【Petroleum Coke】Improving Demand: November Petroleum Coke Imports Show Improvement

【Petroleum Coke】Improving Demand: November Petroleum Coke Imports Show Improvement

In general, November 2024 saw an improvement in petroleum coke imports. Since October, downstream demand in the domestic low-sulfur imported coke market has improved, driving good sales performance. Low sulfur calcined petroleum coke can be used to manufacture graphite electrodes and special carbon products, or as an important material in the steel industry. Additionally, the supply of low-sulfur coke at ports has tightened slightly, causing prices to rise. This trend has contributed to a continued recovery in the domestic petroleum coke market, with port inventories gradually decreasing and traders' shipments significantly improving. Against this backdrop, the market has shown positive performance, and it is expected that petroleum coke imports will increase month-on-month in Q4.

Key Data (December 22, 2024):

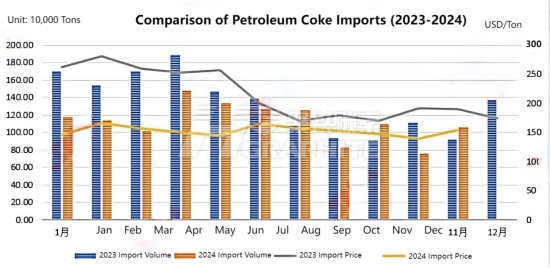

According to customs data, China's petroleum coke imports in November 2024 were 1.0605 million tons, up 39.32% month-on-month and up 15.17% year-on-year. The estimated average import price for November was $154.73/ton, up 10.69% from the previous month and down 18.64% year-on-year. Total petroleum coke imports for 2024 amounted to about 12.416 million tons, a 15.22% decrease from the previous year.

Comparison of Petroleum Coke Imports (2023-2024)

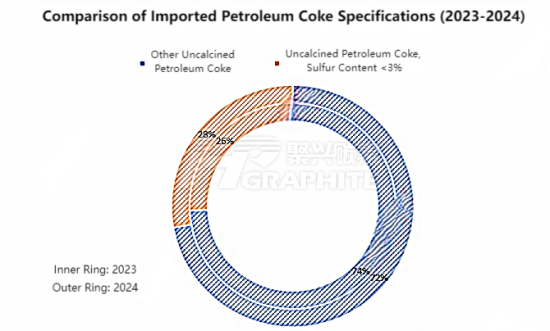

From the perspective of import types, in 2024, the ratio of sulfur content <3% and other uncalcined petroleum coke was approximately 28:72. The import volume of "uncalcined petroleum coke with sulfur content <3%" reached 3.4576 million tons, down 8.10% year-on-year; the import volume of "other uncalcined petroleum coke" reached 8.9583 million tons, down 17.68% year-on-year.

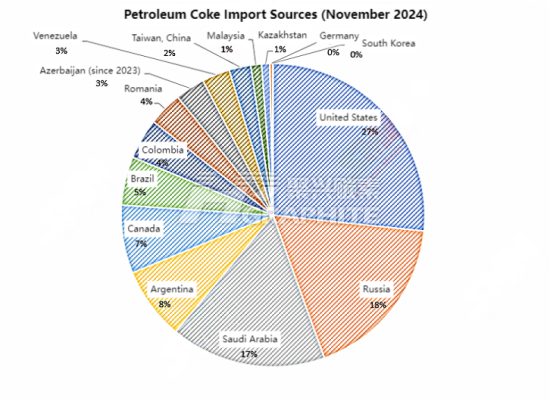

Petroleum Coke Import Sources (November 2024):

The main countries/regions from which China imported petroleum coke in November 2024 were the United States, Russia, and Saudi Arabia. The import volumes (and their respective shares) were 282,900 tons (27%), 189,200 tons (18%), and 175,800 tons (17%).

Outlook:

Overall, November 2024 showed an improvement in petroleum coke imports, driven by improved demand in the low-sulfur coke market and tighter port supplies. This trend is expected to continue, with the market remaining active and Q4 imports expected to rise.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies