【EAF Steel】Steel Exports Under Pressure, Domestic Sentiment Weakens

With the growth of electric arc furnace steelmaking and the new energy industry, the needle coke market has broad prospects, especially driven by the demand for high-power graphite electrodes.

【EAF Steel】Steel Exports Under Pressure, Domestic Sentiment Weaken

This week, China's steel market showed a fluctuating and weak performance. Downstream demand remained generally moderate, while social inventories continued to rise. Market sentiment was further impacted by news that South Korea will impose additional tariffs on Chinese sheet products. As of February 27, the average price of rebar in China was 3,368 yuan/ton, down 12 yuan from the previous week.

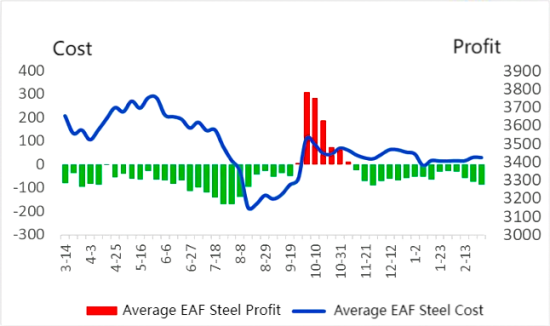

On the raw material side, domestic scrap steel prices rose early in the week but declined later as supply quickly recovered. In the first half of the week, steel mills raised prices to replenish inventories, but in the second half, they shifted back to lowering prices and adopting a wait-and-see approach. The average procurement price remained mostly flat compared to the previous week. Meanwhile, graphite electrode and upstream coke product prices remained firm, leading to a slight increase in EAF steel mill losses.

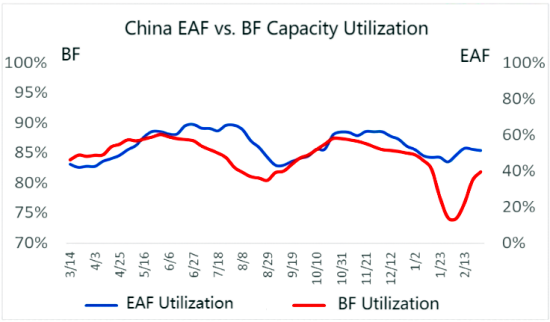

As of February 27, the capacity utilization rate of 135 EAF steel mills in China was 39.59%, up 4.82% from the previous week. EAF steel production reached 247,800 tons per day, marking the third consecutive week of growth.

In March, both infrastructure and real estate sectors in China are expected to see some recovery, though the focus will remain on digesting existing stock, limiting the potential for significant demand growth. Steel exports will face further pressure from additional tariffs imposed by Vietnam (starting March 7) and South Korea. Coupled with relatively ample iron ore and coke supply, the overall steel market price may continue to trend downward in March.

If steel prices experience significant volatility, EAF steel mills — known for their flexibility and quick response — will likely manage more efficiently. Moreover, if recent rumors about a planned 50-million-ton reduction in crude steel production prove true, the cuts are more likely to target smaller inland blast furnaces, naturally increasing the EAF steel ratio.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies