Big news! China's Petroleum Coke Annual Data in 2022!

Big news! China's Petroleum Coke Annual Data in 2022!

1. Capacity

In 2022, China's delayed coking unit total capacity was 143.15 million tons/year, with a year-on-year growth of 2%, of which, the production capacity in East China accounted for 54%, basically unchanged year-on-year.

2. Output

In 2022, China's petroleum coke total volume was 27.84 million tons, with a year-on-year growth of 1.13%. In the first half of the year, the supply of China's petroleum coke was tight and the price support was strong. In the second half of the year, as the market supply recovery, petroleum coke prices fell.

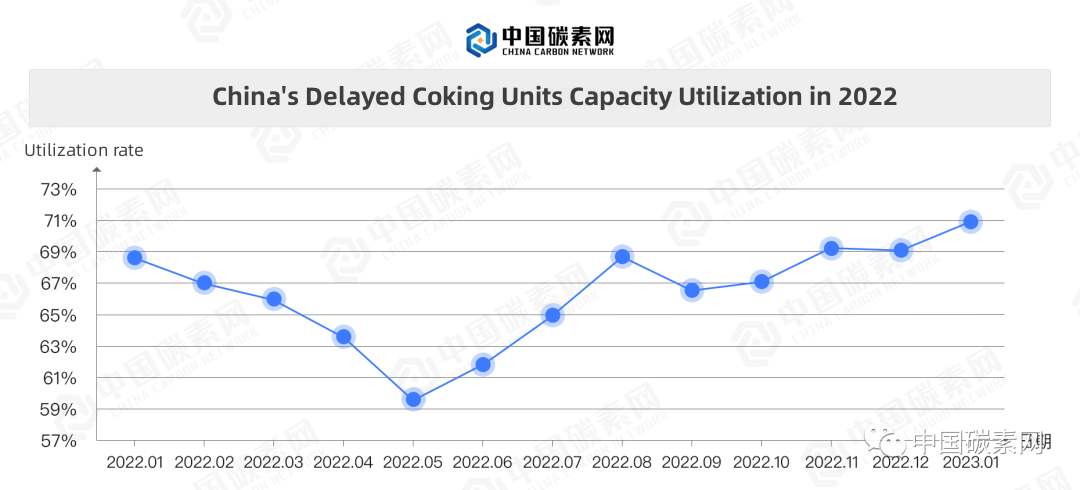

3. Capacity utilization

In 2022, the average capacity utilization rate of China's delayed coking unit was 65.81%, with a year-on-year increase of 0.96 percentage points. The lowest point of the year was 58.36% in April, and the highest was 70.81% at the end of the year.

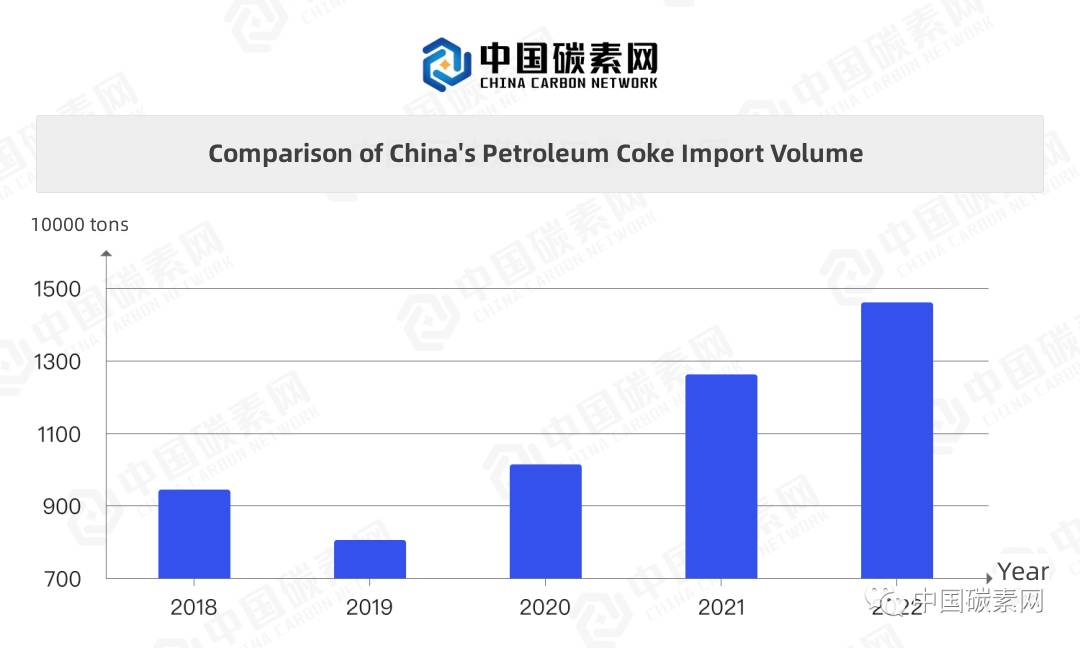

4. Import

In 2022, China's petroleum coke total import volume will reach 14.5 million tons, with a year-on-year growth of 15.81%, reaching a new historical high. A large number of petroleum coke resources have arrived in China's local market, which has brought a big impact on China's local market supply.

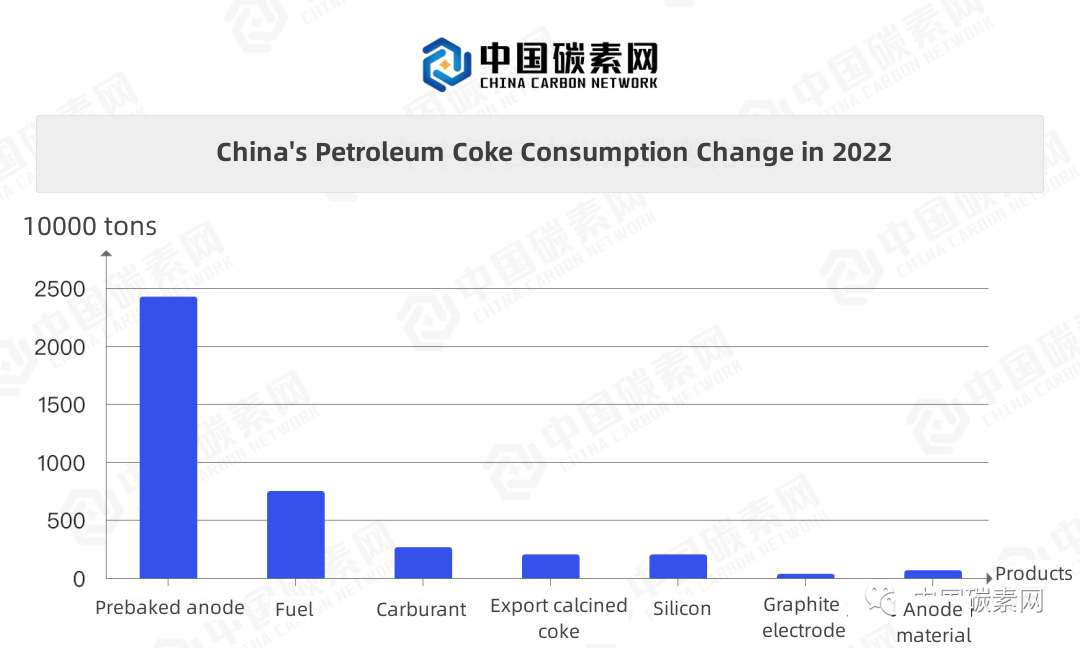

5. Consumption

In 2022, China's petroleum coke total consumption will be 40.7 million tons, with a year-on-year growth of 1.45%, of which, the pre-baked anode market demand still maintained a good growth trend, accounting for 59% of the total consumption structure.

In 2022, petroleum coke market price will go out of the strong shocks trend. The elimination of local refineries' petroleum coke may be accelerated gradually. In this cycle, the petroleum coke industry continues to be in short supply. In the first half of 2022, petroleum coke price may remain at a high level. From the second half of 2022, petroleum coke will enter a period of shock and decline.

In the first half of 2023, it is expected that the downward pressure on the economy will remain large, and petroleum coke price will still fluctuate. Starting from the second half of 2023, the destocking of bulk commodities will gradually end, entering a steady upward cycle, and the fundamentals of petroleum coke will maintain a strong pattern. According to the comprehensive forecast, affected by seasonal supply and demand changes, the high point is expected to remain in the peak period from February to March, and the low point is expected to be from June to December. For more information about calcining petroleum coke, feel free to consult us.

No related results found

0 Replies