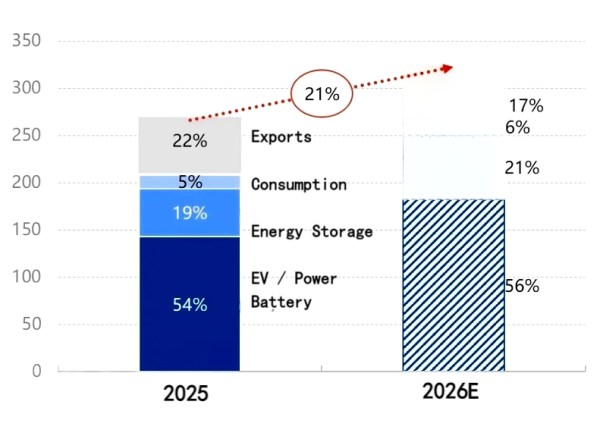

Energy Storage to Record the Fastest Growth Among Downstream Markets in 2026

Compared with 2025, total anode material consumption in 2026 is expected to increase by 21% to 3.23 million tons. The growth rate of energy storage batteries is expected to exceed that of power batteries, with annual growth rates of 33% and 27%, respectively.

Figure 2: Downstream Consumption Structure of Anode Materials in 2026 (Percentage)

In 2026, downstream demand for anode materials is expected to maintain relatively rapid growth, driven mainly by energy storage and power batteries. Incremental consumption from power batteries is estimated at 390,000 tons. With the continuous increase in new energy vehicle penetration, China's power battery industry has achieved positive results in terms of market scale, technological innovation, and supporting systems, becoming an important force in promoting the green, low-carbon transformation and sustainable development of the automotive industry. Incremental consumption from energy storage batteries is estimated at 170,000 tons. The "Special Action Plan for Large-Scale Development of New Energy Storage (2025–2027)" has been officially released, clearly setting an installed capacity target of 180 million kW by 2027 and driving investment of approximately RMB 250 billion, marking the industry's entry into a period of policy dividend release. Incremental consumption of anode materials from consumer batteries is estimated at 40,000 tons. The rapid development of the low-altitude economy (drones, aircraft, etc.) has created new application scenarios for consumer batteries, while national policy support for new energy and intelligent terminal sectors is accelerating the expansion of the consumer battery market. Total downstream consumption in 2026 is expected to increase by 570,000 tons, representing a 21 percentage point increase compared with 2025.

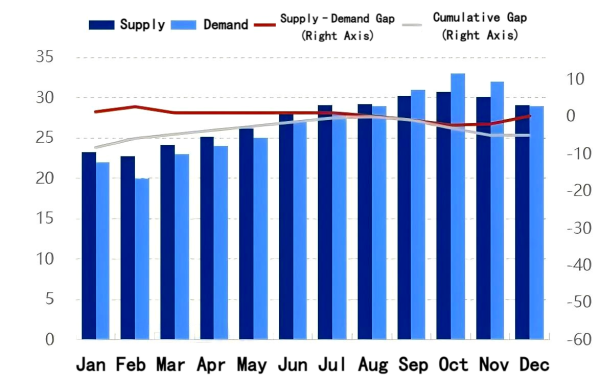

Overall Supply–Demand Balance of China's Anode Material Market Expected in 2026

In 2026, China's total anode material output is expected to reach 3.26 million tons. Including approximately 15,000 tons of imports, total supply will amount to 3.275 million tons. On the demand side, consumption in major sectors such as power batteries, energy storage batteries, and consumer batteries is expected to reach 3.23 million tons. Overall, the annual supply–demand gap is estimated at around 45,000 tons, indicating a basic market pattern of supply slightly exceeding demand.

Figure 3: Comparison of Monthly Supply–Demand Balance of Anode Materials in 2026 (10,000 tons)

From the perspective of the monthly supply–demand balance, the anode material market in 2026 is expected to be dominated by inventory accumulation, with more months of stock build than destocking. Specifically, during the peak consumption season from September to November, demand is expected to exceed supply, while in most other months the market will remain in an inventory accumulation phase. Observing the cumulative annual supply–demand gap trend, January and February represent a period of seasonal demand weakness, during which the supply–demand gap widens and inventories rise. From March to August, as demand recovers, the supply–demand gap gradually narrows, remaining in a state of supply exceeding demand and maintaining a certain level of inventory surplus. When the peak season arrives in the third quarter, short-term demand is expected to exceed supply, reversing the supply–demand gap. Overall, the fundamental outlook for the anode material market in 2026 is expected to remain relatively loose.

It should be noted that the above monthly supply–demand balance estimates for China's anode material market in 2026 are based on comprehensive calculations, mainly derived from domestic anode material and downstream capacity expansion plans, while also referencing historical monthly output and demand fluctuations and incorporating import and export data for evaluation.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies