【Calcined Coke】Market Stabilizes with Slight Improvement Since Early August

【Calcined Coke】Market Stabilizes with Slight Improvement Since Early August

Market Overview

As of August 26, the average price of calcined petroleum coke is 2,148 yuan/ton, remaining stable compared to the previous working day. The market for calcined coke is generally stable, though low-sulfur calcined coke is facing slow sales. Last week, the prices for calcined coke made from Fushun raw coke significantly dropped, and those using Jinzhou and Jinxi raw coke also saw slight declines due to adjustments in petroleum coke prices. Despite these changes, downstream demand has not significantly improved, leading to increased inventory and potential production cuts. The prices for mid-high sulfur calcined coke remain steady, with most companies reporting satisfactory orders for September, and sales of standard goods have slightly improved since the beginning of the month.

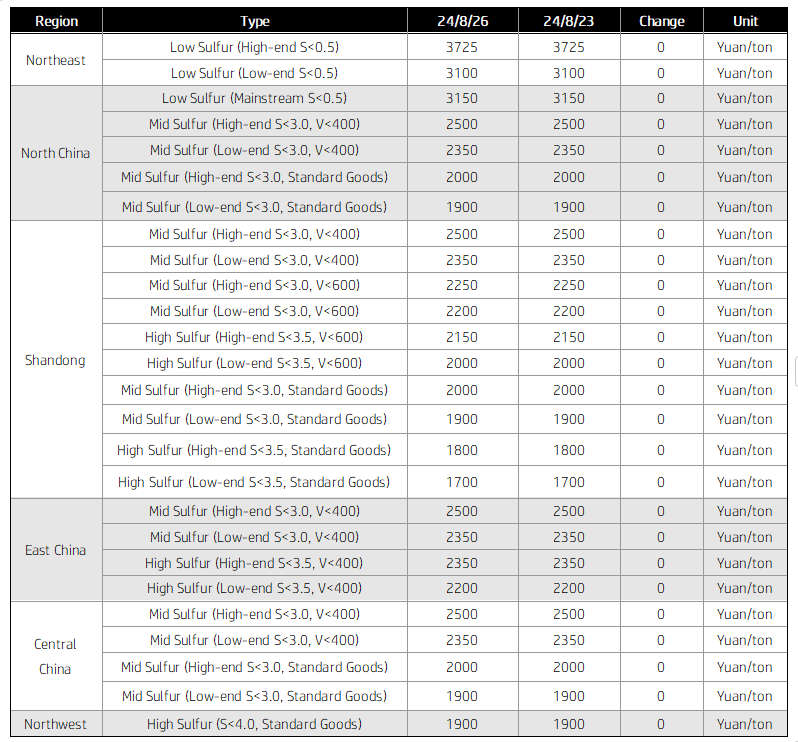

Main Regional Market Transaction Prices

Current Prices

Low-sulfur calcined coke (using Jinxi, Jinzhou petroleum coke as raw material) is priced at 3,050-3,300 yuan/ton; low-sulfur calcined coke (using Fushun petroleum coke) is priced at 3,500-3,725 yuan/ton; and low-sulfur calcined coke (using Liaohe, Binzhou CNOOC petroleum coke) is around 2,900 yuan/ton. Mid-high sulfur calcined coke (S 3.0%, with no requirements for trace elements) was previously priced at 1,950 yuan/ton in cash, but current negotiations are seeing prices at 1,900-1,950 yuan/ton. Mid-high sulfur calcined coke (S 3.5%, with no requirements for trace elements) was previously priced at 1,700-1,750 yuan/ton in cash, with current negotiations maintaining the same price. Mid-high sulfur calcined coke (S 3.0%, V 400) previously priced at 2,400 yuan/ton in cash remains steady.

Supply Side

As of now, the national daily supply of commercial calcined coke is 26,554 tons, with an operating rate of 62.39%, a slight decrease of 0.05% compared to the previous working day.

Upstream Market

Petroleum Coke: Currently, Sinopec's refineries are maintaining stable pricing, with Maoming Petrochemical focusing on self-consumption, Guangzhou Petrochemical producing mainly mid-sulfur coke, and Beihai Refinery maintaining stable production and sales. In PetroChina's refineries, trading is stable, with Northeast low-sulfur coke seeing slight improvement after previous price drops, North China's Dagang Petrochemical maintaining stable pricing, South China's Yunnan Petrochemical producing high-sulfur coke mainly for self-consumption, and Northwest China's Urumqi Petrochemical lowering prices by 70 yuan/ton for 1A-grade coke.

Downstream Market

Graphite Electrodes: Production remains stable, with most firms producing based on specific orders to avoid inventory buildup. However, due to the impact of low-priced resources in the market and downward pressure from downstream buyers, some graphite electrode companies are reluctant to sell, focusing on long-term orders. Demand remains weak, and the market is adjusting accordingly.

Electrolytic Aluminum: The Ministry of Commerce issued a notice on further promoting the "old for new" appliance initiative, specifying subsidy types and standards to stimulate consumer demand, pushing spot aluminum prices higher.

Anode Materials: The market remains quiet, with weaker-than-expected demand from end-users in the new energy vehicle sector. Some anode companies report no significant increase in orders despite the upcoming "Golden September and Silver October" sales season, leading to increased competition and lower prices.

Market Outlook

Calcined coke prices for certain grades are expected to fluctuate slightly tomorrow.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies