【China's Steel Exports】High Growth Amid Weak Domestic Demand, Strong Exports, ...

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【China's Steel Exports】High Growth Amid Weak Domestic Demand, Strong Exports, and Anti-Dumping Challenges

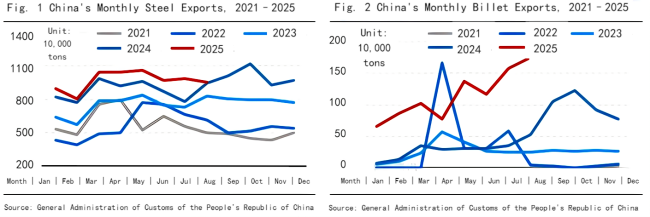

In 2025, China's steel industry continues to show a pattern of "weak domestic demand and strong exports." From January to August, China's steel exports increased by 10.0% year-on-year, while billet exports surged by 293.24% year-on-year. Looking ahead to the fourth quarter, despite ongoing anti-dumping trade frictions, China's steel price advantage still supports exports at high levels. However, under the high base effect, year-on-year growth may slow down.

In 2025, against the backdrop of weak global economic recovery and ongoing geopolitical conflicts, China's steel industry continues the trend of "weak domestic demand, strong exports." According to the latest data from the General Administration of Customs, from January to August 2025, China's cumulative steel exports reached 77.49 million tons, up 10.0% year-on-year. The continued cost-effectiveness of domestic steel prices has been the main driver behind sustaining high export levels. At the same time, amid a wave of anti-dumping measures against Chinese steel exports by multiple countries, exports of semi-finished steel billets remained robust. From January to August 2025, China's billet exports totaled 9.2362 million tons, representing year-on-year growth of 293.24%. This has, to some extent, eased the pressure of domestic long steel oversupply, serving as a short-term substitute for overseas demand in some countries and a way for the steel industry to maintain profit balance.

China's Steel and Billet Exports Remain Competitive, Emerging Market Demand Growing

The price advantage of China's steel exports has partly offset high tariff costs. Meanwhile, China's steel industry has developed into the most complete industrial system, capable of producing the widest range of steel products. Currently, China's competitiveness in terms of product variety, quality, and logistics has significantly improved, providing effective support for construction projects in neighboring countries. In addition, global manufacturing is showing a weak recovery. In August, the global Manufacturing PMI reached 49.9%, up 0.6 percentage points from the previous month, approaching the 50% expansion threshold. This slight improvement in external demand has lifted the steel industry's export order index back into the expansion range, providing some support for steel exports.

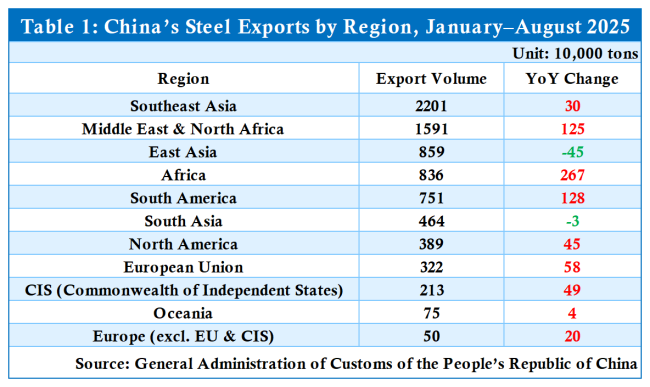

In terms of export regions, China's steel exports this year have mainly flowed to Southeast Asia, the Middle East, and Africa. Affected by anti-dumping tariffs, China's total exports to Vietnam and South Korea have slightly declined, while imports from Africa and South America have increased significantly, becoming important supports for China's steel exports. Specifically, increased demand from other Southeast Asian countries has offset the decline in Vietnam. Thailand, the Philippines, Myanmar, and other ASEAN countries have significantly increased steel imports from China, with overall exports to Southeast Asia rising by 300,000 tons from January to August. In the Middle East, with continued progress in infrastructure projects in Saudi Arabia, Egypt, and the UAE, dependence on Chinese steel is rising. In Africa, demand remains strong due to large-scale infrastructure and energy projects. In South America, demand for steel imports is steadily recovering, driven by macroeconomic repair and manufacturing recovery. In East Asia and South Asia, anti-dumping policies imposed by Japan, South Korea, and India have led to a decline in export volumes. Overall, the resilient demand in the Middle East, Africa, and South America has provided China with new growth opportunities for steel exports, effectively offsetting the slowdown in some markets caused by anti-dumping pressures.

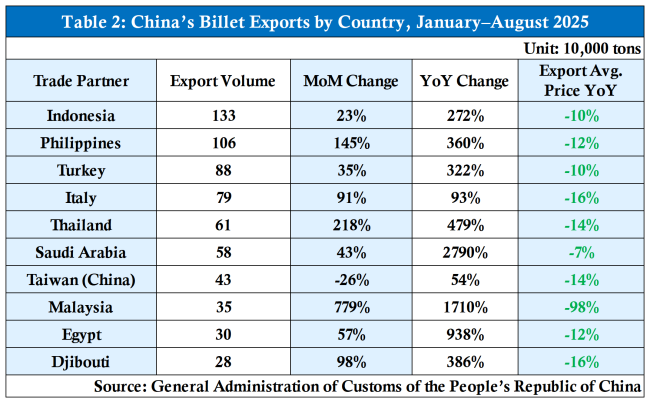

Since September 2024, billet exports have risen significantly, mainly due to their cost-effectiveness in the international market, as well as preferential policies with near-zero tariffs on semi-finished products. This year, billet export prices have continued to decline. In August, China's billet exports reached 1.7642 million tons, up 11.67% month-on-month and 236.03% year-on-year, while the average export price fell 0.91% MoM and 12.44% YoY.

As for billet export destinations, the main markets include Indonesia, the Philippines, Saudi Arabia, Italy, and Turkey. From January to August, Indonesia was the largest recipient of China's billet exports. The top ten export destinations all recorded significant year-on-year increases in billet imports. On one hand, Southeast Asia has absorbed part of China's manufacturing transfer, while Saudi Arabia's localization requirements for construction projects have driven demand for steel. However, importing finished steel directly could affect local industry output and employment, while importing billets allows local rolling mills to process them, meeting domestic infrastructure needs while preserving jobs. Additionally, Chinese companies building factories overseas often import semi-finished products from China for local rolling to meet regional requirements. On the other hand, importing billets is more cost-effective than producing steel from scrap. For instance, billets exported to Italy and Turkey are processed and then resold to other EU countries, thereby avoiding anti-dumping investigations.

Global Trade Protection Still Severe, "Price for Volume" Model Continues

The wave of anti-dumping measures against China's steel industry began in early 2024 and has continued into 2025, covering major export markets such as Vietnam, Brazil, the EU, South Africa, Turkey, and Australia. More than 70 cases have entered the investigation or final ruling stages, affecting finished steel products such as hot-rolled coil, medium plate, and seamless steel pipes. After a period of rushing exports, the industry is entering a phase of adjustment. Rising global trade frictions and related tariffs are gradually suppressing China's steel exports. Meanwhile, semi-finished billets, under specific conditions, match domestic excess capacity with international structural demand, creating short-term opportunities. However, the surge in billet exports has already triggered anti-dumping measures in some countries seeking to protect their domestic steel industries. For example, Pakistan may continue to impose anti-dumping duties as high as 24.04%, though currently, China has little billet export volume to Pakistan, so the impact is limited. In the short term, the surge in billet exports is a market-driven choice, but it is indeed unfavorable for the long-term development of China's steel industry. Restrictions on billet exports may be introduced in the future.

In conclusion, China's steel export price advantage still exists, and the steel industry's export order index has returned to the expansion zone. Exports are expected to remain high in the fourth quarter. However, given the high base of last year's exports, year-on-year growth may still face downward pressure. Based on estimates, if steel and billet exports continue at the average levels of June to August, total steel and billet exports for the year could reach 130 million tons, an increase of about 14 million tons YoY, with Q4 exports up about 400,000 tons YoY.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies