【Carburant】Market Overview in China for 2024

【Carburant】Market Overview in China for 2024

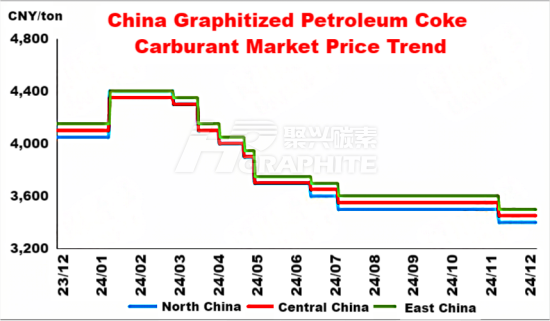

In 2024, China's carburant market primarily operated weakly, with significant competitive pressure in the industry.

Due to a challenging overall economic environment and slow demand recovery, steel mills faced losses and showed low production enthusiasm. Additionally, the cost-reduction and efficiency-enhancing efforts by steel mills put downward pressure on carburant prices, leading to a weak market trend.

Furthermore, the market was in a state of oversupply, with severe price competition among enterprises, resulting in limited industry profit margins.

General Petroleum Coke Carburants

In 2024, the market for general petroleum coke carburants in China experienced slight fluctuations.

In the first half of the year, the weak raw material prices and reduced profits for downstream steel mills, along with frequent furnace repairs and low production rates, resulted in insufficient demand support and downward price pressure for general petroleum coke carburants.

In mid-second quarter, raw material prices began to rise, providing cost support and driving price increases among enterprises, but the downstream market was not receptive to these price hikes, leading to mediocre sales performance.

From August to September, steel mills put more pressure on prices, and low-price competition emerged in the market. The price of Shanxi coal also declined, affecting some enterprises' carbon 90 and below prices.

In October, coal prices increased slightly, providing some support for price hikes, but the market remained generally stable.

In December, steel mill operations slowed, demand shrank, and with a slight reduction in raw material prices, carburant prices fell.

Due to cost pressures, some enterprises mixed other coals to reduce production costs, resulting in varying quality and pricing of petroleum coke carburants in the market.

By the end of December, the regional market price for general petroleum coke carburants was ¥1,550 - ¥1,700/ton (C>90, A<8.5), down by ¥100 - ¥150/ton from the beginning of the year.

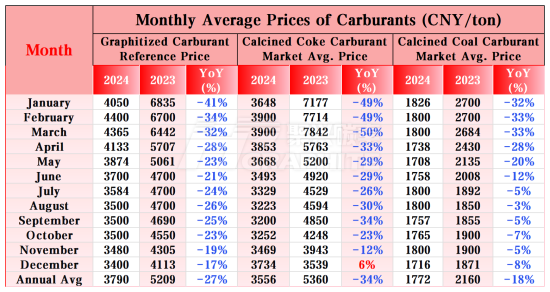

Calcined Petroleum Coke Carburants

The price of calcined petroleum coke carburants in China in 2024 showed a pattern of "increase-decrease-increase."

Initially, the price was driven up by rising petroleum coke prices. After the price increase, downstream demand remained weak, leading to average sales and stable prices. As low-sulfur petroleum coke prices fell and downstream demand remained sluggish, prices continued to decline, with enterprises operating at low margins.

In the fourth quarter, the continuous rise in domestic low-sulfur petroleum coke prices supported the price of calcined coke carburants, but downstream demand remained limited, and acceptance of price hikes was lower than expected. Transactions of low-sulfur calcined coke were stable, with enterprises maintaining a balance between production and sales.

Prices for mid-to-high sulfur grades initially rose but then stabilized and started to recover gradually, mainly influenced by raw material prices and supply-demand dynamics. Despite a decrease in downstream procurement enthusiasm, market prices were weak, and cost pressures began to rise. The market was characterized by limited demand, and trading was sluggish, with prices gradually increasing.

By the end of December, the regional market price for calcined petroleum coke carburants was ¥3,800 - ¥4,300/ton (S<0.5, A<0.5, VM<0.5, 1-5mm), up by ¥500 - ¥1,000/ton from the beginning of the year.

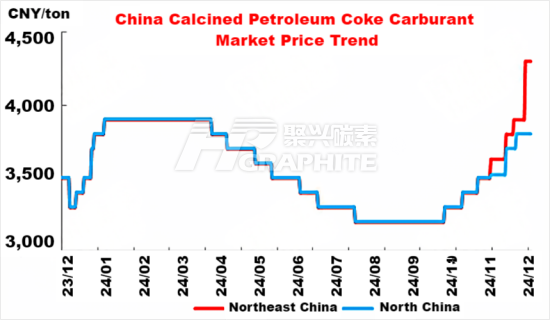

Graphitized Petroleum Coke Carburants

The market price for graphitized petroleum coke carburants in China in 2024 showed a weak trend overall. By the end of December, the reference price for Baichuan Yingfu graphitized petroleum coke carburants was ¥3,400/ton (C≥98%, S≤0.05%, particle size: 1-5mm), down ¥800/ton (a 16.05% drop) from the beginning of the year.

Early in the year, as calcined coke prices continued to rise and with many negative electrode producers reducing or halting production, the supply of spot market materials decreased, boosting demand for stocking. This created a market environment where prices for graphitized coke carburants rose. However, as the production of negative electrodes gradually increased, the output of graphitized coke carburants also rose, but demand was still weak, and steel mills continued to pressure prices down. This led to intense price competition and a downward trend in the market. From August to September, with a continued decrease in negative electrode production, the supply of graphitized coke carburants began to shrink, but demand still failed to strengthen, and the oversupply situation did not ease. Enterprises were mostly holding steady and observing the market, with limited support for a price increase. In October, coke prices began to rise again, but the market remained oversupplied, and competition remained fierce, limiting price increases. By the end of the year, there were mixed factors in the graphitized coke carburant market, with some companies experiencing low inventory and making slight price increases in their sales efforts.

Feel free to contact us anytime for more information about the carburant market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies