EAF steel: Steel prices rebounded weakly, EAFs continued to reduce production

EAF steel: Steel prices rebounded weakly, EAFs continued to reduce production

China's construction steel market transaction improved slightly this week, However, rainfall and epidemic still have a certain impact on the demand of the southern market. In addition, after the enterprises in Shanghai and other regions concentrated on resuming production, some construction groups were short of funds in June, which was worse than that in the early stage. As the RP/HP/UHP graphite electrode manufacturer in China, we report comprehensive news of international graphite. The overall market showed a weak rebound pattern. As of July 1, the average price of domestic rebar was 4306 yuan, 87 yuan higher than last Friday.

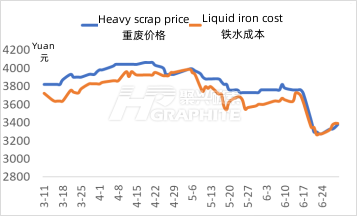

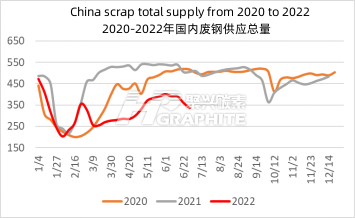

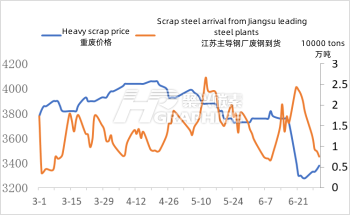

In terms of raw materials: This week, the price of scrap steel shown a super drop bounce. Compared with last week, the average purchase price of EAF steel scrap rose 106 yuan to 2967 yuan (excluding tax). However, due to the fact that scrap enterprises have basically finished going to the warehouse in the early stage, coupled with the impact of heavy rain, the amount of scrap delivered by steel plants has not increased but decreased.

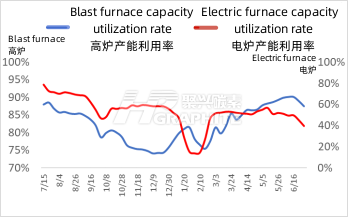

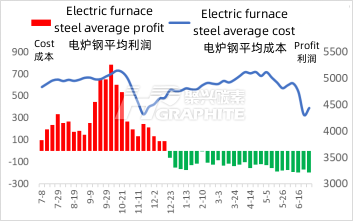

In terms of steel production situation: A few electric furnace steel plants in Jiangsu, Guizhou and Shaanxi resumed production this week, but most of them are still in limited production. The number of shutdown and maintenance manufacturers in Sichuan, Hubei and Northeast China has increased. According to statistics, this week, the utilization rate of China's 135 steel plants EAF steel capacity was 39.77%, 5.54% lower than last week, and EAF steel output was 223100 tons/day.

At present, the domestic steel market is still in the off-season of consumption, and the motivation for continuous price rebound is insufficient. In the short term, it is difficult to improve market demand significantly. It is expected that the domestic construction steel and scrap prices will mainly fluctuate next week, and EAF steel output still has room to decline. Contact us for carbon market analysis and consulting services.

No related results found

0 Replies