【Anode Materials】China's 2024 "Overseas Expansion" of Anode Materials, Global Share Soars to 95.9%!

With the rapid development of the electric vehicle and energy storage markets, the demand for graphitized petroleum coke is also increasing. Especially in high-performance lithium batteries, the growing demand for anode materials is further driving the market demand for graphitized petroleum coke.

【Anode Materials】China's 2024 "Overseas Expansion" of Anode Materials, Global Share Soars to 95.9%!

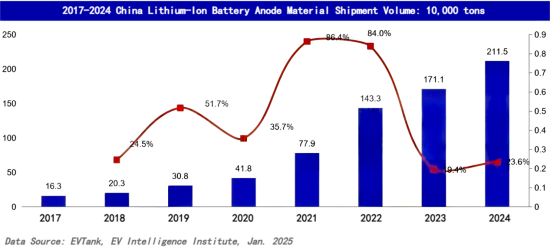

In 2024, global shipments of anode materials reached 2.206 million tons, a year-on-year increase of 21.3%. Of this, China's anode material shipments totaled 2.115 million tons, further increasing its global share to 95.9%.

Recently, a joint report by the Ivey Economic Research Institute and the China Battery Industry Research Institute, titled "White Paper on the Development of China's Lithium-Ion Battery Anode Materials Industry (2025)", revealed that global anode material shipments in 2024 reached 2.206 million tons, up 21.3% compared to the previous year. Of this, China's anode material shipments accounted for 2.115 million tons, raising its global share to 95.9%.

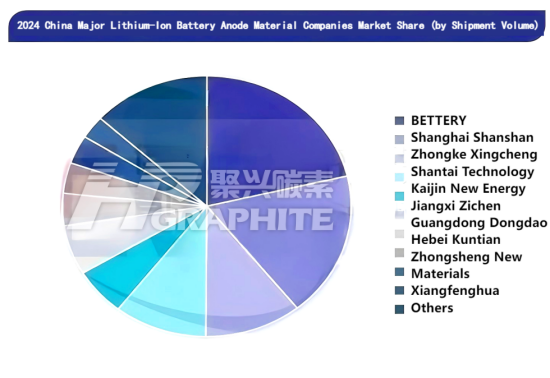

Due to the export control of natural graphite, some overseas clients have gradually shifted to artificial graphite, resulting in a further increase in the share of artificial graphite anode materials in global shipments. According to the white paper, the share of China's artificial graphite anode materials rose to 84.4% in 2024, reaching 1.785 million tons. Meanwhile, new anode materials, such as silicon-based anodes, accounted for 3.3% of the total shipments. Silicon-based anodes have seen significant growth, driven by large cylindrical batteries and semi-solid-state batteries. The blending ratio of silicon-based anode materials continues to rise, with leading company BETTERY holding over 50% market share in silicon-based anodes in 2024, maintaining an absolute monopoly position. Companies such as Tianmu Xian Dao and Zhide New Energy also performed well in the silicon-based anode shipments in 2024.

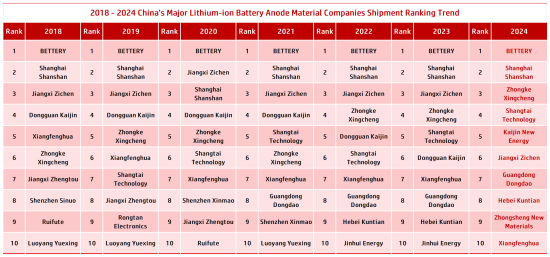

In 2024, BETTERY ranked first with over 20% market share, followed by Shanghai Shanshan in second place. The threshold for entering the top 10 companies has risen to 60,000 tons. Zhongsheng New Materials replaced Jinhui Energy to enter the top 10, while Xiangfenghua dropped from 6th place in 2023 to 10th. According to the white paper, the fastest-growing company in terms of shipment volume in 2024 was Zhongsheng New Materials.

Looking ahead, as the differentiated performance requirements of anode materials for downstream battery manufacturers gradually emerge, the competitive landscape of anode material companies is expected to change significantly. Products excelling in fast-charging, rate performance, and high capacity will stand out. On the other hand, the supply and demand relationship of the entire anode material industry is gradually improving. It is expected that the industry will enter a more positive development phase in 2025, with the operating rates of first-tier companies further increasing and improving business performance.

With the rapid development of new energy vehicles, energy storage, and other sectors, the demand for anode materials will continue to grow. At the same time, with ongoing technological advancements and further cost reductions, the performance of anode materials will continue to improve, meeting a wider range of application needs. It is advisable to focus on the industrialization opportunities of new anode materials, such as fast-charging performance anode materials, silicon-based anode materials, hard carbon anode materials, and metal anode materials.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies