【PetCoke】Coke Prices on the Rise! Further Price Hikes Expected!

【Petroleum Coke】Coke Prices on the Rise! Increased Market Inquiries and Transactions, Further Price Hikes Expected!

Market Overview

As of October 11, the average market price for petroleum coke was RMB 1,712/ton, up RMB 6/ton from the previous working day, representing an increase of 0.35%. The current petroleum coke market trend is generally stable with an upward movement. Demand from downstream buyers remains solid, with increased market inquiries and transactions. Some low-sulfur coke products from leading refineries continue to see price increases, while local refinery prices are also trending upward.

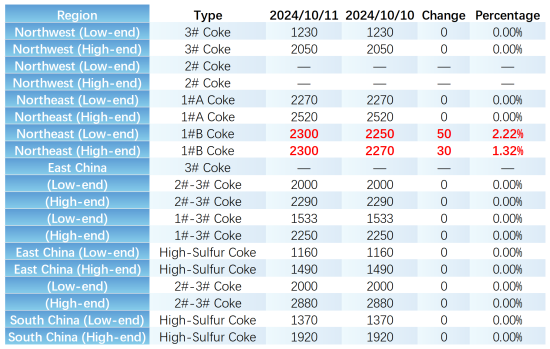

Key Regional Market Transaction Prices

PetroChina's refineries have maintained stable petroleum coke transactions. In the anode sector, battery factories have seen an increase in storage orders, leading to steady demand for anode-grade coke. For carbon-grade coke, demand from aluminum manufacturers remains relatively active. In Shandong, Jinan Refinery focuses on producing storage-grade coke and 2#B products, selling on an as-needed basis, while Qingdao Refining mainly supplies high-sulfur coke, and Qilu Petrochemical's demand for aluminum-use carbon is stable. Some of PetroChina's refineries have also raised petroleum coke prices, with Jinzhou Petrochemical increasing prices by RMB 30/ton and Jinxi Petrochemical by RMB 50/ton. Low-sulfur coke inventories remain low, and demand from downstream buyers is strong, resulting in a positive market outlook. In the Northwest region, refineries like Lanzhou Petrochemical and Yumen Refinery maintain stable shipments, while in Xinjiang, Dushanzi Petrochemical has low inventories, and Urumqi Petrochemical and Karamay Petrochemical mainly supply the local aluminum-carbon and silicon markets. CNOOC's refineries are currently shipping based on orders, with downstream flows directed towards aluminum carbon and anode materials.

Local Refineries

Local refineries have reported satisfactory shipments, with market prices generally trending upward. Downstream enterprises continue to have a demand for petroleum coke, providing some support. As a result, some refineries have raised their prices by RMB 10-50/ton, while others have reduced prices by RMB 10-20/ton to ensure steady shipments. Current market fluctuations include: Dongying Qirun's petroleum coke sulfur content has risen to around 5.0%; Huifeng Petrochemical's petroleum coke sulfur content has dropped to about 2.93%; Fuhai Hualian's petroleum coke vanadium content has increased to 403 PPM, being sold as high-vanadium 3#B.

Imported Coke

For imported coke, shipments of low-sulfur sponge coke at ports are performing well, with prices for Indonesian coke continuing to rise. Meanwhile, the supply of high-sulfur, high-vanadium sponge coke remains ample, and its sales remain generally moderate at the ports.

Supply Side

As of October 11, there are 13 routine maintenance operations at coking units nationwide. The daily production of petroleum coke stands at 88,065 tons, with a coking capacity utilization rate of 69.44%, a decrease of 0.08% compared to the previous working day.

Demand Side

Demand from aluminum-carbon enterprises for petroleum coke remains steady. The trading activity in the anode materials market has shown little fluctuation, with overall operating rates ranging between 40% and 45%. As a result, these enterprises remain cautious in their purchases of raw petroleum coke. Graphite electrode producers also face limited downstream demand improvement, maintaining a steady market outlook with restrained procurement of petroleum coke. The demand for high-sulfur shot coke in the silicon carbide industry and in southern fuel markets remains stable.

Market Outlook

The overall market activity for petroleum coke remains satisfactory, with steady demand from downstream enterprises. Most refineries are maintaining their current output levels and focusing on stable shipments. As such, the market price of petroleum coke is expected to remain stable in the short term, with potential minor price increases of around RMB 10-50/ton from some refineries. The price of shot coke is expected to maintain its stable trend in the near future.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies