【Petroleum Coke】Prices Skyrocket: A "Life-or-Death" Crisis for Anode Material Industry?

【Petroleum Coke】Prices Skyrocket: A "Life-or-Death" Crisis for Anode Material Industry?

Introduction: From "Industrial MSG" to "Black Gold Aristocrat" – The Phenomenal Rise of Petroleum Coke

On February 7, 2025, the factory price of some low-sulfur petroleum coke neared 6,000 CNY/ton, a staggering 150% increase from early 2023. Once seen as a byproduct of refining, this “industrial MSG” is now shaking up the global new energy supply chain as “black gold.” As a core material for lithium battery anodes, the soaring price of petroleum coke not only affects company profits but may also reshape the cost structure of power batteries. This article reveals the three driving forces behind this price surge, the triple impacts on the industry chain, and the solutions for companies. Calcined petroleum coke is petroleum coke treated through a high-temperature calcining process. This process removes volatile components, increasing its purity and density, which enhances its conductivity and heat resistance. Calcined petroleum coke is commonly used in electric arc furnaces, aluminum electrolysis, graphite electrodes, and carburizing agents.

I. The "Three-Body Movement" of Price Surge: Supply, Demand, and Capital Collusion

01. Supply Side: "Refining Cuts + New Energy Squeeze" - The Deadly Strangulation

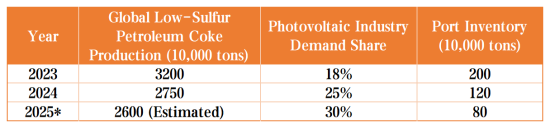

1. Refining Capacity Shrinking: Under global "dual carbon" policies, refining plants in Europe and the U.S. are accelerating the phase-out of outdated capacity. In 2024, European refining capacity dropped by 8%, and 12% of U.S. shale oil refineries shut down. As a byproduct, low-sulfur petroleum coke's supply sharply decreased.

2. Explosive Photovoltaic Demand: The global demand for photovoltaic-grade petroleum coke surged by 35% in 2024. Silicon material companies like Tongwei and GCL are scrambling for low-sulfur coke resources, pushing up prices.

3. Inventory Game: Traders' hoarding reached historical peaks, with domestic port inventories dropping from 2 million tons in 2023 to 800,000 tons, artificially creating a "false shortage."

02. Demand Side: The "Resource Black Hole" of Anode Material Capacity Surge

1. Lithium Battery Anode Demand Surge: In 2024, global lithium battery anode material demand reached 2.2 million tons, requiring over 3 million tons of petroleum coke, but actual supply is only 2.6 million tons, leaving a 13% gap.

2. Capacity Bubble: China's anode material companies are planning to reach over 5 million tons of capacity by 2025, far exceeding global demand expectations (3.5 million tons), leading to fierce competition for raw materials.

03. Geopolitics: The "Butterfly Effect" of Oil and Coke Prices

1. Oil Price Transmission: In 2024, international oil prices surpassed 120 USD/barrel, squeezing refinery margins and further exacerbating the petroleum coke shortage.

2. Trade Barriers: U.S. graphite export restrictions to China are forcing Chinese anode companies to turn to domestic petroleum coke, intensifying domestic demand pressure.

II. "Triple Blow" for Anode Companies: Costs, Payment Terms, and Substitution Crisis

01. Cost Surge: Cost per ton skyrockets by 8,000 CNY, gross profit margin drops below 10%.

1. Producing 1 ton of artificial graphite requires 1.2-1.5 tons of petroleum coke. At 6,000 CNY/ton, raw material costs soared from 5,000 CNY/ton in 2023 to 9,000 CNY/ton.

2. With added graphitization costs (15,000 CNY/ton), total anode material costs exceed 25,000 CNY/ton, while market prices are only 28,000-30,000 CNY/ton, reducing the gross margin from 35% to 8%.

3. Typical Case: A second-tier anode company's Q4 2024 financial report shows net profit per ton dropping from 6,000 CNY to 500 CNY, nearing losses.

02. Cash Flow Crisis: Price Cuts from Downstream + Extended Payment Terms

1. Battery Manufacturers "Price Cut Orders": Leading domestic lithium battery companies demand a 15% price reduction from anode material suppliers, disrupting price transmission mechanisms.

2. Payment Term Negotiations: Accounts receivable cycles have stretched from 90 to 180 days, leading to a sharp increase in cash flow risks for small and medium-sized companies.

03. Technology Substitution Threat: The "Dimensional Blow" of Silicon-Based Anodes

1. Tesla's 4680 battery with silicon-carbon anodes boosts energy density by 20%, and if petroleum coke prices remain high, the pace of technological substitution could accelerate.

2. Industry Anxiety: Leading companies like BTR and SGL are increasing R&D investments in silicon-based anodes by 50%, but commercialization will still take 3-5 years.

III. The Battle for Survival: From "Resource Bottleneck" to "Industry Chain Restructuring"

01. Vertical Integration: Penetrating the Upstream Resource Side

1. Equity Stakes in Refineries: Locking in low-sulfur coke supply.

2. Coking Coal Development: Developing coal-based needle coke as a substitute for petroleum coke, reducing costs by 20%.

02. Horizontal Technological Revolution: Diversifying Material Systems

1. Natural Graphite Resurgence: Through surface coating modification (e.g., nano-silicon carbide coating), achieving over 2,000 cycle life and reducing costs by 30% compared to artificial graphite.

2. Silicon-Based Anodes Acceleration: The theoretical capacity of silicon-based anodes (4200 mAh/g) is 10 times that of graphite, which can offset raw material cost pressures.

3. Hard Carbon Breakthrough: GAC Aion develops biomass hard carbon (coconut shell-based), suitable for sodium-ion batteries, with raw material costs only 1/3 of petroleum coke.

03. Global Supply Chain Restructuring: From "Made in China" to "Global Layout"

1. Overseas Expansion: Several domestic anode material companies have invested in overseas production bases.

2. Petroleum Coke Import Substitution: Importing high-sulfur coke from Russia and Venezuela, using desulfurization processes (5% cost increase) to relieve supply pressure.

IV. Future Outlook: 2026 as a Potential Turning Point for the Industry

01. Price Inflection Point Speculation

1. Downward Pressure: In the second half of 2025, new refining capacities in the Middle East and India will narrow the low-sulfur coke supply gap to 5%.

2. Upward Risk: If oil prices exceed 150 USD/barrel and refinery operating rates remain low, coke prices may soar to 8,000 CNY/ton.

02. Technological Route Endgame

1. Artificial Graphite: Market share drops from 80% to 60%, but still remains the mainstream route.

2. Natural Graphite: Market share rises from 15% to 25%, with cost advantages becoming more apparent.

3. Silicon-Based/Hard Carbon: Market share increases from 5% to 15%, opening a second growth curve.

03. Industry Reshaping

1. Concentration of Market Leaders: The CR5 (top 5 companies) market share will rise from 70% to 85%, with smaller companies exiting the market.

2. International Competition and Cooperation: Japanese and Korean companies (e.g., POSCO Chemical) are accelerating mergers and acquisitions of Chinese second-tier companies, fighting for remaining market share.

Conclusion: Crisis or Opportunity? The Dilemma of China's Anode Industry Amid the Petroleum Coke Surge

The skyrocketing price of petroleum coke represents not just a resource shortage crisis but a turning point as the industry shifts from expansive growth to lean operations. As Chinese companies break through this bottleneck through vertical integration, technological iteration, and global layout, this "black gold storm" may give birth to true global lithium battery material giants. The answer may lie in the next technological breakthrough or resource acquisition battle.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies