【Petroleum Coke】Market Expected to Remain Steady in the Short Term

【Petroleum Coke】Market Expected to Remain Steady in the Short Term

On February 24, the average price of petroleum coke was 3,327 yuan per ton, down by 17 yuan from the previous working day, a decline of 0.51%.Today's petroleum coke market saw relatively stable trading, with overall transaction volumes lower than in previous periods. Major refineries are maintaining steady prices, with shipments based on demand, while imported coke faced pressure to move, with some prices falling. Local refineries are experiencing weaker sales, and prices continue to decline. Calcined petroleum coke is mainly used in the production of graphite electrodes, carbon paste products, diamond sand, food grade phosphorus industry, metallurgical industry, and calcium carbide, among which graphite electrodes are the most widely used.

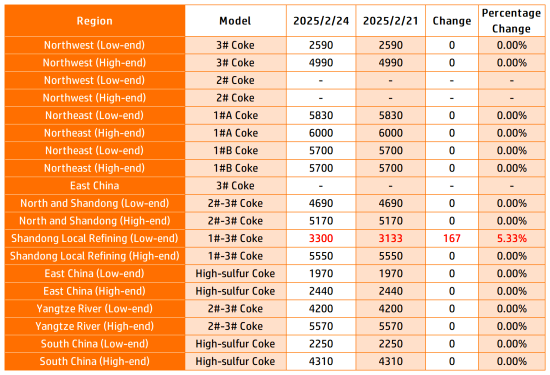

Main Regional Market Transaction Prices

Sinopec refineries: Prices remain steady, with downstream demand from aluminum carbon and anode material industries mainly based on need. In the Yangtze River region, demand for anode coke remains stable, and in East China, Jinling Petrochemical is selling mainly 3#A and 4#B coke. In South China, Guangzhou Petrochemical is mainly selling 3#C coke, while Beihai Refinery is offering 4#A coke.

PetroChina refineries: Most are maintaining stable prices. In Northeast China, low-sulfur coke sales are acceptable, and in Northwest China, Yumen Refinery’s bidding continues through the end of the month, while Lanzhou Petrochemical plans to hold a normal auction this Friday. In Southwest China, Yunnan Petrochemical's sales are stable.

CNOOC refineries: Today, shipments are mainly based on specific orders.

Local Refineries

From the weekend to today, local refineries' petroleum coke sales remain sluggish, with some prices continuing to fall. Downstream companies are still adopting a wait-and-see approach, primarily purchasing based on need, increasing the pressure on refineries to sell. Additionally, some quality indicators have worsened, prompting a price drop of 100-600 yuan per ton. However, some lower-priced petroleum coke remains in demand, with prices rising by 50-80 yuan per ton. For example:

Tianhong Chemical's petroleum coke sulfur content has increased to 5.4%, with vanadium reaching 600 PPM. The latest auction starting price is 1,500 yuan per ton.

Shandong Shengxing's petroleum coke sulfur content has risen to about 8.0%, with a 100 yuan per ton price reduction.

Dongying Qirun's petroleum coke sulfur content has risen to 5.0%, with a 100 yuan per ton price reduction.

Imported Petroleum Coke

Due to the price decline in local refineries, coupled with the month-end period, downstream carbon enterprises remain cautious, leading to pressure on the sale of imported petroleum coke, with some prices falling.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies