Graphite electrode market review and outlook

Ⅰ. Graphite electrode market review

In February, graphite electrode enterprises in Hebei, Shanxi, Shandong and other places were still subject to environmental protection control and production restriction, which had a great impact. Although some recovery, but most of the enterprises are still in shutdown state. The graphite electrode market operation is overall insufficient, some specifications have been out of stock, along with the high cost, graphite electrode enterprises are reluctant to sell, and market supply may be in a state of continuous tension in the short term.

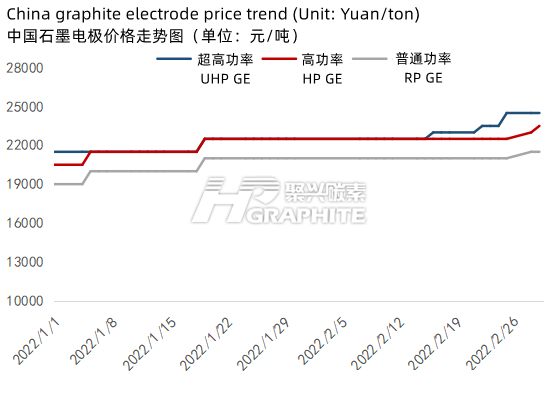

Take jiangsu area φ500 ultra-high power graphite electrode for example, as of January 29, UHP graphite electrode quoted 24500 yuan/ton, HP graphite electrode quoted 23500 yuan/ton, RP graphite electrode quoted 21,500 yuan/ton, an average increase of 1000-2000 yuan/ton compared with the beginning of the month. Most graphite electrode manufacturers are optimistic about the market in February.

Ⅱ. Raw materials

In February, affected by the international macro situation, international crude oil price hit new highs. As a result, the prices of petroleum coke and needle coke continued to rise, petroleum coke prices rose on average 900-1000 yuan/ton, and needle coke prices rose on average 900-1000 yuan/ton. Under the support of positive demand for anode materials, the price of low sulfur coke and needle coke is still expected to rise, and the pressure on graphite electrode cost may be difficult to alleviate.

Graphite electrode raw materials price analysis (unit: yuan/ton) | |||

Product | Specification | March 2nd | Month on month |

Petroleum coke | Daqing 1#A | 7300 | 1000 |

Petroleum coke | Jinxi 1#B | 6000 | 900 |

Needle coke | Oil series | 13833 | 2000 |

Needle coke | Coal series | 11500 | 750 |

Coal tar pitch | High-end | 5900 | 0 |

Notes:

1. Oil series needle coke price is the average market price of China National Petroleum Corporation, Shandong Yida and Shandong Jingyang:

2. Coal series needle coke price is the average market price of Shanxi Hongte and Baowu carbon materials.

With the purchase demand of the steel market at the end of February, the ultra-high power graphite electrode price increased significantly, with an average increase of 2000 yuan/ton, followed by the increase of high-power and regular power graphite electrode, at 1000 yuan/ton. The market transaction price has been solid. According to research, at present, the profit of domestic ultra-high power graphite electrode is 2599-3599 yuan/ton, with a year-on-year increase of 810 yuan/ton. In the state of low profit operation in recent half a year, the profit of graphite electrode has been reversed.

Ⅲ. Demand side

1. Graphite electrode for steel

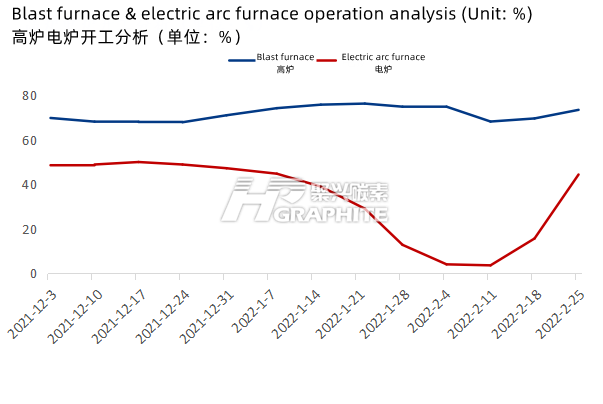

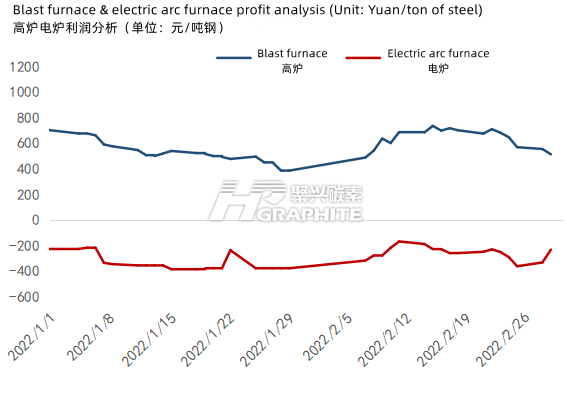

From the start-up of domestic blast furnaces and electric furnaces, the start-up has rebounded to a certain extent, of which electric furnace is more obvious. The start-up of electric furnaces is 44.36%, with a year-on-year increase of 40.34%, the start-up of blast furnaces is 73.44%, and a year-on-year increase of 5.25%. In terms of finished product profit, the profit of electric furnace rebounded significantly. The profit of electric furnace is -233.31 yuan/ton of steel, with a year-on-year increase of 85.48 yuan/ton of steel, and the profit of blast furnace is 514.16 yuan/ton of steel, with a year-on-year increase of 25.65 yuan/ton of steel. The start-up of steel mills has rebounded, forming a positive support for graphite electrode domestic demand.

2. Graphite electrode for non-steel

In February, metal silicon price rose and the downstream transaction was low. Due to some factories’ periodic maintenance and Xinjiang environmental protection inspection or production reduction resulted in a certain decrease in the operation of silicon factories and a decrease in the consumption of graphite electrodes. In terms of yellow phosphorus, the supply is tight. Affected by transportation, environmental protection, weather and other factors, the operation of manufacturers in Sichuan, Yunnan, Guizhou and other areas decreased significantly, and the overall operation of the market is less than 40%. In addition, due to the influence of power limitation policy in some areas, the re-operation of construction in March or not as expected. In February, the overall operation of refractory industry rebounded, and the operation of some varieties rebounded by nearly 10%. Therefore, on the whole, although the non-steel market for graphite electrode demand in February is negative, there is good support in March.

Ⅳ. March market outlook

At present, the downstream factories of graphite electrode are in the stage of production resumption, graphite electrode demand has rebounded. Most of the manufacturers mainly focus on early orders. Although the price is high, the transaction price of some new orders has risen. Due to Winter Olympics environmental protection and production restriction policy, the downstream goods preparation is far less than that in previous years. For the current upward price of graphite electrode or favorable stimulation of downstream procurement, therefore graphite electrode demand improved in March. In addition, under the low operation as well as the high cost, graphite electrode price upward power still exists, bullish sentiment is relatively strong. Comprehensive supply and demand analysis, there is room for graphite electrode price to rise in March, contact us to get more latest graphite market news.

No related results found

0 Replies