Graphite electrode price is expected to rebound after the Winter Olympics

At the end of the first quarter of 2022,

graphite electrode price is expected to rebound

As of January 2022, graphite electrode market upstream raw material prices continue to rise, high cost and weak demand game atmosphere continues, most of the graphite electrode enterprises will maintain prices wait-and-see. Some enterprises predict that after the End of the Winter Olympics, graphite electrode prices are expected to rebound, specific analysis is as follows:

1. Cost side

Due to the active production of negative electrode materials in the market, enterprises are actively storing raw materials and purchasing low sulfur petroleum coke, which leads to the shortage of domestic petroleum coke and the overall rise of price. As of January 24, 2022, the price of Fushun and Daqing low sulfur petroleum coke has exceeded 6000 yuan/ton. At the same time, the rise of petroleum coke price has driven low sulfur calcined coke price synchronous upward, with an increase of about 200-500 yuan/ton compared with the end of last month. At present, Jinxi low sulfur calcined coke mainstream transaction price is 6400-6700 yuan/ton; Low sulfur calcined coke with Fushun and Daqing raw materials mainstream transaction price is 8700-9200 yuan/ton;

In terms of needle coke, due to the good preparation in the downstream negative material market, raw coke price has risen. In addition, the price of imported needle coke in the first quarter has been set, and showes an upward state. Therefore, it is expected that after the Spring Festival, needle coke price may be rise steadily.

Graphite electrode upstream raw materials Price list (unit: yuan/ton) 石墨电极上游原料价格表(单位:元/吨) | ||||

Product 产品 | Average index price 指数均价 | Compared with last 较上月 | Compared with the beginning of the year 较年初 | Same period last year 上年同期 |

1# Petroleum coke | 5600 | 13.07% | 5.66% | 80.65% |

Needle coke | 10135 | 0.00% | 0.00% | 71.94% |

Medium temperature asphalt | 5631 | -0.99% | 0.67% | 72.44% |

Coal modified asphalt | 5854 | 1.63% | 2.74% | 65.39% |

2. Demand side

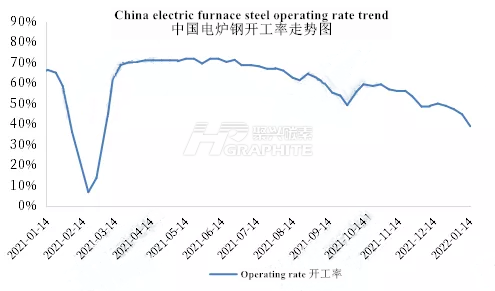

At present, graphite electrode terminal demand is off-season, and some short-process steel plants have entered seasonal shutdown, or will resume production in mid and late February; At present, some long-process steel plants are mainly limited by the environmental protection control of the Winter Olympic Games. It is expected that after the Winter Olympic Games, the steel plants will resume normal production, and graphite electrodes demand is expected to increase.

3. Supply side

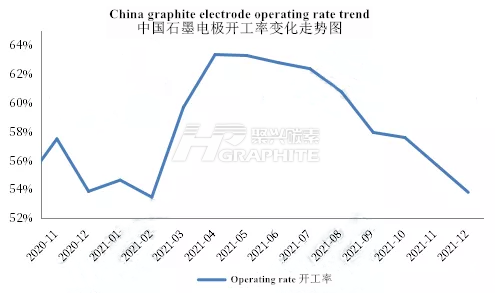

On the one hand, at present, the graphite electrode enterprises in Henan, Hebei, Shanxi, Inner Mongolia and other regions are affected by Winter Olympic Games environmental protection control, and the enterprises are greatly affected by the production restriction. Some enterprises have stopped production or are expected to stop production at the end of January, and production can be resumed in the middle and early March. In addition, northeast and other areas of some graphite electrode enterprises affected by the weather, molding and other processes suspended production, the overall operation of graphite electrode market was poor, and the market supply contracted.

On the other hand, in the mid to late 2021, affected by the poor market demand, some graphite electrode enterprises have low-price inventory clearing action. At present, most graphite electrode enterprises reflect the inventory is low. Therefore, under the comprehensive influence, it is expected that the supply of graphite electrode market may be tight after the Spring Festival.

To sum up, after the Winter Olympics, graphite electrode market demand is expected to increase, the market supply may be in a tight state. Moreover, the price of upstream graphite electrode raw materials has always been high, and graphite electrode price has an upward rebound power. The price of graphite electrode is expected to rise by about 1000-2000 yuan/ton, contacting us for graphite electrode latest market news.

No related results found

0 Replies