【EAF Steel】Market Rebounds Weakly, Electric Arc Furnaces Continue to Struggle

【EAF Steel】Market Rebounds Weakly, Electric Arc Furnaces Continue to Struggle

This week, Chinese domestic construction steel prices showed narrow fluctuations. After a slight increase at the beginning of the week, the market maintained moderate transactions. However, the market faced significant resource pressure, intensifying the selling mindset of some traders. In the second half of the week, prices declined again. As of May 12th, the average price of domestic rebar steel was 3,714 yuan, a decrease of 12 yuan compared to the previous week, more information on graphite electrodes for EAF steelmaking.

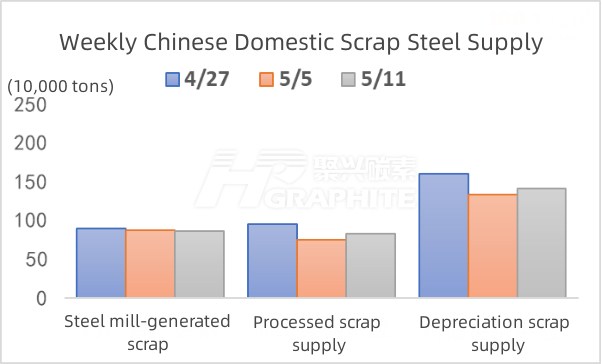

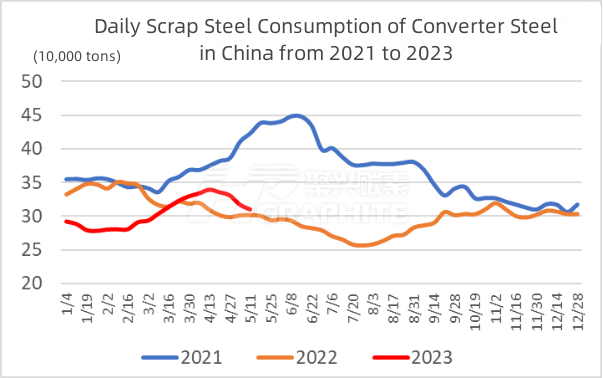

In terms of raw materials, the scrap steel market showed mixed trends this week. However, due to the continuous decline in steel prices and the impact of heavy rainfall in certain regions (such as Jiangxi and South China), the overall resource level has not fully recovered to the pre-holiday level. Some steel mills in Guangdong, Guangxi, and Jiangsu implemented price increases to replenish their inventories, while other regions mainly experienced price declines. The average purchase price of steel mill scrap (electric furnace charge) decreased by 14 yuan to 2,483 yuan (excluding VAT) compared to the previous week.

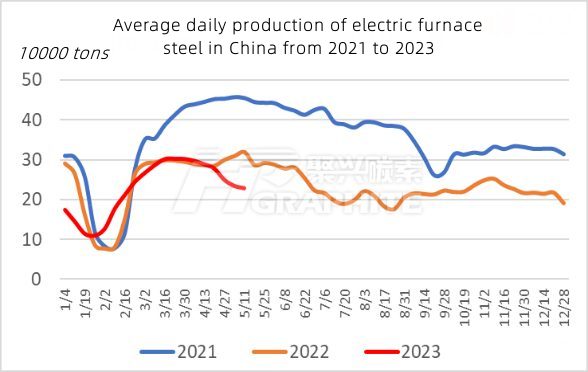

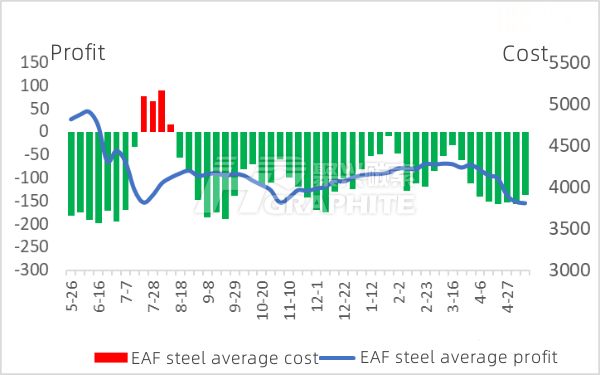

The average profit level of electric arc furnace steel mills slightly rebounded compared to the previous week. However, the extent of losses remained significant, and steel mills faced continued sales pressure, resulting in low production enthusiasm. The few electric arc furnace steel mills that resumed production this week were mostly special steel enterprises, and a few northern electric arc furnace steel mills are considering switching to production of flanges. According to statistics, the capacity utilization rate of electric arc furnace steel among 135 steel mills nationwide was 40.57%, a decrease of 1.03% compared to the previous week. The daily production of electric arc furnace steel was 228,400 tons, marking a continuous decline for seven weeks.

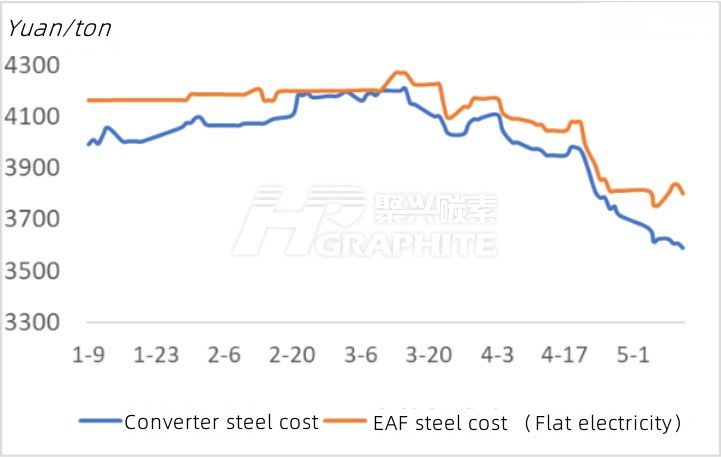

Currently, steel inventories in the market are significantly higher than the same period last year. Both end-user demand and export markets are facing obstacles. Moreover, the southern region is expected to experience a significant rainfall process next week, making it difficult for short-term market demand to improve. Additionally, after the collapse in pig iron costs, which are now approximately 200 yuan lower than heavy scrap prices, blast furnace steel mills maintain a relatively high capacity utilization rate, while electric arc furnace steel mills bear the majority of the production reduction pressure. This passive situation is expected to persist at least until the end of May. Contact us for more information on the steel market news.

No related results found

0 Replies