【Needle Coke】Market Demand Favorable, Anode Inventory Depletion

【Needle Coke】Market Demand Favorable,

Anode Inventory Depletion

Market Overview

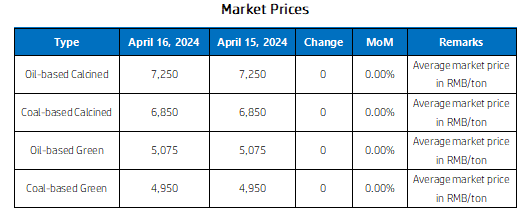

As of April 16, 2024, the Chinese needle coke market remains stable. Domestic needle coke prices range from 4,850 to 5,200 RMB/ton for green coke and 6,500 to 8,000 RMB/ton for calcined coke. The mainstream transaction prices for imported oil-based needle coke are 450-1,150 USD/ton for green coke and 800-1,300 USD/ton for calcined coke, while coal-based needle coke is priced at 800-1,000 USD/ton for calcined coke. The average domestic needle coke price stands at 7,479 RMB/ton, maintaining stability from the previous workday. Current market conditions for Chinese needle coke are generally stable, with some enterprises reporting ex-factory prices for green coke at 5,500 RMB/ton. The demand for anode materials is expected to continue until June, and with increasing shipments, needle coke enterprises are experiencing low inventory levels. Given the continued high raw material prices, needle coke companies are expected to persist in pushing prices higher.

Upstream Market

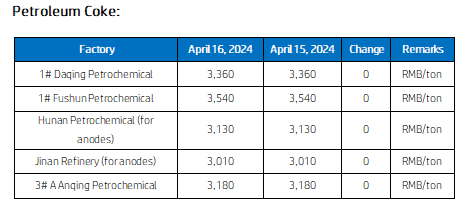

Slurry: Slurry oil prices slightly increased by 20-30 RMB/ton on April 16, with mainstream prices for medium to high sulfur slurry ranging from 4,150 to 4,600 RMB/ton, and low sulfur slurry priced between 4,200 and 5,300 RMB/ton. Despite a slight decline in international crude oil prices and negative market sentiment, the overall market attitude remains positive with satisfactory downstream participation, leading to slight increases in slurry oil prices.

Coal tar pitch: Coal tar pitch discussions were bearish, with modified pitch prices in major production areas ranging from 5,750 to 6,100 RMB/ton. New orders in the coal tar pitch market are on hold, with occasional lower bids observed. Some deep-processing plants in coal tar have resumed production during the week, leading to increased supply and a bearish market atmosphere. Downstream pressure on costs has resulted in cautious purchasing and price negotiations. Additionally, raw material coal tar prices are expected to adjust downwards, influencing expectations for lower new orders in coal tar pitch.

Downstream Market

Graphite Electrodes: The graphite electrode market faces challenging transaction conditions with weak downstream demand affecting production enthusiasm. Some enterprises that planned to resume production have delayed their plans. Decisions will be based on future market demand, with some producers considering further production controls to avoid inventory accumulation. Mainstream companies maintain stable production, with the graphite electrode market operating weakly stable.

Negative Electrode Materials: The market for negative electrode materials is currently stable. Feedback from the market indicates that frequent guidance policies from national and local governments regarding the new energy vehicle industry have accelerated the release of new energy vehicle consumption. Downstream battery companies are optimistic about purchasing, leading to a gradual depletion of inventories and an increase in production enthusiasm among negative electrode material companies, with operational rates maintained at around 50%

Market Forecast

The demand from terminal electric arc furnace steel plants continues to be weak, leading to expectations of a weakly stable calcined coke market. However, due to favorable demand in the green coke market and ongoing anode material orders, prices may continue to rise. The expected price range for needle coke on the next workday is 6,500-8,000 RMB/ton for calcined coke and 4,900-5,200 RMB/ton for green coke. For future insights on the needle coke supply chain, feel free to contact us.

(Source: BAIINFO)

No related results found

0 Replies