【Steel】Thunderstruck! Over 100 Yuan Surge as Good News Hits — Is a Market Reversal Coming?

Graphite electrodes are essential in electric arc furnace steelmaking, serving as the core component for arc heating. With excellent conductivity and high-temperature resistance, they play a vital role in ensuring molten steel quality and boosting production efficiency. Controlling graphite electrodes means controlling the key to electric arc furnace steelmaking.

【Steel】Thunderstruck! Over 100 Yuan Surge as Good News Hits — Is a Market Reversal Coming?

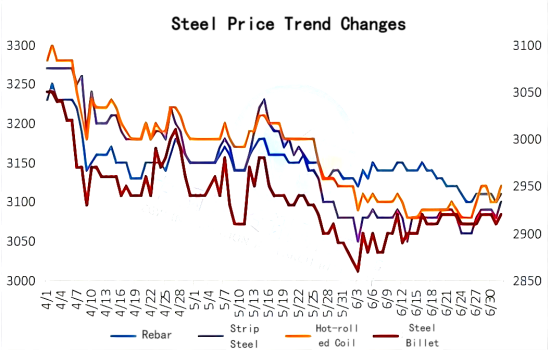

In today's complex and ever-changing global economic landscape, the steel market — a barometer of economic development — continues to attract close attention. Recently, a multitude of Chinese Domestic and international macroeconomic factors, along with changes in steel industry fundamentals, are intertwining to shape the future direction of the market. After a prolonged period of fluctuation, the steel market has finally seen an upswing this week. But what does this mean for the market going forward?

Chinese Domestic Policy: Guidance from the Central Financial and Economic Affairs Commission

The Central Financial and Economic Affairs Commission recently held a meeting, emphasizing the need to regulate and govern disorderly low-price competition in accordance with laws and regulations, and to promote the orderly exit of outdated production capacity. This policy signal carries profound implications for structural adjustment within the steel industry.

For a long time, the industry has faced issues with certain companies engaging in cutthroat price competition, disrupting market order and hindering healthy sector development. Implementation of this policy will accelerate consolidation and upgrading within the steel industry.

On one hand, it will standardize market competition, guiding enterprises to shift from price wars to competition in technology, quality, and service — thereby enhancing overall competitiveness.

On the other hand, phasing out outdated capacity will free up resources for more competitive enterprises, optimize the industry's capacity structure, raise concentration levels, and help the steel industry transition to a high-quality development model. All these measures are favorable for stabilizing steel prices and improving profitability across the sector.

Production Cuts Rumors and Market Games

Recently, rumors of production cuts in Tangshan have surfaced again. The new round of curtailment is said to be stricter and longer in duration than the previous one — potentially involving a 30% reduction across the sintering, ironmaking, and steelmaking processes, lasting for as long as one month.

This rumor has quickly sent ripples through the steel market. It has two major impacts:

1) Changing Supply Expectations: If the production curbs are implemented as rumored, market supply will shrink, easing the pressure from oversupply and strongly supporting steel prices.

2) Boosting Market Sentiment: Amid ongoing weak demand, the news acts like a shot of adrenaline, reviving market confidence and encouraging bullish expectations for steel prices, which may influence trading behavior. However, attention must be paid to whether these policies are actually enforced.

Overseas: Fed Rate Cuts and Their Impact

On September 19 last year, the U.S. Federal Reserve issued a statement after its policy meeting, cutting the target range for the federal funds rate by 50 basis points to 4.75%–5% — the first rate cut in four years. On a global level, the rate cut provides some relief from economic downward pressure.

As construction and manufacturing are two major demand drivers for steel, the easing of economic pressure is expected to stimulate investment and production, thereby driving up steel demand.

Moreover, rate cuts typically weaken the U.S. dollar, enhancing the international price competitiveness of dollar-denominated steel products. This could benefit both direct and indirect exports of Chinese steel. While the timing of further rate cuts this year remains uncertain, current discussions are helping lift market sentiment to some degree.

Tariff Barriers and Steel Trade Difficulties

Since the beginning of this year, the U.S. has launched a "tariff storm" that has rattled global steel trade. The so-called "reciprocal tariffs" policy is a classic example of trade protectionism.

Previously, the U.S. had already imposed steep tariffs on Chinese steel imports — with rates soaring to 60%. Although steel and aluminum were temporarily excluded from the latest round of reciprocal tariffs, ongoing anti-dumping measures by countries like Vietnam, South Korea, and India continue to pose obstacles for China's steel exports.

In the short term, rising prices of goods exported to the U.S. are increasing consumer costs domestically, and global supply chain stability is being challenged. According to preliminary estimates by the World Trade Organization, the U.S. tariff actions this year could cause global trade volumes to shrink by about 1% in 2025.

Fundamental Supply and Demand Tug-of-War

Supply Side Variability

From the production side, blast furnace operating rates first declined and then rebounded, while electric arc furnace (EAF) utilization saw a noticeable drop. In June, steel production cuts and maintenance slightly increased compared to May, but varied by product. Hot-rolled coil and wire rod saw reduced maintenance, while rebar production cuts intensified.

Looking ahead to July, as the seasonal demand lull deepens and steel mills enter mid-year maintenance, more production cuts are expected. However, under ongoing economic pressure, steelmakers remain vital to local government tax revenues. Large-scale cuts could affect local income and employment, making production decisions more complex.

Demand Side Weakness

Steel demand from key downstream sectors remains sluggish. Construction steel demand is severely hampered by the struggling real estate and infrastructure sectors. The real estate industry continues to underperform, with little hope of near-term recovery. Infrastructure is also under strain, with investment growth slowing. In June, steel usage fell 7.8% month-on-month, and is projected to drop another 5.6% in July.

On the industrial side, except for the automotive and shipbuilding sectors, demand from machinery, steel structures, and other industries declined in June. As the seasonal lull continues, steel demand from seven major sectors is expected to decline further in July.

Summary and Outlook

In summary, the steel market is currently navigating a complex environment shaped by both macroeconomic conditions and fundamental shifts. While the U.S. Fed's rate cut offers some opportunity, ongoing trade barriers remain a source of uncertainty. Domestically, policies aimed at optimizing and upgrading the industry are encouraging, but weak demand persists and may not improve in the short term.

Steel prices are expected to fluctuate after this recent rise. In the short term, if production cut policies are effectively implemented, reduced supply will support prices. However, continued weak demand will cap any significant price rally. In the medium to long term, global economic uncertainty, persistent trade frictions, and the ongoing process of Chinese Domestic industry restructuring will deeply impact steel's supply-demand dynamics and price trends.

Recommendation: Market participants are advised to lock in profits gradually during any price rally.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies