【Petroleum Coke and Calcined Coke Market】Stable to Slightly Rising

Stable to Slightly Rising: Petroleum Coke and Calcined Coke Market

Ⅰ. Petroleum coke market analysis

Market Overview: the petroleum coke market showed moderate trading activity during the week of May 12th to May 18th. Mainstream prices partially increased, driven by active production and sales in the refining market. Decreased coking operations led to market price adjustments, with an average price of 2440 CNY/ton.

Refineries: Refinery operations were generally favorable, with most executing contracts and some witnessing price increases for medium to high sulfur coke. Sinopec's refineries maintained stable prices and increased shipments, while CNOOC fulfilled contract orders and Sinopec had satisfactory shipments.

Local refineries: Selected medium to high sulfur refineries actively increased shipments, resulting in marginal price increases and continued exploration of higher prices.

Future forecast: In the short term, some refineries will undergo routine maintenance in May, leading to a decrease in domestic petroleum coke production. This, coupled with increased downstream procurement, will benefit the petroleum coke market. However, high inventory levels in port terminals may impact downstream purchasing sentiment. Carbon anode manufacturers prioritize production based on order volume, while calcination enterprises maintain minimal inventory, creating a favorable environment for petroleum coke price increases. Steel mills utilizing electric furnaces continue to reduce production, and graphite electrode demand remains sluggish, providing limited support to the market for low sulfur coke. An increase in production rates of negative electrode materials will benefit high-quality, low sulfur coke, potentially increasing raw material demand. Overall, downstream enterprises have relatively low petroleum coke inventory, making it a necessity, and therefore, demand for petroleum coke persists. Refineries are expected to actively ship, leading to stable prices as the main trend, with the possibility of slight increases.

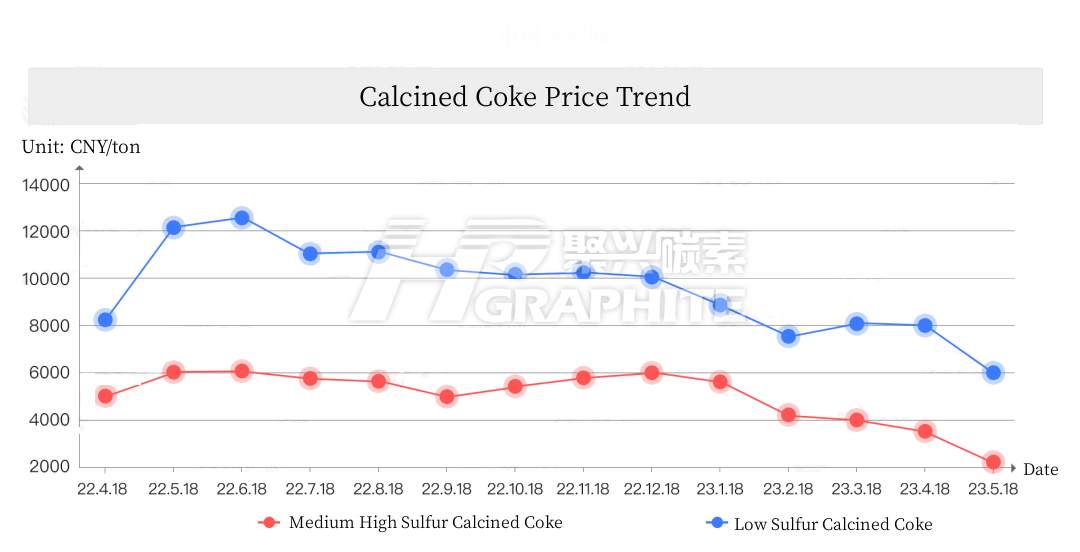

Ⅱ. Calcined coke market analysis

Market Overview: the calcined coke market remained stable during the week of May 12th to May 18th, with satisfactory shipments and stable prices for low sulfur coke, while prices for medium to high sulfur coke showed a slight increase. The average price for low sulfur coke was 5200 CNY/ton, and for medium to high sulfur coke, it was 2800 CNY/ton. The mainstream transaction range for low sulfur coke (using Jinxi and Jinzhou petroleum coke as raw materials) was 4800-5500 CNY/ton; for low sulfur coke (using Fushun petroleum coke as raw material), it was 5500-6500 CNY/ton; for low sulfur coke (using Liaohe, Jinzhou, and Binzhou Zhonghai petroleum coke as raw materials), it was 4000-5000 CNY/ton.

Regarding raw materials, the petroleum coke market had good trading activity during the week, with prices mainly increasing and refinery shipments improving, resulting in low inventory levels. Most downstream demand was based on as-needed procurement, with a few companies showing increased purchasing enthusiasm, driving up coke prices.

Future forecast: In the short term, demand for low sulfur coke remains satisfactory, and prices are expected to remain stable. Contact us for more information on petroleum coke product news.

No related results found

0 Replies