【Carburant】2024 Market Overview: Raw Material Fluctuations, Weak Demand & Export Decline

【Carburant】2024 Market Overview:

Raw Material Fluctuations, Weak Demand, and Significant Export Decline

Raw Materials:

Electrically Calcined Anthracite: The market price of electrically calcined anthracite in China in 2024 initially stabilized, then declined, and later maintained stability. Downstream demand continued to be poor, with no new favorable factors. Some enterprises slightly reduced production, but supply remained relatively sufficient. Prices of raw materials continued to fluctuate, with limited profit margins overall. Some companies opted to blend different types of coal or directly produce, leading to significant differences in transaction prices and actual revenues between companies. In general, the price of electrically calcined anthracite was lower than in the same period last year.

Petroleum Coke: The petroleum coke market in China reversed in 2024, showing an "N" shaped price trend. The overall supply of petroleum coke decreased in 2024, mainly due to a reduction in imported petroleum coke, particularly low-vanadium coke, while high-vanadium coke supply remained abundant. Demand for sponge coke from carbon, anode materials, and other sectors continued to rise, while the fuel coke market saw demand drop due to downstream market conditions and policy restrictions. This led to a noticeable trend of price differentiation in the petroleum coke market.

Calcined Petroleum Coke: The calcined petroleum coke (cpc) market in China showed weak trading in 2024, especially for low-sulfur calcined petroleum coke, with the market performing poorly throughout the year. Most production enterprises were operating at a loss. The market for mid- to high-sulfur calcined petroleum coke saw supply and demand increases lower than market expectations, with most enterprises maintaining marginal profit, while some were in a loss-making situation.

Market Supply:

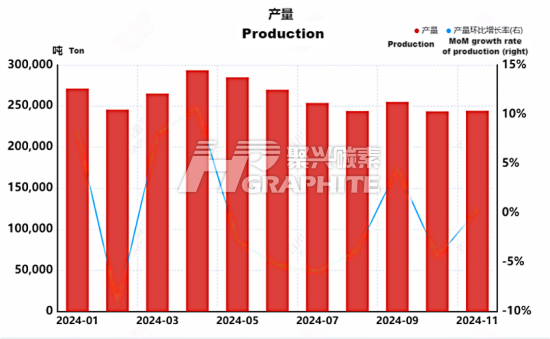

In 2024, the supply of carburants in China remained relatively sufficient.

According to incomplete statistics, by the end of December, there were 70 carburant production enterprises in the country, with a total production capacity of 6.076 million tons. This includes 1.073 million tons of capacity for anthracite carburants, 3.065 million tons for calcined petroleum coke carburants, and 1.938 million tons for graphitized petroleum coke carburants.

The total output for the year from January to December was 3.368 million tons, with an average operating rate of 55.43%.

Domestic Demand:

The steel market in China saw a slight decline in 2024, with the comprehensive average steel price at 99.4 points, down 9 points (an 8.3% decrease) compared to the same period in 2023.

The main reason for the price decline this year was the overall poor economic environment, with downstream demand failing to meet expectations. End users purchased only as needed, and market sentiment was low, with little speculative demand and a lack of active trading, leading to weak overall transactions and no favorable fundamentals to drive the market.

From mid-September to early October, prices experienced a brief increase, mainly due to the release of favorable policies from central authorities, including measures to strengthen counter-cyclical adjustments, interest rate and reserve ratio cuts, and the use of ultra-long-term treasury bonds and special bonds. This generated a more optimistic macro sentiment, stimulating market transactions and improving merchant sentiment, but the increase was short-lived.

By the end of the year, prices started declining again, mainly due to the arrival of the off-season, with increased rain and snow, making it difficult for demand to improve and reducing support for the market.

Overall, the steel market in 2024 has maintained a trend of slight decline.

International Demand:

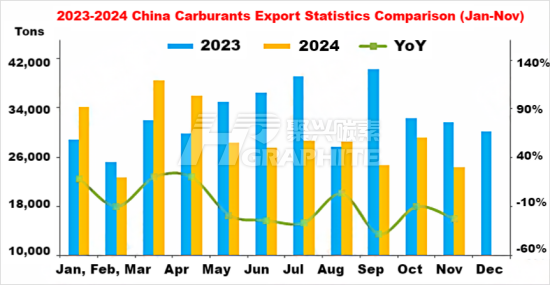

China's carburant export volume in 2024 showed a weak, fluctuating trend, reaching its highest point in March at 38,440 tons. The total export volume for the year was 322,343 tons, a 10.08% decrease compared to the previous year.

In 2024, the total export volume of carburants was 322,343 tons, with an export value of USD 102,935,572, a decrease of 10.08% in volume and 49.66% in value compared to the same period in 2023.

The demand for carburant exports from China decreased in 2024, and due to poor market conditions, prices were under pressure from downstream sectors, leading to a dominant downward price trend and a significant reduction in total export value.

Feel free to contact us anytime for more information about the carburant market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies