【CPC】Market Overview: Prices Steady, Companies Considering New Year Price Increases

【CPC】Market Overview: Prices Steady, Companies Considering New Year Price Increases

As of December 24, the average market price for calcined petroleum coke (CPC) is 2482 yuan/ton, unchanged from the previous working day. The low-sulfur calcined coke market remains stable, but the downstream electrode market is under pressure, leading to general lukewarm purchasing enthusiasm for calcined coke. Some calcined coke enterprises have raised their quotes due to high-priced raw material replenishment. The trading of medium and high-sulfur calcined coke is relatively active, with some specific grade products beginning to negotiate January orders. Under cost pressure, production enterprises are inclined to increase their quotes. The prices of medium and high-sulfur regular grade calcined coke have temporarily stabilized, primarily sold on an order-by-order basis.

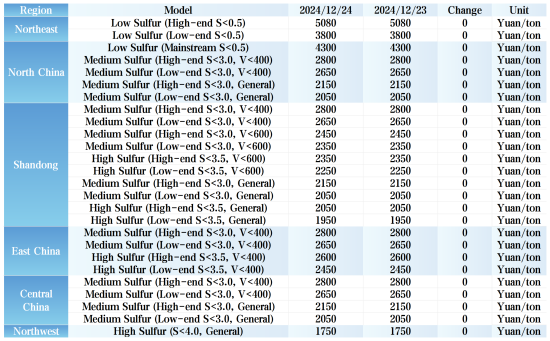

Main Regional Market Transaction Prices

Market Prices

Low-Sulfur Calcined Coke

Jinxi and Jinzhou Petroleum Coke as Raw Materials: Main transaction prices range from 4300 to 4500 yuan/ton.

Fushun Petroleum Coke as Raw Material: Main factory gate transaction prices range from 4800 to 5080 yuan/ton.

Liaohe and Binzhou Zhonghai Petroleum Coke as Raw Materials: Main transaction prices are around 3800 to 4100 yuan/ton.

Medium and High-Sulfur Calcined Coke

3.0% Sulfur, No Requirements for Trace Elements: Previous main factory contract price was 2050 to 2150 yuan/ton; current negotiation prices remain in the range of 2050 to 2150 yuan/ton.

3.5% Sulfur, No Requirements for Trace Elements: Previous main factory contract price was 1950 to 2050 yuan/ton; current negotiation prices remain in the range of 1950 to 2050 yuan/ton.

3.0% Sulfur, Vanadium 400: Previous contract price was 2650 to 2800 yuan/ton; current negotiation prices remain in the range of 2650 to 2800 yuan/ton.

Supply Situation

Currently, the national daily supply of commercial calcined coke is 26,990 tons, with an operating rate of 60.68%. The supply of calcined coke in the market remains stable compared to the previous working day.

Upstream Market

Petroleum Coke:

Sinopec's refineries are mainly focused on maintaining stable prices, with steady shipment performance. In the Yangtze River region, Wuhan Petrochemical is operating normally, while Anqing Petrochemical and Hunan Petrochemical have good shipments of petroleum coke for negative electrode materials. Jiujiang Petrochemical primarily produces 3B and 3C petroleum coke, mainly for carbon factories to purchase. In East China, the shipment of medium and high-sulfur petroleum coke is acceptable, and most refineries are shipping according to grade 4#B. Currently, China National Petroleum Corporation (CNPC) refineries have stable trading activities, with low-sulfur coke resources still in tight supply. Downstream orders for negative electrode materials are relatively stable, with carbon factories purchasing according to demand. In the northwest region, refineries predominantly supply carbon for aluminum production, with limited demand for silicon. CNOOC's refineries are currently shipping primarily based on orders.

Downstream Market

Graphite Electrodes:

Downstream companies are gradually increasing their bidding activity, with more inquiries and bidding actions taking place in the market, especially from steel mills, which have a clear need to stockpile graphite electrodes. Market bidding has begun to ramp up, and graphite electrode companies are actively bidding based on their production conditions, albeit with caution in quoting new orders; overall, they remain focused on stability.

Electrolytic Aluminum:

Alumina prices continue to decline, and coupled with poor downstream processing demand, some companies have started to reduce or halt production, leading to a negative market sentiment and a drop in spot aluminum prices.

Negative Electrode Materials:

The market for negative electrode materials is currently stable. Although downstream demand is gradually being released, the oversupply situation in the negative electrode materials market has not changed significantly. In this context of surplus supply, pricing power remains mostly in the hands of downstream enterprises. Downstream battery cell manufacturers continue to pursue cost reductions, and the prices of negative electrode materials remain at low levels.

Market Outlook

In the short term, it is expected that the mainstream prices of low-sulfur calcined coke will remain stable, while there is a strong bullish sentiment for medium and high-sulfur calcined coke. Prices are anticipated to continue to increase in the future.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the cpc market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies