【Anode Materials】2024 Market Review: Breaking the Ice and Preparing for Spring!

【Anode Materials】2024 Market Review:

Breaking the Ice and Preparing for Spring!

For the anode materials industry, the past year, 2024, was not an easy one. Issues such as overcapacity and declining product profits were not mere threats hanging over the industry like the Sword of Damocles, but real burdens pressing down. However, anode companies have not been like Sisyphus in vain; though the burden was heavy, it was not an insurmountable barrier. On the contrary, within the broader context of the continued expansion of the new energy industry, the anode sector in 2024 managed to shed the earlier blind and reckless enthusiasm. With more developmental thinking and approaches, the industry pursued a healthier market environment and forward momentum. While the production and sales volume of anode materials rose, the industry also experienced significant transformations.

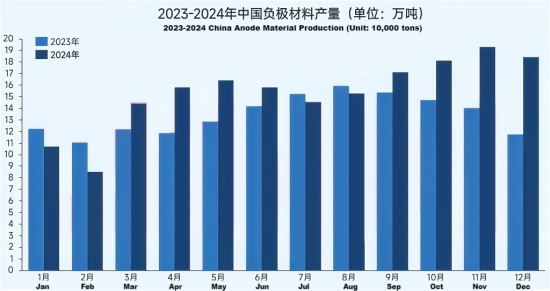

According to statistics, in 2024, China's graphite anode material output reached 1.845 million tons, a 14% increase compared to 2023.

Graph: 2023-2024 China Anode Material Output (Units: 10,000 tons)

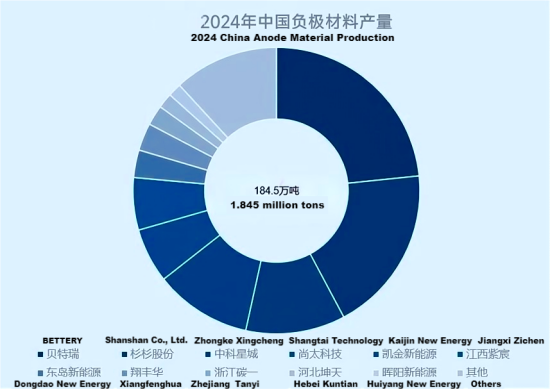

In 2024, BETTERRY maintained its leading position in the anode materials industry with a market share of approximately 23%. Notably, the "three big, four small" industry structure showed significant adjustments.

Companies like Zhongke Xingcheng, Shanty Technology, and Kaijin New Energy closely grasped the growth in downstream demand, actively responding to new product iterations, and saw their rankings improve compared to previous years. Companies like Jiangxi Zichen, on the other hand, reasonably managed material production and sales according to their own circumstances, improving inventory and production cost situations while building a quality downstream customer chain. Although their rankings in production and sales declined, they still achieved improvements in overall business.

Graph: 2024 China Anode Material Output

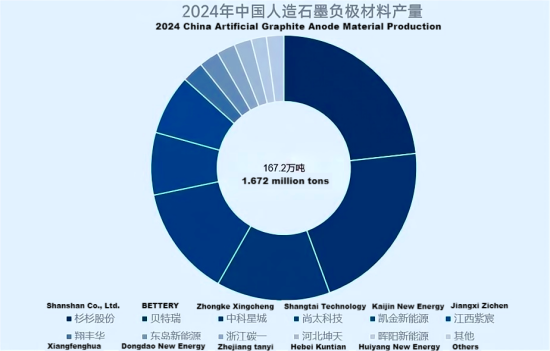

In 2024, with the application of advanced technologies such as special anode coke and continuous graphitization, the production costs of artificial graphite were further controlled, leading to a decline in prices. Meanwhile, due to natural graphite export controls, some overseas customers gradually shifted to using artificial graphite. The market share of artificial graphite continued to rise.

According to statistics, in 2024, China's artificial graphite anode output reached 1.672 million tons, a 15% year-on-year increase, accounting for 90.6% of the total graphite anode output. Shanshan Co. maintained its leading position in the artificial graphite anode industry in 2024, with a market share of about 21%.

Graph: 2024 China Artificial Graphite Anode Output

With the ongoing development of the new energy industry, in addition to growth in output levels, the iteration and upgrading of new products also led to further demands from customers for the performance of anode materials.

In the power sector, with the improvement of new energy vehicle battery endurance and charging performance standards, power cell anodes faced higher requirements for capacity and fast charging rates. Leading companies launched high-capacity fast-charging anode products in 2024, making a significant contribution to their growth. New companies, such as Huiyang New Energy, seized the key opportunity of the 314Ah battery cell iteration in the energy storage sector, responding actively to industry upgrades and customer demands, while achieving a notable increase in their own production, sales, and market share. Meanwhile, in the consumer sector, with the release of new models, silicon-based anode materials saw wider application.

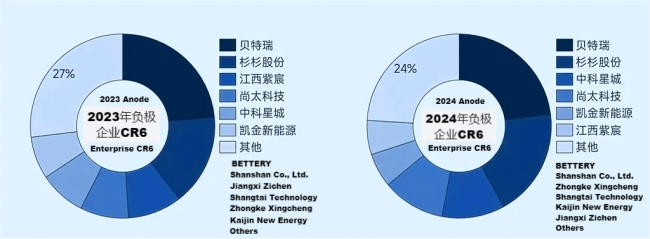

Graph: 2023-2024 Anode Industry CR6

In 2024, industry concentration continued to rise, with CR6 reaching 76%. Under the current backdrop of limited cost reduction space for anode materials, downstream customers have shifted their focus to "quality" and "supply" of materials. Leading companies, benefiting from their stronger technical foundations, superior material specifications, and large-scale production capabilities, were able to achieve "quality and quantity" while curbing the industry's unhealthy competitive behavior of underpricing, which only harms the financial health of companies. This is detrimental to long-term operations and makes it harder for companies to respond to short-term market fluctuations. In fact, in 2024, some previously low procurement prices were widely resisted by the industry. While a significant price correction has yet to occur, this at least demonstrates the industry's pursuit of a better market environment and a recognition of healthy operating practices. In 2024, anode prices neared their "bottom," and a "rebound" is not far off.

From a pricing and profit perspective, 2024 was certainly not a stellar year. The low prices continued to put pressure on the anode industry, and even upstream related industries began to face increasing pressure. However, beneath the "ice surface" lie changes that, though not immediately visible, will have a profound impact in the long term. These changes, such as adjustments in company strategies and industry mindset transformations, could present opportunities for the anode materials market to improve. After the thaw, the anode industry is set to usher in its "spring" in 2025.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies