【Anode Materials】Breaking News! Surging Market Demand Drives Up Prices!

With the rapid growth of electric vehicles and energy storage systems, the demand for high-performance lithium batteries is increasing, driving the need for high-quality petroleum coke and artificial graphite. The quality and specifications of calcined petroleum coke directly affect the performance of artificial graphite, making high-quality petroleum coke crucial for lithium battery anode production.

【Anode Materials】Breaking News! Surging Market Demand Drives Up Prices!

Introduction:

Due to the sharp rise in raw material costs for anode materials, production profits have entered a negative margin. After negotiations with major downstream battery manufacturers, a new round of price increases for anode materials has finally arrived.

1. New Round of Anode Material Price Increases

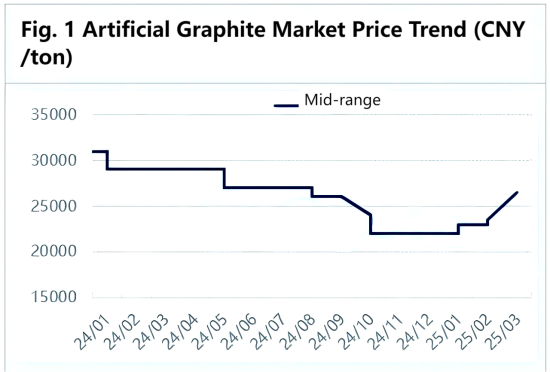

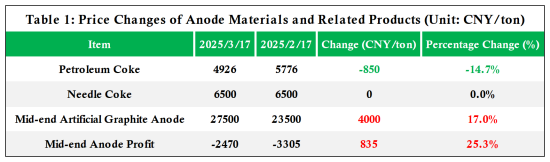

In March, the price of mid-range artificial graphite anode materials reached 27,500 yuan/ton, increasing by 3,000–4,000 yuan/ton, a 17% rise. The mainstream price of low-end artificial graphite stood at 20,000 yuan/ton, up by 2,500 yuan/ton, an increase of 14.3%. This price surge primarily affects mid-to-low-end products, as these rely heavily on petroleum coke as a raw material. The significant price surge of petroleum coke in February resulted in severe negative profit margins for mid-to-low-end anode materials.

2. Partial Recovery in Anode Material Profit Margins

Since early March, low-sulfur petroleum coke prices have begun to decline, but due to the lag in the anode material production cycle, most products currently on the market were manufactured using high-cost raw materials from February. As a result, although anode material prices have rebounded, manufacturers utilizing February's high-cost raw materials are still operating at a loss. As of the week ending March 17, the loss for mid-range artificial graphite anodes stood at 2,470 yuan/ton, an improvement of 835 yuan/ton from the previous month. Unless manufacturers consume previously stocked lower-cost raw materials, profitability will remain under pressure.

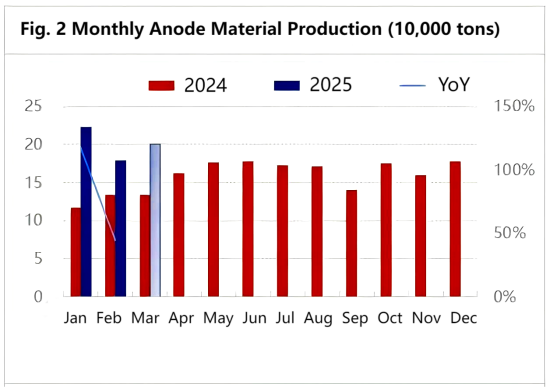

3. Localized Decline in Anode Material Production Load in March

Overall, anode material production in March is expected to increase slightly month-over-month, but operational rates across manufacturers vary. Some companies have slightly reduced production due to high raw material costs and difficulty passing price increases onto customers. However, demand from downstream battery manufacturers remains stable to positive. As anode material prices gradually recover and petroleum coke prices continue to decline, cost pressure on manufacturers is expected to ease.

4. Explosive Growth in Demand: Market Poised for Transformation

As 2024 draws to a close, the lithium-ion anode material market is undergoing a profound transformation, driven by multiple converging factors. The sector is now at the center of industry focus due to a surge in demand.

From a demand perspective, the rapid expansion of new energy vehicles (NEVs) and energy storage continues to fuel anode material consumption. Although growth has moderated from the 30%+ surge of previous years, the long-term outlook remains strong. Market data shows:

2022: China's lithium battery anode material shipments reached 1.433 million tons, up 84% YoY.

2023: Shipments rose to 1.67 million tons.

2024: Expected to hit 1.89 million tons.

2025: Forecasted to skyrocket to 2.705 million tons, maintaining a 20%+ annual growth rate.

5. Policy Support and Environmental Factors Driving Industry Growth

The strategic importance of anode materials for lithium-ion batteries in NEVs has led to strong government support through various policies:

Subsidies for EV purchases

Tax incentives

Preferential road access policies

Carbon credit systems

These regulatory measures have created a favorable environment for the NEV sector, reinforcing China's global leadership in lithium battery anode materials. Additionally, growing environmental concerns have unlocked new market potential. Lithium batteries, as eco-friendly energy storage solutions, play a critical role in:

Electric vehicles

E-bikes

Power tools

These applications reduce carbon emissions and align with global carbon neutrality goals, strengthening the long-term sustainability of the industry.

6. Market Consolidation: Industry Leaders Gaining Ground

A notable trend in the anode materials market is the increasing concentration of resources among leading enterprises. Many smaller firms are struggling to cope with rising costs and high technological barriers, leading to market exits.

Meanwhile, top-tier companies are gaining dominance thanks to:

Economies of scale

Technological advancements

Strong customer networks

A report from CICC suggests that between 2025 and 2026, outdated anode production capacity will be gradually phased out, supply expansion will slow, and market supply dynamics will improve significantly.

7. Price Recovery Expected in 2025

The anode materials market is undergoing a silent shift in pricing dynamics. Throughout 2024, prices remained low, squeezing corporate profits. However, price rebound expectations are building up.

As of March 6, 2025, the price of low-end artificial graphite anodes increased by 7.89%. Industry experts believe that while current prices remain low, improving supply-demand conditions could lead to a steady price increase in 2025.

CITIC Securities: China's NEV sector is entering a deep electrification phase, signaling a potential recovery in anode materials alongside other battery components.

Northeast Securities: From Q1 2025 onward, the anode industry may undergo a significant reshuffling, driving price normalization.

8. The Road Ahead: Innovation and Market Expansion

Looking ahead to 2025, the anode materials sector is expected to continue its robust growth, propelled by technological advancements and expanding market demand.

Leading companies will strengthen their dominance through R&D and global expansion.

Smaller players will exit the market, reshaping competitive dynamics.

For the industry, this marks a pivotal moment of both challenges and opportunities. The anode material market is entering a new phase of evolution, and its future trajectory promises to be nothing short of extraordinary. Stay tuned!

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies