【Negative Electrode News】Shanshan Group Files for Bankruptcy Reorganization...

Low-sulfur calcined petroleum coke is a key raw material for lithium battery anode materials. It enhances the charging and discharging performance of batteries by improving conductivity and efficiency through its high carbon content and graphite structure.

【Negative Electrode News】Shanshan Group Files for Bankruptcy Reorganization, Key Test for Negative Electrode Leader

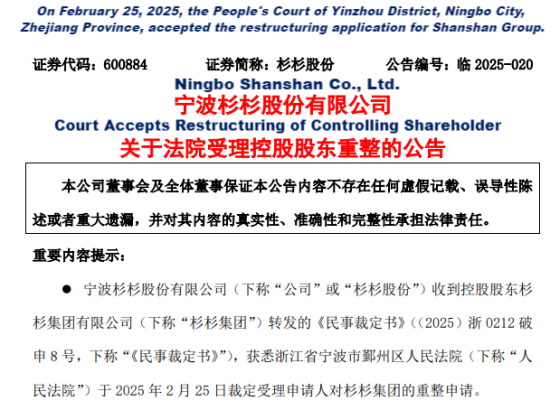

On the night of February 26, Shanshan Co., Ltd. (SH600884) announced that it had received a "Civil Ruling" from its controlling shareholder, Shanshan Group Co., Ltd. (hereinafter referred to as "Shanshan Group"). The ruling, numbered (2025) Zhe0212 Bankruptcy Application 8, revealed that the People's Court of Yinzhou District, Ningbo City, Zhejiang Province (hereinafter referred to as "Yinzhou Court") had accepted the reorganization application for Shanshan Group on February 25.

01 Shanshan Group: Does Not Involve Shanshan Co., Ltd.

Previously, on January 21, the applicants, China Construction Bank Co., Ltd. Ningbo Branch, Ningbo Yinzhou Rural Commercial Bank Co., Ltd. Ningchuan Branch, and Industrial Bank Co., Ltd. Ningbo Branch, filed for reorganization of Shanshan Group at the Yinzhou Court.

On February 25, the Yinzhou Court ruled to accept the reorganization application for Shanshan Group and appointed Zhong Lun (Shanghai) Law Firm, Zhejiang Yongtai Law Firm, and Zhejiang Zhongxing Accounting Firm (Special General Partnership) as the administrators for Shanshan Group.

In response, a representative from Shanshan Group stated that the core purpose of the reorganization is to help the company revitalize its assets, restore its operational vitality and debt repayment ability, and ensure the company's continued operations through legal procedures. Shanshan Group will maintain communication with all parties, expressing confidence and determination to actively address the issue, proceed with the reorganization in an orderly manner, and fully safeguard the legitimate rights of creditors and investors. During the reorganization, Shanshan Group will prioritize the interests of its employees, safeguard their legal rights, and actively fulfill its social responsibilities.

The representative further stated that the reorganization process will focus on the group's own debts and assets and will not involve the listed company, Shanshan Co., Ltd. At the same time, the group will ensure the stable operation of the listed company and core industries, continuously creating value for society and shareholders.

It is reported that the core operating entities of the "Shanshan System" are Shanshan Holdings, Shanshan Group, and Shanshan Co., Ltd. Shanshan Holdings directly holds 50.63% of Shanshan Group's shares. Shanshan Group and its concerted parties collectively hold 37.87% of Shanshan Co., Ltd.'s shares.

Shanshan Co., Ltd. stated that the company has independent and complete business and operational capabilities, and it maintains independence in assets, business, and finances from its controlling shareholder. Currently, the company's production and operations are normal, and this issue has not caused a significant impact on the company's day-to-day operations. The company will continue to work hard to manage its operations to ensure the sound management of the listed company.

However, Shanshan Co., Ltd. also mentioned that Shanshan Group's reorganization process could lead to a change in control of the company. The shares of Shanshan Co., Ltd. held by Shanshan Group and its concerted parties have a high percentage pledged, judicially frozen, marked, or under pending judicial freezing.

According to another announcement released on February 26, 31.94 million shares of Shanshan Co., Ltd. (1.42% of the total share capital) held by Shanshan Group's credit account were judicially disposed of through centralized bidding and block trading from February 24 to 25, as requested by Guotai Junan Securities to assist in judicial enforcement. This led to Shanshan Group holding 320 million shares of Shanshan Co., Ltd. as of February 25, accounting for 14.21% of the total share capital; Shanshan Group and its concerted parties together hold 628 million shares, accounting for 27.87% of the total share capital.

02 Facing “Internal and External Troubles”

According to information, in 1989, Zhejiang businessman Zheng Yonggang founded the "Shanshan" system, gradually transforming from a single apparel business into a leading player in lithium battery materials and optical materials. Shanshan Co., Ltd. was listed on the Shanghai Stock Exchange in January 1996, and was known as the "First Stock of Apparel." Later, Shanshan Co., Ltd. shifted its focus to the emerging lithium battery industry and gradually spun off its apparel business. Today, Shanshan Co., Ltd.'s main business focuses on lithium battery negative electrode materials and polarizers.

In February 2023, Zheng Yonggang passed away due to sudden heart disease. In March of the same year, the board of Shanshan Group elected Zheng Yonggang's 32-year-old eldest son, Zheng Ju, as the new chairman of Shanshan Group with unanimous approval. During Zheng Ju's hasty takeover, a battle for the inheritance with his stepmother and Zheng Yonggang's widow, Zhou Ting, became the focal point of the market.

In November 2024, Shanshan Co., Ltd. announced that Zheng Ju had resigned as chairman due to work reasons, and Zhuang Wei had resigned as vice chairman due to personal reasons. The board of directors elected Zhou Ting as the new chairman, with a term until the end of the 11th board's tenure. After resigning as chairman, Zheng Ju continued to serve as vice chairman of the 11th board, with the same term until the end of the tenure.

According to sources from Shanshan Group, since Zhou Ting took over the "Shanshan System," she has visited all creditor banks in an effort to secure more breathing room and opportunities for the group. Some banks have agreed to extend loans.

On February 7, Shanshan Group held a reorganization hearing, and after the meeting, Zhou Ting stated that it was regrettable that Shanshan Group had come to this point, but there was still much work to be done, and she would continue to make efforts, never giving up.

Tianyancha shows that on February 7, Shanshan Holdings Co., Ltd. underwent an industrial and commercial change. Zhou Ting, the widow of Zheng Yonggang, stepped down as chairman and legal representative, changing her position to director. Zhou Shunhe took over as legal representative and chairman, and Sun Wei stepped down from the board.

In addition, the financial chain crisis of the "Shanshan System" continues to worsen. According to the latest credit bond announcement released by Shanshan Group in January 2025, over 95% of the group's debt must be repaid within one year. As of the announcement date, the group's interest-bearing liabilities totaled 12.621 billion yuan (excluding the listed company Shanshan Co., Ltd.), with short-term debt due within one year amounting to 12.037 billion yuan.

As for Shanshan Co., Ltd.'s debt repayment ability, as of September 2024, the company's cash holdings were 3.839 billion yuan, but its total interest-bearing liabilities amounted to 17.141 billion yuan, with short-term loans reaching 6.217 billion yuan.

Due to overdue debt repayments, Shanshan Group has been sued by more than ten banks and creditors since June 2024.

In November 2024, the "Shanshan System" Ningbo Jutai was forced to judicially auction some shares of the listed company Yongshan Lithium Industry (603399.SH) due to debt default, thus losing its final control over the company.

It is worth mentioning that Shanshan Co., Ltd. recently released its 2024 performance forecast, which shows that the company's core businesses—negative electrode materials and polarizers—maintain strong operational resilience. In 2024, the company expects to achieve operating revenue of 18 to 19 billion yuan, with a net profit of 650 million to 750 million yuan.

Regarding negative electrode materials, Shanshan Co., Ltd. is expected to maintain its global market share at 21% in 2024, with significant growth in sales and a notable improvement in profitability. In the polarizer business, the company expects to maintain a 34% market share in large-size polarizers in the first half of 2024, remaining a global leader. At the same time, the successful completion of the SP business acquisition will further enhance its market share in high-end polarizers, providing strong support for long-term profitability.

A representative from Shanshan Co., Ltd. stated that recent meetings have confirmed that the Ningbo Municipal Government and related financial institutions will fully support Shanshan Co., Ltd.'s normal and stable operations, ensuring the sustainable development of its two main industries, maintaining the stability and safety of its industrial and supply chains, and conveying positive energy to the market.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies