【CPC】Market Price Stability, Increased Demand for Low-Sulfur Coke, and Future Price Trend Analysis

【Calcined Petroleum Coke】Market Price Stability, Increased Demand for Low-Sulfur Coke, and Future Price Trend Analysis

On February 17, the average market price of calcined petroleum coke (CPC) was 4102 RMB/ton, steady compared to the previous working day. Today, the mainstream price of low-sulfur calcined petroleum coke remained stable, with downstream inquiries gradually increasing. However, electrode companies are still purchasing mainly based on demand for high-priced low-sulfur calcined petroleum coke raw materials. The market for medium-high sulfur calcined petroleum coke remains stable, with some companies beginning to negotiate future orders. Given the frequent price fluctuations in raw materials, calcined petroleum coke companies are cautious when quoting for long-term orders.

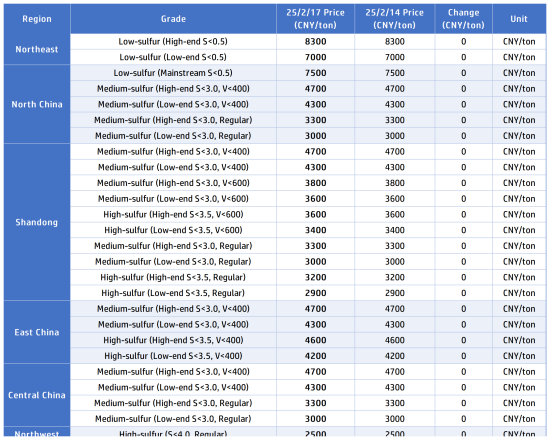

Main Regional Market Transaction Prices:

1. Low-Sulfur Calcined Petroleum Coke:

· Low-Sulfur Calcined Petroleum Coke (using Jinxi and Jinzhou petroleum coke as raw material): The mainstream transaction price is CNY 7000-7500 per ton;

· Low-Sulfur Calcined Petroleum Coke (using Fushun petroleum coke as raw material): The ex-factory mainstream price is CNY 8100-8300 per ton;

· Low-Sulfur Calcined Petroleum Coke (using Liaohe and Binzhou Zhonghai petroleum coke as raw material): The mainstream transaction price is around CNY 7000-7500 per ton.

2. Medium-High Sulfur Calcined Petroleum Coke:

· Sulfur 3.0% (no trace elements requirement): Previous ex-factory mainstream contract price CNY 3000-3300 per ton, today's negotiated price is CNY 3000-3300 per ton;

· Sulfur 3.5% (no trace elements requirement): Previous ex-factory mainstream contract price CNY 2900-3200 per ton, today's negotiated price is CNY 2900-3200 per ton;

· Sulfur 3.0%, Vanadium 400: Previous contract price CNY 4300-4700 per ton, today's negotiated price is CNY 4300-4700 per ton.

Supply Side:

Today, the national commercial calcined petroleum coke daily supply is 25,743 tons, with a 57.52% operating rate, slightly down by 0.14% from the previous working day.

Upstream Market:

· Petroleum Coke: Sinopec's refineries are maintaining steady prices with steady shipments. Downstream buyers mostly purchase according to demand. Some negative material companies have increased inquiries and procurement for negative coke. In the Yangtze River region, negative coke shipments are active. In East China, medium-high sulfur coke supply is decreasing with good shipment performance. In North China, Yanshan Petrochemical is mainly shipping 4B, while Shijiazhuang Petrochemical is shipping 4A, and Cangzhou Petrochemical is mainly shipping 3#B and 4#A. PetroChina's refineries are showing acceptable shipments, with low-sulfur coke stocks in Northeast China generally at low levels, providing some support on the supply side. Refineries in the Northwest are primarily supplying carbon materials for aluminum.

Downstream Market:

· Graphite Electrodes: Prices for upstream raw materials in the graphite electrode market continue to rise. Companies are adjusting prices, with the actual transaction center shifting upward. Although downstream demand is still insufficient, the price of graphite electrodes in the mainstream market remains firm, with companies actively stabilizing post-price hikes.

· Electrolytic Aluminum: Aluminum ingot social inventory continues to increase, with the market supply abundant. Coupled with the incomplete recovery of downstream processing, purchasing numbers are low, and spot aluminum prices are falling.

· Negative Materials: The negative materials market is operating steadily, with feedback indicating that there is still an excess of structural capacity and many suppliers. Due to limited downstream demand, new orders are still lower than expected, and companies are competing for orders, continuing to face survival pressure.

Market Forecast

It is expected that the price of low-sulfur calcined petroleum coke will continue to be driven by changes in raw material prices. As the price of low-sulfur petroleum coke fluctuates, medium-high sulfur calcined petroleum coke companies will maintain price stability in shipments.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies