【Negative electrode】Prices Weak and Stable, Low Production Enthusiasm for Enterprises

【Negative electrode】Prices Weak and Stable, Low Production Enthusiasm for Enterprises

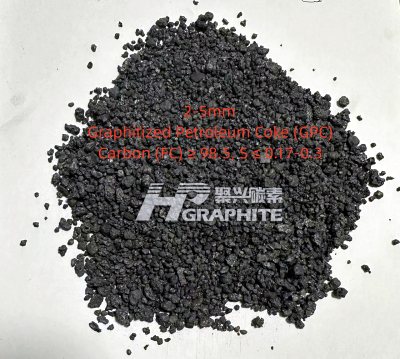

The price of lithium battery negative electrode materials is weak and stable, and the production enthusiasm of enterprises is low. The current market for negative electrode materials is facing three major problems: continuous cost reduction, evident overcapacity in the industry, and weak willingness to receive orders from downstream enterprises, all of which are negative factors for the negative electrode material market. The GPC in the preparation of negative electrode materials for reference. The specific situation is as follows:

Currently, the domestic lithium battery negative electrode material market has a weak and stable price trend, and the market prices still have the intention to decline. According to feedback from downstream enterprises, the market demand began to pick up in the second quarter, and the terminal shipments increased significantly. However, the current market outlook is unclear, and most enterprises express unknown expectations for the market improvement points. The market situation did not meet expectations, and the previous accumulation of inventory is serious. Currently, companies mainly rely on inventory clearance and on-demand purchases for rational procurement of negative electrode materials. The negative electrode material market itself has been affected by the crazy expansion of production capacity in the past. At present, it has shown a situation of overcapacity, and the market price is relatively chaotic. The competition in the middle and low-end product markets is relatively fierce, with low-price sales existing. The production enthusiasm of enterprises is low, mainly focusing on consuming inventory. Furthermore, the market's mindset is to buy high but not low, making the demand support for the negative electrode material market weak, and the overall trading atmosphere is not good. The lack of terminal demand has affected the upstream raw material side. The prices of low-sulfur petroleum coke, needle coke, and coal tar pitch have continued to decline. The processing fees for graphiteizing negative electrodes have been lowered to near the cost line, and the production costs of negative electrode material companies have fallen. Downstream market bargaining is evident. Overall, the recent performance of the negative electrode material market is not good, and the price stability support is insufficient.

By 2023, there will be a significant overcapacity in graphiteizing negative electrodes, and there are still negative electrode material integration projects being put into production, and the matching graphiteizing capacity of enterprises will continue to increase, squeezing independent graphiteizing capacity. In addition, the overall demand for the negative electrode material market is not good, and the orders for graphiteizing are sharply decreasing. Graphitization companies have begun to stop or reduce production since the Spring Festival. As of mid-April 2023, the overall operating rate of the graphiteization market is between 30-40%. Due to the continued downturn in the graphiteization market, the construction progress of some new projects has slowed down, and some companies have stopped their new projects. The mainstream quotation for graphiteizing processing fees is CNY 12,500/ton, and some graphiteizing companies have settled at prices lower than the market price, about CNY 11,000/ton. Downstream enterprises have offered prices as low as CNY 10,000/ton.

On the raw material side: petroleum coke, needle coke, and coal tar pitch are the three main production materials for negative electrode materials, and all three have exhibited weakness in the market so far. In the first quarter, petroleum coke prices plummeted, with a large amount of imported petroleum coke arriving at ports and petroleum coke inventory remaining high, leading to ample supply. However, downstream enterprises' overall demand was average, and the wait-and-see sentiment was strong, resulting in on-demand purchasing. As of the end of the first quarter, the average market price for petroleum coke was 2,455 yuan/ton, down 32.81% from the beginning of the year. After the Qingming holiday, the market began to improve, and petroleum coke prices began to tentatively rise, prompting downstream enterprises to stock up early, but the price increase was limited.

Currently, coal tar pitch has fallen by 700-1,000 yuan/ton, and downstream acceptance of goods has become more cautious due to the impact of raw material prices. They are mostly making small on-demand purchases or observing the execution of earlier orders, and market entry is mainly price-driven, putting significant constraints on negotiations with coal tar pitch suppliers.

The needle coke market is weakly stable, with graphite electrodes and negative electrode materials as the main downstream products. At present, graphite electrode orders are relatively stable, but negative electrode material orders are few, mainly driven by rigid demand. In addition, the prices for needle coke were suppressed during the cost reduction phase, resulting in pressure on mainstream manufacturers' shipments. Currently, the operating rate of oil-based needle coke is less than 40%, and depleting inventory is the main task for companies. Coal-based needle coke is only produced by a few companies with an operating rate of less than 10%.

Data shows that in March 2023, China's production and sales of new energy vehicles reached 674,000 and 653,000 respectively, an increase of 22% and 24.4% month-on-month and 44.8% and 34.8% year-on-year, respectively, with a market share of 26.6%. From January to March 2023, production and sales of new energy vehicles reached 1.65 million and 1.586 million, respectively, up 27.7% and 26.2% year-on-year, respectively, with a market share of 26.1%. Some provinces have continued their subsidies for new energy vehicles, and price reductions by car companies, along with government subsidies, have led to a competition between fuel vehicles and new energy vehicles for market share. The demand for the power market is slowly recovering, with limited demand growth.

In March, China's production of power batteries reached a total of 51.2 GWh, up 26.7% year-on-year and 23.5% month-on-month. March's power battery production has returned to levels seen in August and December of last year, and the industry is gradually recovering. In recent years, top battery companies have continued to expand their production capacity, and the supply side is expected to face an overcapacity situation. The operating rate in each link is still not optimistic, and companies may face challenges.

In terms of prices: with insufficient cost support and weak willingness to accept goods downstream, there is still considerable room for downward adjustment of negative electrode material prices. It will take some time for the overall market atmosphere to recover. It is preliminarily estimated that prices for mid-to-low-end products will decrease by 3,000 yuan/ton and prices for high-end products will decrease by 2,000 yuan/ton around the May Day holiday. Specifically, the mainstream price for high-end negative electrodes will be between 54,000 and 66,000 yuan/ton, the mainstream price for mid-range negative electrodes will be between 38,000 and 48,000 yuan/ton, and the mainstream price for low-end negative electrodes will be between 17,000 and 26,000 yuan/ton. Due to market uncertainty, negative electrode material companies are mostly adopting a wait-and-see attitude.

Looking at the long term, the rapid development of the entire new energy industry has seen capacity increase rapidly and overcapacity emerge in various sectors, including negative electrode materials. In particular, in the past two years, existing companies in the industry have greatly expanded their capacity, and there are many new entrants with capacity layouts. Starting in 2023, market expansion will no longer be as fervent as before, and the market will undergo significant changes. 2023 will be an adjustment period for the negative electrode material industry. However, looking at it in the long term, companies still maintain sufficient confidence in the negative electrode material industry. From the perspective of national policies and market demand, the long-term high-speed development of the industry is inevitable. Whether in the direction of power batteries or energy storage, the total market demand will continue to increase, and as the requirements for range and endurance of new energy vehicles continue to increase, lithium-ion battery negative electrode materials will also develop towards higher capacity. The research and introduction of new silicon-based negative electrode materials is expected to accelerate. For more information on negative electrode materials, please feel free to consult us.

No related results found

0 Replies