【CPC】 Calcined Petroleum Coke Market Overview (September 12)

【CPC】 Calcined Petroleum Coke Market Overview (September 12)

Market Summary

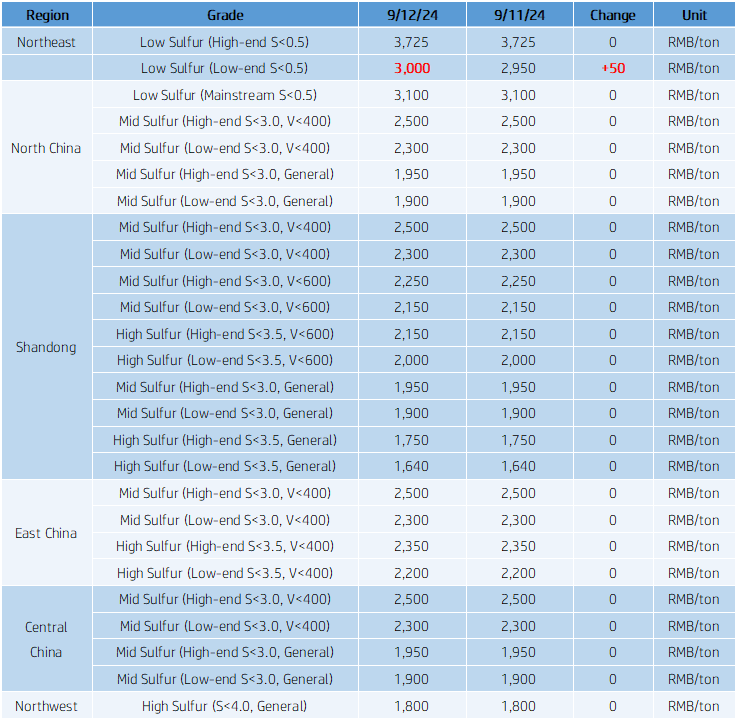

On September 12, the average market price of calcined petroleum coke (cpc) stood at 2,148 RMB/ton, stable compared to the previous day. The market for calcined coke is running steadily. Low-sulfur calcined coke prices in Northeast China have risen slightly due to raw material price increases, though market demand has yet to show significant improvement. Most companies maintain a balance between production and sales. The market for mid- to high-sulfur calcined coke is relatively active, but demand from the anode materials sector is underperforming expectations, leading some companies to lower their quotations for standard screened products.

Regional Market Prices for Calcined Petroleum Coke (September 12)

Market Prices

Low-Sulfur Calcined Coke: The mainstream transaction price for low-sulfur calcined coke (using Jinxi and Jinzhou petroleum coke as raw materials) is RMB 3050-3200/ton. For calcined coke produced from Fushun petroleum coke, the factory’s mainstream transaction price is RMB 3500-3725/ton. Low-sulfur calcined coke made from Liaohe and Binzhou CNOOC petroleum coke has a market price of approximately RMB 2850-3050/ton.

Medium- to High-Sulfur Calcined Coke:

Sulfur 3.0%, No Trace Element Requirements: The previous factory contract price was RMB 1950/ton in cash; the current negotiation price is RMB 1900-1950/ton.

Sulfur 3.5%, No Trace Element Requirements: The previous mainstream contract price was RMB 1640-1750/ton in cash; the current negotiation price remains RMB 1640-1750/ton.

Sulfur 3.0%, Vanadium 400: The previous contract price was RMB 2400/ton in cash; the current negotiation price is still RMB 2400/ton in cash.

Supply Situation

The daily supply of commercial calcined coke nationwide is 26,741 tons, with an operational rate of 62.83%. The overall supply of calcined coke remains stable compared to the previous working day.

Upstream Market

Petroleum Coke: Currently, refineries under Sinopec are maintaining steady shipments. In the Yangtze River region, anode coke is being shipped based on demand. Hunan Petrochemical's storage coke shipments are stable, while Jiujiang and Jingmen refineries focus on aluminum carbon orders. In North China, Cangzhou Refinery is undergoing maintenance, with reopening planned for the end of October. In Shandong, Jinan Refinery mainly produces 2B coke and a small amount of storage coke. Prices at select PetroChina refineries are rising, with low-sulfur coke in Northeast China showing good sales and sufficient orders. Jinxi Petrochemical has raised prices by RMB 30/ton, while others maintain stable pricing. Liaohe Petrochemical has also raised prices by RMB 110/ton, with steady downstream demand. In the Northwest, refinery prices remain stable, primarily executing orders. In the Southwest, Yunnan Petrochemical is producing mid-sulfur coke for anode material. CNOOC refineries are delivering on a per-order basis.

Downstream Market

Graphite Electrodes: Graphite electrode manufacturers are maintaining a balanced production and sales ratio. While there are new orders, companies are cautious in accepting them to preserve current profits. The market has an oversupply of low-priced resources, leading downstream companies to pressure prices. As a result, manufacturers' enthusiasm for shipments is low, and actual transactions in the graphite electrode market remain to be improved. The market is stable for now.

Aluminum Electrolysis: External aluminum prices, combined with decreasing aluminum ingot inventories and continued macroeconomic policy support, are boosting market sentiment, leading to an increase in spot aluminum prices.

Anode Materials: The downstream demand for anode materials has been weaker than expected. Orders for anode companies are declining, and the market is currently oversupplied. Battery manufacturers have strong bargaining power, leading to significant price reductions. Anode material prices are unlikely to rise, and with rising production costs and price pressures, profits for anode companies remain slim. Companies are adopting a wait-and-see attitude in terms of production.

Market Forecast

Calcined petroleum coke prices are expected to remain stable across various models tomorrow, with slight adjustments for individual companies based on market conditions and cost factors.

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies