Calcined petroleum coke plays a crucial role in modern industrial production, especially in the aluminum and steel sectors. With its high carbon purity, low sulfur content, and low levels of impurities, it is widely used across multiple high-temperature and high-performance applications.

【Petroleum Coke】Latest Market Prices (April 16)

【Petroleum Coke】Latest Market Prices (April 16)

On April 16, the average price of petroleum coke in the Chinese market was 2,861 RMB/ton, down 8 RMB from the previous working day, a decrease of 0.28%. The overall market sentiment remained stable today, with major refiners maintaining stable pricing and shipments. Downstream buyers continued to place orders based on their production schedules. Local refineries saw moderate sales, with prices mostly trending downward.

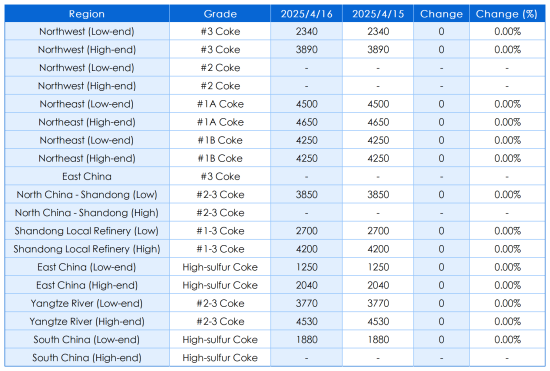

Main Regional Market Transaction Prices

Sinopec-affiliated refineries shipped according to demand. In the Yangtze River area, Anqing Petrochemical mainly supplies anode materials. Hunan Petrochemical is scheduled for maintenance on April 20, while Jiujiang Petrochemical remains under maintenance. Other refineries maintained stable shipments. In South China, Beihai Refining is undergoing maintenance, with only Guangzhou Petrochemical operating normally, maintaining stable outbound volume. In Northwest China, Tarim Petrochemical mainly supplies terminal downstream customers, with traders restricting inflows.

Under CNPC, Daqing and Jinxi Petrochemical plants in Northeast China are under maintenance, supporting supply-side sentiment. The market is currently buyer-driven, with tepid downstream purchasing activity. Refineries in Northwest China are operating normally, while Karamay Petrochemical's 1 million ton coking unit maintenance schedule is yet to be determined.

CNOOC-affiliated refineries are dispatching according to orders.

In terms of local refineries, petroleum coke sales were generally average today, with prices mostly declining. Due to low downstream enthusiasm and cautious purchasing, some refineries faced delivery difficulties, leading to price cuts of 10–100 RMB/ton. A few refineries, supported by smooth sales and low inventory levels, raised prices slightly by 5–50 RMB/ton. Today, Xintai Petrochemical (South District) adjusted its petroleum coke sulfur content to 4.5%, with an offer price of 1,800 RMB/ton.

For imported coke, high-sulfur products dominated the market recently. Overall port-side activity remained weak, with traders actively shipping, but downstream carbon plants procured only as needed, making it difficult to push up import coke prices.

Feel free to contact us anytime for more information about the petroleum coke market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies