【CPC】Latest Prices! Improved Shipments! Enterprises Report Good Trading Conditions!

【Calcined Petroleum Coke】 Latest Prices! Improved Shipments! Enterprises Report Good Trading Conditions!

Market Overview

As of September 23, the average price of calcined petroleum coke in the market is 2,150 RMB/ton, an increase of 2 RMB/ton compared to the previous working day, with a rise of 0.07%. Currently, trading in the calcined coke market is acceptable, with slight improvements in the low-sulfur calcined coke market. However, enterprises are still offering discounts to stimulate orders, and the transaction prices from downstream electrode companies are mainly on the decline. Although there are shipments of low-sulfur calcined coke, price increases are sluggish. The medium-high sulfur calcined coke market remains stable, with prices for aluminum-grade calcined coke remaining firm. Most companies report marginal profits and good trading conditions.

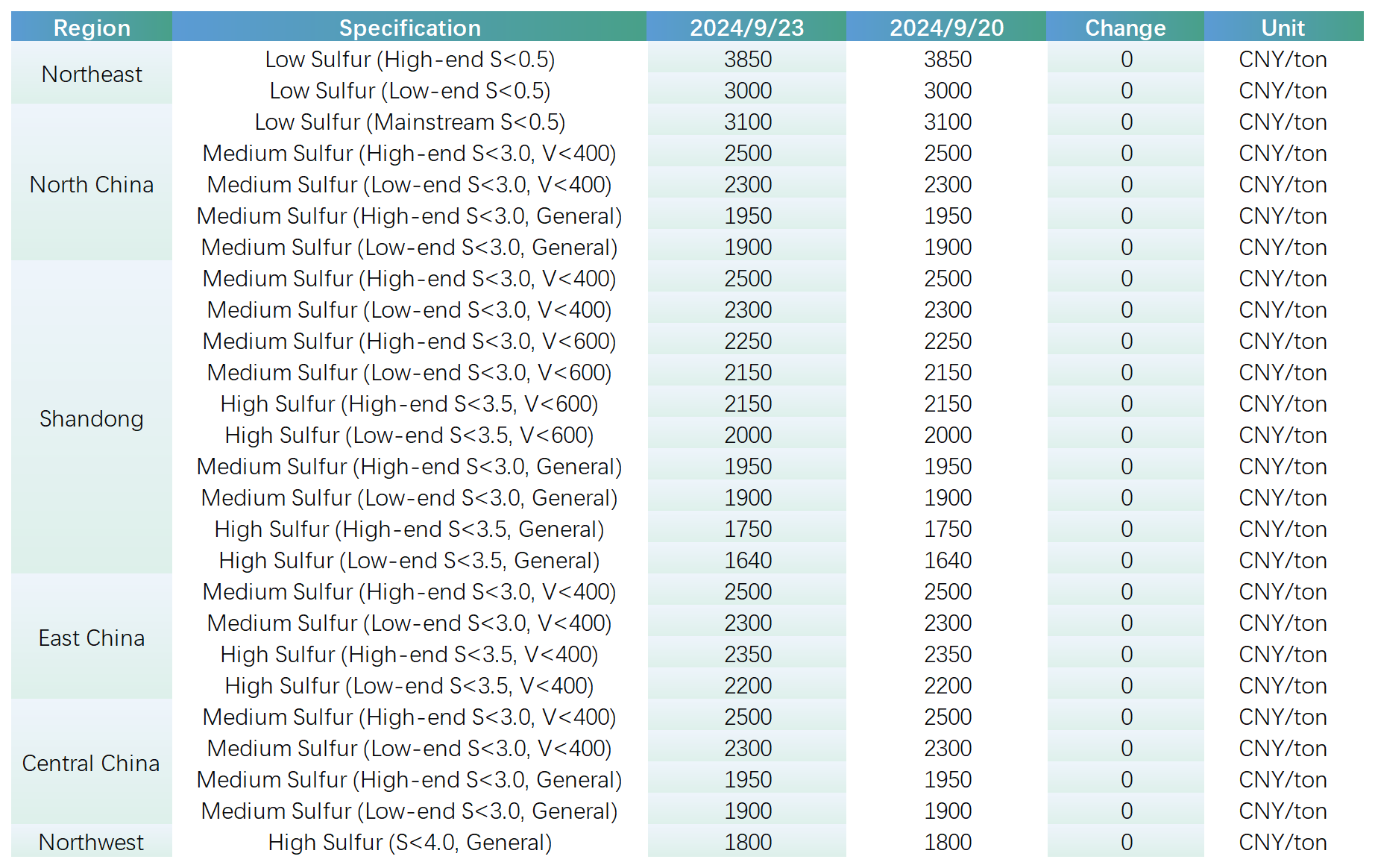

Main Regional Market Transaction Prices

Market Prices

Low-sulfur calcined coke (using Jinxi and Jinzhou petroleum coke as raw materials): Mainstream transaction prices are 3,050-3,200 RMB/ton.

Low-sulfur calcined coke (using Fushun petroleum coke as raw material): Mainstream ex-factory transaction prices are 3,500-3,850 RMB/ton.

Low-sulfur calcined coke (using Liaohe and Binzhou Zhonghai petroleum coke as raw materials): Mainstream transaction prices are around 2,850-3,050 RMB/ton.

For medium-high sulfur calcined coke (sulfur 3.0%, with no requirements for trace elements), the previous ex-factory mainstream contract price was 1,950 RMB/ton; current negotiation prices are in the range of 1,900-1,950 RMB/ton. For medium-high sulfur calcined coke (sulfur 3.5%, with no requirements for trace elements), the previous ex-factory mainstream contract price was 1,640-1,750 RMB/ton; current negotiation prices remain at 1,640-1,750 RMB/ton. For medium-high sulfur calcined coke (sulfur 3.0%, vanadium 400), the previous contract price was 2,400 RMB/ton; current negotiation prices remain at 2,400 RMB/ton.

Supply Situation

Currently, the national daily supply of commercial calcined coke is 26,583 tons, with an operating rate of 62.46%. The supply in the calcined coke market has decreased by 0.04% compared to the previous working day.

Upstream Market

Petroleum Coke: Currently, prices of petroleum coke from Sinopec's refineries are mostly stable. In North China, Yanshan Petrochemical has low inventory and good shipments, primarily producing 4B, with Shijiazhuang refinery shipping 4A, while Cangzhou refinery is under maintenance. In Shandong, Qingdao Petrochemical maintains stable shipments, while Jinan refinery ships storage coke as needed, and Qingdao Refining maintains stable pricing for shipments. Some refineries under CNPC have seen price declines. In Northeast China, low-sulfur prices are stable, with downstream demand for graphite electrodes remaining essential, and demand for anode materials is steady. In Northwest China, refinery shipments are average, with Yumen Refinery and Lanzhou Petrochemical reducing prices by 50 RMB/ton, while prices in Xinjiang remain stable. CNOOC currently executes orders at stable prices.

Downstream Market

Graphite Electrodes: The graphite electrode market has been dragged down by earlier declines in raw material prices, with actual transaction prices mainly decreasing. Coupled with weak downstream demand, shipments of graphite electrodes are difficult, and companies are often discounting sales. The mainstream market prices are impacted by low-priced resources and have declined slightly overall.

Electrolytic Aluminum: Influenced by external markets, combined with data from the Ministry of Finance showing a 2.6% year-on-year decline in national general public budget revenue from January to August, market sentiment has declined, leading to a drop in spot aluminum prices.

Anode Materials: Market feedback indicates that the release speed of downstream demand is not keeping pace with the expansion speed of the anode materials market, which is still in a phase of oversupply. Competition among enterprises is fierce, and due to the current serious homogenization of mid-to-low-end products, actual transaction prices for mid-to-low-end anode materials remain low, with ongoing low-price competition for orders.

Market Forecast

It is expected that the mainstream prices of various grades of calcined coke will remain stable tomorrow.

Feel free to contact us anytime for more information about the calcined coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies