【Steel Market】September Outlook: Manufacturing Supports, Construction Weak, Iron Ore...

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel Market】September Outlook: Manufacturing Supports, Construction Weak, Iron Ore Under Pressure, Coke Supports Finished Steel Prices

I. Differentiated Steel Consumption and Export Performance

1. Steel consumption shows "strong manufacturing, weak construction" characteristics

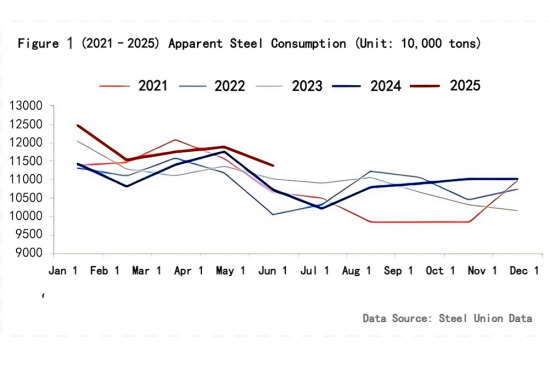

According to statistics, on the demand side, from January to July 2025, the total consumption of the five major steel products was approximately 113.6 million tons, a month-on-month decrease of 4.27% and a year-on-year increase of 6.06%. As of August 22, 2025, the total construction steel consumption from January to August was 70.4805 million tons, a year-on-year decrease of 3.8%; weekly hot-rolled coil consumption totaled 108.2 million tons, a year-on-year increase of 1.51%; cold-rolled coil consumption totaled 29.0408 million tons, up 2.65% year-on-year; wire rod consumption totaled 27.0658 million tons, down 8.33% year-on-year; medium and heavy plate consumption totaled 53.3256 million tons, up 4.38% year-on-year.

From the consumption performance, steel consumption from January to August 2025 exhibits a "strong manufacturing, weak construction" pattern. Automotive, new energy, infrastructure projects, and export demand supported consumption of hot-rolled, cold-rolled, and medium and heavy plates. In contrast, shrinking real estate investment led to weak demand in the construction steel sector, highlighting structural contradictions. According to research, the fund allocation rate for construction sites improved significantly this week, reaching the peak weekly increase since mid-June. Coupled with growth in manufacturing and emerging sectors, some of the construction sector's decline may be offset, suggesting that overall steel demand in September is likely to recover gradually.

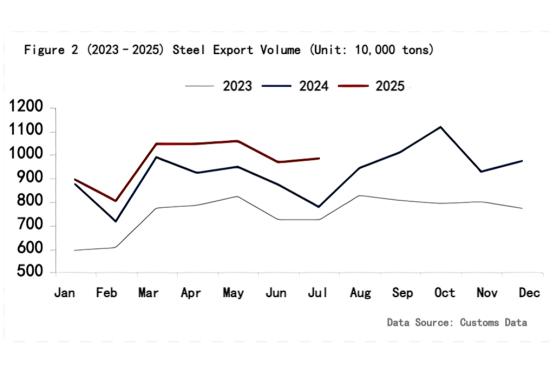

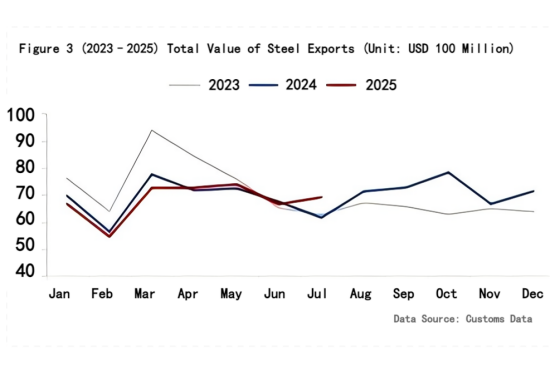

2. Cumulative steel exports from January to July 2025 increased year-on-year

According to the General Administration of Customs, China exported 9.836 million tons of steel in July 2025, an increase of 0.158 million tons from the previous month, up 1.6% month-on-month, and a year-on-year increase of 26.37%. From January to July, cumulative steel exports totaled 67.983 million tons, up 11.4% year-on-year, while the average export price declined 11.16% year-on-year. Chinese enterprises continue to prioritize volume over price, adopting low-margin, high-volume strategies. Major export destinations are concentrated in East Asia, accounting for 80% of total exports. Weak domestic real estate constrains construction steel consumption, prompting steel mills to rely on exports to relieve domestic supply pressure. The core logic of China's steel exports remains a low-price advantage, but with trade barriers and global economic weakness, annual export growth may slow.

II. Iron Ore Prices Slide, Coke Provides Short-Term Support

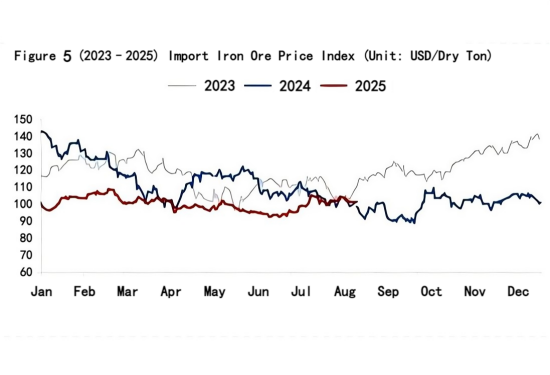

1. 2025 iron ore market shows ample supply, with prices trending lower

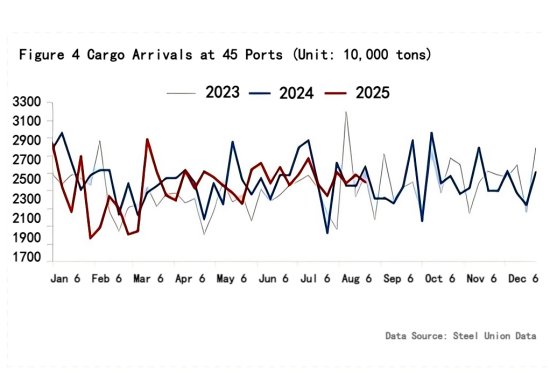

From January to July 2025, the iron ore market exhibited "ample supply and demand, with downward price pressure," influenced by supply expansion, weak demand, and policy factors. As of August 22, 2025, cargo arrivals at 45 ports totaled 23.933 million tons, up 1.528 million tons month-on-month (+6.82%), and down 6.76% year-on-year. The import iron ore price index stood at 100.75 USD/dry ton, down 3.17% month-on-month and up 2.49% year-on-year. Global iron ore production increased significantly (Vale S11D expansion, Rio Tinto West Pilbara projects). Combined with overseas economic slowdown and uncertain domestic demand, iron ore prices are expected to remain under pressure.

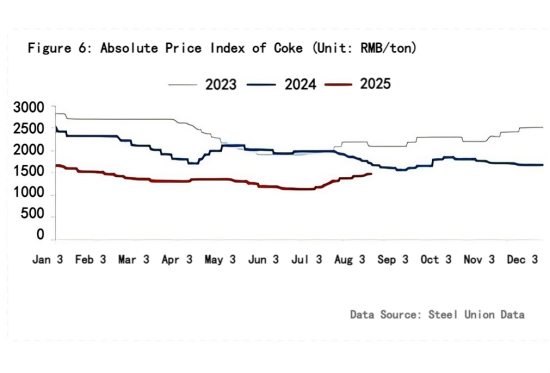

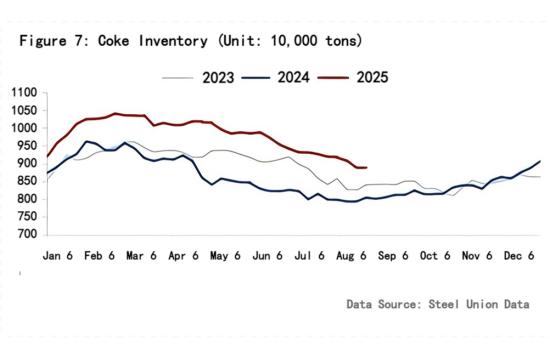

2. Tight supply-demand balance, coke prices raised multiple times in the past two months

As of August 27, 2025, the MyCpic absolute coke price index stood at 1,455.2 RMB/ton, up 203.9 RMB/ton month-on-month, and down 244.2 RMB/ton year-on-year. According to full-sample statistics as of August 22, coke inventories at the four major ports were 8.8858 million tons, down 0.2965 million tons month-on-month and up 0.8494 million tons year-on-year. Last week marked the seventh round of coke price increases, restoring profits to near profitability. Currently, coking plants maintain previous operating rates, keeping low inventories. From this week, most coking enterprises in Shandong further increased production limits on top of previous reductions, with typical cuts around 30%. Some coal mines still have planned shutdowns for inspections. Overall, coke supply is tightening marginally. End-of-month production reductions in molten iron may limit further price increases, but coke prices in September are expected to remain supported, providing support to finished steel prices.

III. September Steel Market Outlook

Cost Side: Recently, steel mill profit margins have narrowed. With reduced molten iron production at the end of August, iron ore prices may face short-term pressure. Although coke price increases are constrained, medium- to long-term trends are likely to see relatively strong coke prices due to supply tightening.

Supply Side: Steel mill profitability this year has risen significantly, directly motivating production. Daily molten iron output remains at a mid-to-high level for the past five years. Although Hebei Tangshan blast furnaces planned a 40% production limit from August 31 to September 3, the estimated daily molten iron impact is only 41,800 tons, with limited actual supply effect. Market reactions are largely sentiment-driven. Additionally, inventories of the five major steel products have increased for four consecutive weeks, showing obvious supply-side pressure. Future attention should focus on mill maintenance plans and the recovery of "Golden September, Silver October" demand.

Demand Side: Steel consumption shows a clear "strong manufacturing, weak construction" pattern. While fund allocation at construction sites has improved significantly this week, real estate bottoming is expected to be a prolonged process, explaining the continued decline in construction steel demand over the past two years. Growth in manufacturing and emerging sectors partially offsets this decline. Overall, demand is expected to recover gradually in September, with Golden September and Silver October prospects still present.

Chinese domestic steel market is currently at a complex crossroads. On the supply side, blast furnace molten iron output remains high, and mills are reluctant to reduce production. Inventories of the five major steel products continue to rise, transferring factory pressure to social inventories and creating overall supply pressure. On the demand side, a clear divergence exists: manufacturing is stable, while construction remains weak. Weak construction steel demand due to the real estate bottoming remains the main drag. Cost-wise, coke provides support under tight supply-demand conditions, while iron ore prices are under pressure due to ample supply expectations.

Entering September, the market will closely watch the actual enforcement of northern production cuts, the recovery of traditional Golden September and Silver October demand, potential Fed rate cuts, and marginal changes in costs. Overall, considering gradual supply absorption, delayed but anticipated peak-season demand, potential macro recovery, and cost-side support, Chinese domestic steel prices in September are expected to first stabilize and then rise.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies