【Petroleum Coke】Market Analysis of Petroleum Coke Varieties During May Day

【Petroleum Coke】Market Analysis of Petroleum Coke Varieties During May Day

Price Analysis

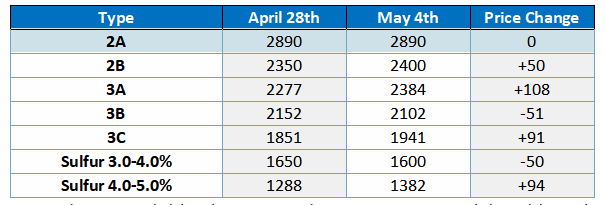

Shandong Refinery Petroleum Coke Prices

Unit: Yuan/ton

During the May Day holiday, downstream carbon companies supported the stability and small increase in the prices of Shandong refinery petroleum coke. The domestic inventory of major port petroleum coke continued to climb, up 8.15% from the previous period. Due to the low market prices, the shipment of imported coke is limited, but the difficulty of a significant increase in the price of Shandong refinery petroleum coke is high due to the pressure of high inventory. During the holiday period, the price of Shandong refinery petroleum coke increased by 50-100 yuan/ton, but frequent changes in petroleum coke indicators by refinery companies during the holiday period also caused some market prices to decline.

Supply Analysis

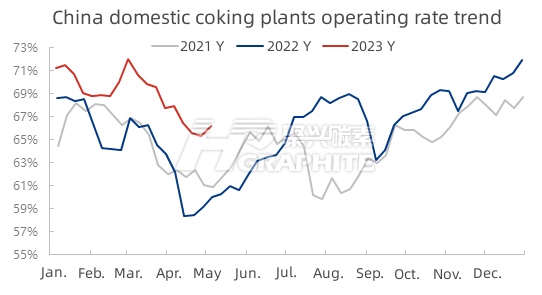

According to statistics on the 92 petroleum coke production enterprises in China, the average operating rate of delayed coking units increased by 0.86% from the previous period to 66.15% during this period, an increase of 6.17% from the same period last year. During the May Day holiday, Maoming Petrochemical, Huaxing Petrochemical, and China National Offshore Oil Corporation's delayed coking units started producing coke. The operating rate of delayed coking units in China has increased, and the national petroleum coke production increased by 1.33% compared to the previous period.

Demand Analysis

During the holiday period, the demand from downstream carbon companies remained stable, but most companies maintained procurement as needed due to sufficient supply of raw materials. Downstream graphite electrode manufacturers still operated at low loads using low-sulfur petroleum coke, and there was no significant increase in the operating rate of negative electrode material enterprises. For aluminum carbon, most companies maintained normal production, while some companies slightly reduced production.

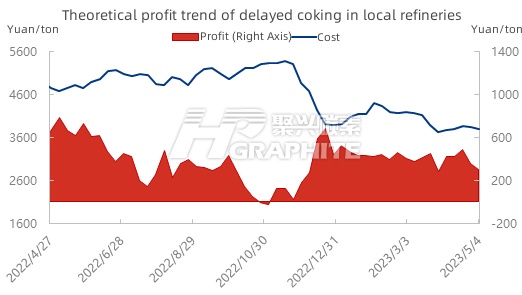

Theoretical Profits

During this period, the theoretical processing profit of Shandong refinery delayed coking units was 306 yuan/ton, down 50 yuan/ton from the previous period's 356 yuan/ton. This period's average diesel price decreased by 107 yuan/ton from the previous period to 6,345.3 yuan/ton, the gasoline price decreased by 106 yuan/ton to 6,283 yuan/ton, and the coking wax price decreased by 279 yuan/ton from the previous period. In terms of raw materials, the average price of coking material decreased by 70 yuan/ton to 4,288 yuan/ton. Therefore, the refinery coking profit in this period has slightly declined compared to the previous period.

Future Outlook

In the week following the holiday, with the gradual resumption of maintenance enterprises and the gradual arrival of imported petroleum coke in May, the domestic supply of petroleum coke will continue to increase, while demand in various downstream fields will remain stable, and carbon companies will mostly purchase as needed. In terms of prices, it is expected that the main petroleum coke prices will partially increase, the mainstream price of Shandong refinery petroleum coke will remain stable, and slight declines will be the main trend. For further understanding of petroleum coke market trend, feel free to contact us.

No related results found

0 Replies