【CPC】Market Fluctuates Narrowly, Low-Sulfur CPC Prices Under Pressure

【CPC】Market Fluctuates Narrowly, Low-Sulfur CPC Prices Under Pressure

Market Overview

On March 31, the average price of calcined petroleum coke (CPC) was RMB 3,378/ton, down RMB 82/ton (-2.37%) from the previous working day. The low-sulfur CPC market remained stable, with most enterprises keeping their offers firm. Downstream buyers have procurement demand but show low price acceptance. The medium-to-high sulfur CPC market saw limited fluctuations, with most indicator-grade CPC being sold under long-term contracts. Buyers continued to push for lower prices, causing slight order price reductions, while standard-grade CPC remained stable in sales.

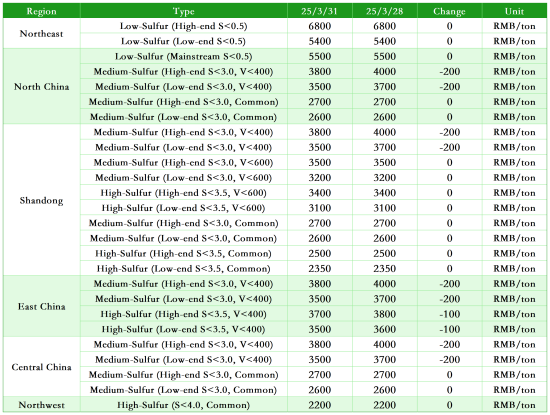

Main Regional Market Prices

Market Prices

Low-Sulfur CPC

(Sourced from Jinxi and Jinzhou petcoke): RMB 5,400-5,700/ton

(Sourced from Fushun petcoke): RMB 6,500-6,800/ton

(Sourced from Liaohe and Binzhou CNOOC petcoke): RMB 5,100-5,800/ton

Medium-to-High Sulfur CPC

(S <3.0%, no trace element requirements): Previous contract price RMB 2,600-2,700/ton, current negotiation price RMB 2,600-2,700/ton

(S <3.5%, no trace element requirements): Previous contract price RMB 2,350-2,500/ton, current negotiation price RMB 2,350-2,500/ton

(S <3.0%, V <400ppm): Previous contract price RMB 3,500-3,800/ton, current negotiation price RMB 3,500-3,800/ton

Supply

China's commercial CPC daily supply is currently 27,783 tons, with an operating rate of 59.88%, remaining stable compared to the previous working day.

Upstream Market

Petroleum Coke: Sinopec refineries are maintaining stable transactions, with steady demand from carbon anode and anode material enterprises. In East China, Shanghai Petrochemical and Yangzi Petrochemical are selling as per 4#B petcoke standards. In Shandong, Qingdao Petrochemical is selling mid-to-high sulfur petcoke as per 3#A, while Qingdao Refining's vanadium content has risen to 500ppm. CNPC refineries continue stable sales. In Northeast China, Daqing Petrochemical and Jinxi Petrochemical are preparing for maintenance, potentially reducing low-sulfur coke output. In North China, Dagang Petrochemical is auctioning petcoke, while refineries in Northwest China have no maintenance plans and are mainly supplying aluminum carbon producers. CNOOC refineries are fulfilling existing orders.

Downstream Market

Graphite Electrodes: Tender activity in the graphite electrode market has been increasing, but prices remain low. While demand is recovering, it has not provided strong support for the market. Graphite electrode producers remain cautious, and the market is running weakly stable.

Electrolytic Aluminum: Weakened by external markets and continuous declines in aluminum spot prices, market sentiment is bearish, and purchasing activity remains subdued.

Anode Materials: The anode materials market remains relatively stable, but competition among small and medium-sized enterprises is intensifying. Industry concentration is high, leading to continuous low prices and survival pressure on smaller players.

Market Outlook

Low-sulfur CPC: Raw material prices are stabilizing, so CPC prices are expected to remain steady.

Medium-to-high sulfur CPC: Prices are generally stable, with some grades fluctuating slightly based on market conditions.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the calcined petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies