【Steel Prices】Too Early for a Bottom Rebound

Graphite electrodes are vital consumables in electric arc furnace (EAF) steelmaking, mainly used for arc heating. With superior electrical conductivity and high-temperature resistance, they are key to improving both the output and quality of EAF steel.

【Steel Prices】Too Early for a Bottom Rebound

Recently, driven by news such as the "resource tax" and "production cuts," coking coal prices were the first to rebound sharply. In the past two days, the overall ferrous metal market has shown signs of stabilization as prices turned positive. With costs supported and China–U.S. communications taking place, the market is now questioning whether steel prices are beginning a bottom rebound. In the author's view, steel prices have not fully bottomed out yet. While a short-term, phased rebound is possible, it will be difficult to reverse the overall trend. The main obstacles include continued downward pressure on raw material prices, increasingly apparent supply–demand imbalances during the off-season, and ongoing macroeconomic uncertainty alongside lackluster economic data.

01. Downward Pressure on Raw Materials Remains

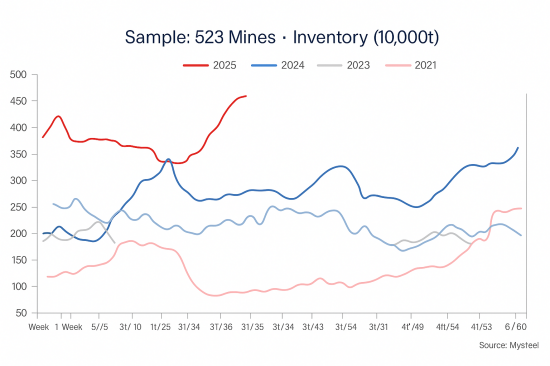

The recent rebound in coking coal prices has been mainly driven by sentiment and technical factors, and is more evident in the futures market. With steel mills reducing raw material inventories and coking coal supply remaining relatively abundant, coke and coking coal have limited bargaining power within the ferrous supply chain. According to our survey of 523 coking coal mines, despite continuous production cuts at coal mines recently, washed coal inventories have reached record highs in recent years. Furthermore, coking coal auctions have largely ended in either failure or price declines. With some coking plants still operating at a profit, spot prices for coke and coking coal may continue to come under pressure.

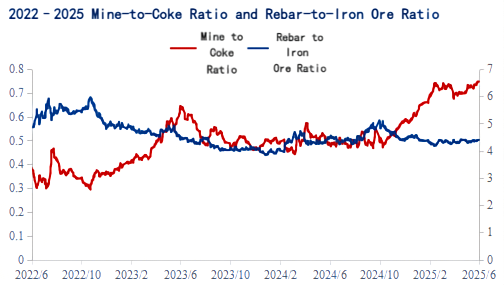

While iron ore has shown weakness recently, it has demonstrated stronger resistance to price declines over the long term compared to coking coal and rebar. Comparing the price trends of iron ore, coking coal, and rebar in recent years reveals a steadily rising iron-to-coal price ratio (ore/coal), particularly since October 2024, with the ratio climbing from 0.5 to above 0.7. Though the iron-to-rebar ratio hasn't shifted as dramatically, its continued decline also reflects iron ore's relative price strength. In the short term, iron ore faces limited downward pressure; however, as hot metal output declines and if coke and coal prices bottom out, iron ore valuations may also face downward revision.

02. Off-Season May Bring Inventory Buildup Risk

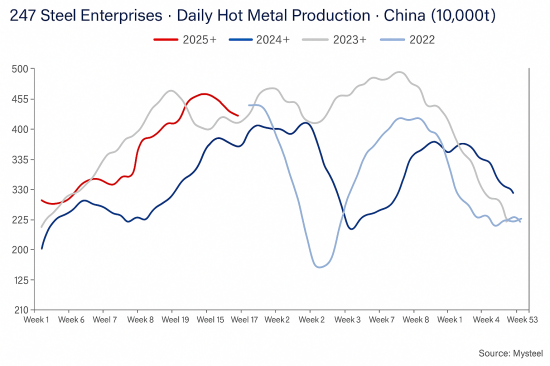

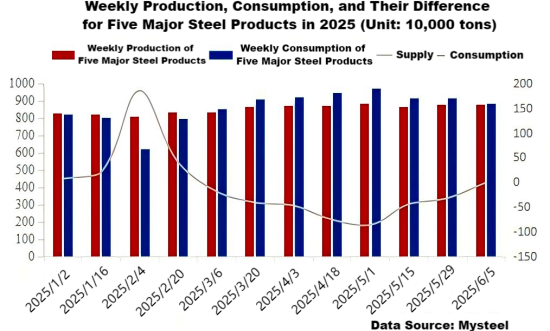

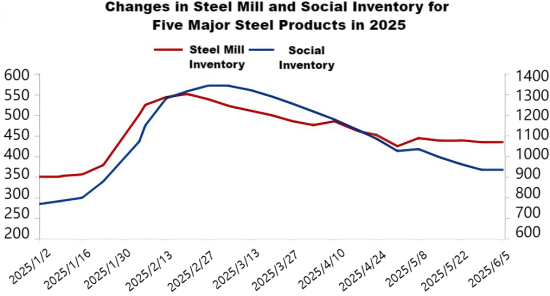

Data on the five major steel product categories indicate a synchronized decline in supply and demand recently. However, demand is falling faster than supply, bringing the supply–demand gap close to a tipping point. The inventory accumulation inflection is expected to emerge within the next two weeks. Although total inventory (mill + social stock) remains significantly lower than in previous years — at 13.6381 million tons as of June 5, 2025, compared to 17.5806 million tons at the same time in 2024, down 22.5% year-on-year — which has been a key support for steel price resilience in the first half of the year, declining off-season demand coupled with still-positive steel mill margins (as of June 10, national blast furnace profit for rebar remains above 100 RMB/ton) suggest that production cuts are unlikely to be implemented quickly. If the inventory accumulation cycle begins, the market may fall into a negative feedback loop of "inventory build-up → price drop → loss → production cut → raw material price decline → finished steel price drop."

03. Macroeconomic Uncertainty Still a Disruption

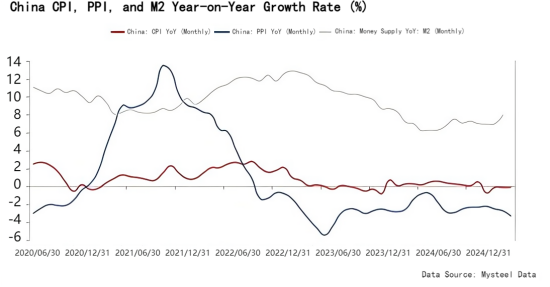

Externally, data from the U.S. Bureau of Labor Statistics showed that non-farm payrolls increased by 139,000 in May, exceeding expectations of 130,000, with the unemployment rate holding steady at 4.2%. This has once again delayed expectations for a Federal Reserve rate cut. Domestically, the marginal effectiveness of monetary policy stimulus in boosting economic vitality is diminishing. Recent data show that M2 growth has rebounded (with a projected increase in May), but both CPI and PPI continue to decline on a month-on-month and year-on-year basis. Considering both internal and external factors, short-term policy measures are unlikely to quickly turn the market around. Meanwhile, the outcomes of recent key diplomatic talks remain uncertain. Trade frictions go beyond mere trade imbalances, and amid ongoing geopolitical tug-of-war, a clear short-term direction is hard to establish.

Conclusion:

Although steel prices show signs of a short-term rebound, the annual low has yet to be confirmed. A sustained upward trend lacks substantive support. For now, caution is advised against risks stemming from raw material price declines, off-season inventory accumulation, and macroeconomic uncertainties.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies