【Anode Materials】Prices Edge Up: Anode Materials and Raw Material Price Trends in Q1 2025

The rapid growth of EVs and energy storage boosts demand for graphitized petroleum coke, mainly driven by increased use in lithium battery anodes.

【Anode Materials】Prices Edge Up: Analysis of Anode Materials and Raw Material Price Trends in Q1 2025

In the first quarter of 2025, petroleum coke prices experienced significant volatility, increasing production costs for downstream sectors such as anode materials and prebaked anodes, attracting close market attention.

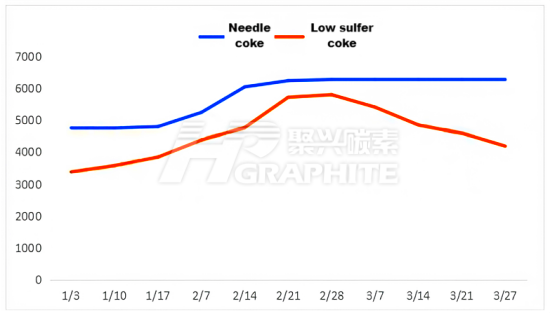

Petroleum Coke Prices Surged Then Declined

As a critical raw material for anode materials, petroleum coke saw a sharp price increase during Q1. The average price at the beginning of the year was approximately RMB 3,383/ton, which soared to RMB 5,808/ton by the end of February, representing a 71.7% increase. Needle coke prices also rose, from RMB 4,766/ton at the start of the year to RMB 6,286/ton by late February.

Chart: Q1 2025 Anode Material Raw Material Price Trends (RMB/ton)

Data Source: ICC Xinluo Information

This round of price increases was driven by multiple supply and demand factors. On the supply side, domestic refineries conducted centralized spring maintenance in line with environmental policies and equipment upgrades. Since January 1, 2025, China adjusted tariff rates and codes for fuel oil imports, raising import costs for local refineries, some of which opted to reduce operating rates. Meanwhile, on the import side, downstream companies actively restocked after the holiday, further depleting port petroleum coke inventories. On the demand side, operating rates at anode and prebaked anode enterprises were strong, with downstream companies actively purchasing to secure production. The combination of reduced supply and strong demand led to significant price increases.

Since March, excessive earlier prices have weakened downstream purchasing interest. Coupled with a gradual increase in low-sulfur coke arrivals, supply pressure eased. As a result, low-sulfur coke prices declined. By the end of the month, downstream procurement interest improved, leading to a slight price rebound for low-sulfur coke.

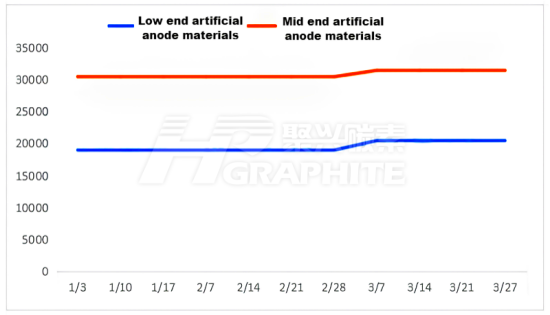

Anode Material Prices Saw Modest Increases

Petroleum coke, being the core raw material for lithium battery anodes, directly affects production costs. During the peak price period, most anode manufacturers faced losses.

In a relatively abundant supply environment, costs played a more decisive role in anode pricing, with material producers generally holding strong pricing sentiment. Since petroleum coke is primarily used in mid- and low-end anode products, prices in this segment rose slightly in early March. Low-end anode materials increased by RMB 1,500/ton to RMB 20,500/ton, while mid-range anode materials rose by RMB 1,000/ton to RMB 31,500/ton.

Chart: Q1 2025 Anode Materials Price Trends (RMB/ton)

Data Source: ICC Xinluo Information

Outlook

Some domestic low-sulfur coke producers are expected to begin maintenance in April, and prices may see further upward movement in early to mid-April. However, the magnitude of fluctuations is likely to be milder than earlier periods, and the petroleum coke and related downstream markets are expected to gradually stabilize.

Feel free to contact us anytime for more information about the artificial graphite anode market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies