【Graphite Electrodes】January-October Market Review: Modest Boost Expected in Q4

【Graphite Electrodes】January-October Market Review: Modest Boost Expected in Q4

Market Review

The Chinese graphite electrode market in 2024 was largely sluggish, with prices trending downward. Weak demand from the steel sector, impacted by a downturn in the real estate market, exacerbated the challenges for graphite electrode producers, who faced sustained losses throughout the year.

Many small and medium-sized graphite electrode enterprises ceased production, relying on existing inventories to minimize losses, adhering to a "less production, less loss" principle. Although a collective price hike attempt was made in July, actual transaction prices remained low due to oversupply and weak demand, undermining market confidence.

By early October, macroeconomic policies and rising rebar prices boosted market confidence. This led to a shift in the graphite electrode market, with producers planning price increases.

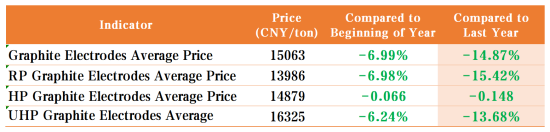

Graphite Electrode Market Price Trends in 2024 (as of early October)

Supply Analysis

As of early October, operating rates in the graphite electrode industry ranged between 30%-45%, lower than the previous year. Major producers maintained production, ensuring supply-demand balance. In contrast, smaller enterprises largely refrained from operations, awaiting more favorable conditions.

Throughout the year:

· Q1: Production was disrupted due to weather and equipment maintenance, but resumed after the Spring Festival as temperatures rose.

· Q2-Q3: Persistently weak demand and low prices deterred production, leading to widespread production cuts.

Demand Analysis

Real estate sector sluggishness and slower infrastructure investment led to reduced demand for construction steel, with low rebar prices and unprofitable EAF steel production further dampening demand for graphite electrodes. Long-process steel mills procured small-sized electrodes on a need basis, with no significant stockpiling during the traditional peak season of September-October.

Other markets, such as yellow phosphorus and silicon metal, also showed poor performance, contributing to reduced electrode demand.

Cost Analysis

Prices of upstream raw materials, such as low-sulfur calcined coke, needle coke, and coal tar pitch, declined compared to last year, reducing cost support for graphite electrodes. In an effort to cut costs, producers adjusted raw material blends, resulting in varying product quality.

Market Outlook

By October, favorable macroeconomic policies led to price increases of RMB 300-500/ton. Supportive measures such as interest rate and reserve ratio cuts showed potential for improved profitability in the EAF steel sector. While downstream steel mills might accept these price hikes, actual demand for graphite electrodes is expected to remain limited, with procurement focused on immediate needs.

In Q4, the graphite electrode market is likely to stabilize, with limited room for significant price adjustments. Pre-Spring Festival restocking could provide a slight boost to transactions.

(Source: Baiinfo)

Feel free to contact us anytime for more information about the Graphite Electrodes market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies