【Steel】Causes and Structural Changes Behind China's High Growth in Steel Exports

Graphite electrodes are the "lifeline" of EAF steelmaking! As the core material for arc conduction and heating, they feature high conductivity and heat resistance, directly affecting molten steel quality and output. Mastering graphite electrodes means mastering the initiative in EAF steelmaking!

【Steel】Causes and Structural Changes Behind China's High Growth in Steel Exports

From 2024 to 2025, the global trade environment has posed significantly greater challenges to China's steel exports. Major target markets—including Southeast Asia, the European Union, and several Latin American countries—have launched intensive anti-dumping investigations against Chinese steel products, particularly hot-rolled coils, cold-rolled coils, galvanized sheets, and stainless steel plates. Trade frictions have escalated markedly.

Meanwhile, the implementation of the EU Carbon Border Adjustment Mechanism (CBAM) and similar new carbon tariff systems has begun in earnest, imposing stricter requirements on the calculation, disclosure, and cost-sharing of carbon footprints for export products, thereby further complicating the international trade landscape.

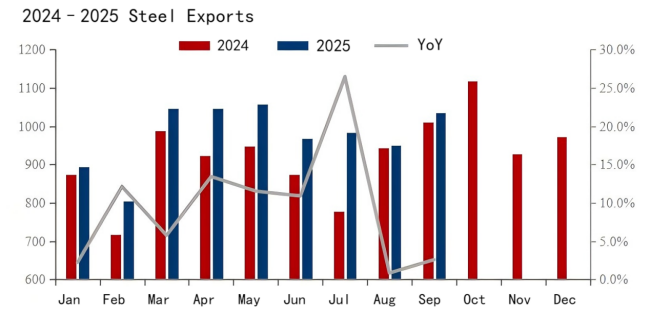

Despite these trade barriers, China's total steel exports have continued to grow strongly. Data show that from January to September 2025, China exported a total of 87.96 million tons of steel, an increase of 7.4 million tons year-on-year, representing a 9.2% rise. In contrast, steel imports remained sluggish—totaling only 4.53 million tons during the same period, down 650,000 tons or 12.6% year-on-year.

There are roughly three reasons behind this strong export growth:

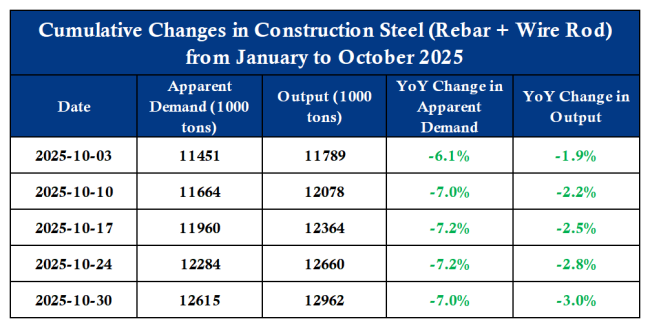

First, the domestic supply-demand imbalance has intensified (particularly severe oversupply in construction steel), increasing the willingness to export.

Second, China retains a significant cost advantage, with large domestic-foreign price differentials.

Third, exporters have adjusted product types and destination markets, adopting flexible export strategies.

Domestic structural oversupply in construction steel has driven companies to enhance export efforts. The domestic real estate market continues its deep adjustment, while infrastructure investment growth has slowed marginally, leading to a sharp decline in demand for construction steel (such as rebar and wire rod). From January to September, apparent consumption dropped by 7.2% year-on-year. This structural surplus—especially the heavy inventory pressure in construction steel—has forced steel mills to turn to international markets, using exports to ease domestic market strain.

China's cost advantage in steel production is not only derived from resource endowments but also from industrial efficiency and economies of scale. Domestic coking coal output remains stable, complemented by low-cost imports from Mongolia, giving Chinese steelmakers a 30%-40% cost advantage in coking coal procurement over their European counterparts.

In terms of energy costs, large domestic steel mills operate self-owned power plants (mainly coal-fired), achieving an average electricity cost of about USD 40 per ton of steel—over 60% lower than in Europe (which relies mainly on natural gas power). Together with massive production scale, complete upstream-downstream integration, efficient logistics, and ongoing process improvements, these factors form a comprehensive cost advantage that is difficult to challenge in the short term.

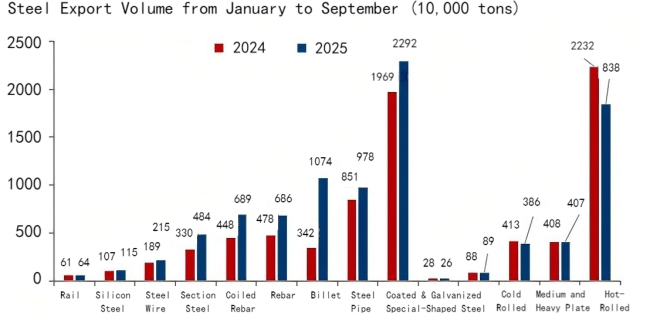

Export strategies have evolved, with major changes in product and destination structures. Export growth has been driven largely by long products. Due to severe oversupply and collapsing domestic demand, long products (especially finished construction steel and semi-finished billets used in long products) have become heavily reliant on exports to absorb excess capacity. From January to September, exports of rebar, wire rod, sections, and steel pipes increased by 44%, 54%, 47%, and 15% year-on-year, respectively.

Flat product exports, on the other hand, have slowed significantly. Directly impacted by anti-dumping actions, exports of common flat steels such as hot-rolled and cold-rolled coils have either decelerated or declined. From January to September, hot-rolled coil exports fell by 17.7% year-on-year. Exporters are actively adjusting their strategies—on one hand, exploring niche flat steel segments less affected by trade barriers (such as high-grade specialty steels and coated sheets); on the other, improving compliance through semi-finished exports.

Steel billet exports have surged, showing a substantial increase in both volume and share, primarily consisting of long-product billets (square billets). From January to September, China exported a total of 10.74 million tons of steel billets, up 214% year-on-year. Reports indicate that exporters continue to proactively expand their product portfolios to respond to escalating international trade barriers.

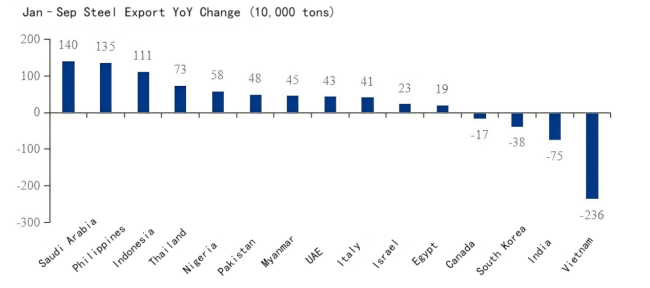

The destination structure of China's steel exports has also shifted, showing an increasingly diversified trend with rising importance of emerging markets.

Traditional markets are under pressure. Vietnam remains China's largest steel export destination (7.12 million tons from January to September), but frequent anti-dumping actions—five rulings already in 2025—have caused exports to drop by 24.9% year-on-year. Anti-dumping measures from South Korea have also led to reduced exports.

Emerging markets, however, are on the rise. Other Southeast Asian countries have effectively offset declines from Vietnam and South Korea. In the Middle East, countries like Saudi Arabia and the UAE continue advancing infrastructure projects, increasing dependence on Chinese steel (especially high-end plates and structural steels). African markets are unlocking their potential, with imports from Nigeria, Tanzania, and Ghana rising sharply, emerging as new growth points. In South America, recovering macroeconomic conditions have boosted steel import demand, with countries such as Brazil, Peru, and Chile reporting higher import volumes.

In conclusion, supported by strong global cost competitiveness and flexible export strategies, China's steel exports are expected to reach 120 million tons in 2025—a record high—and to remain between 110–120 million tons in 2026.

In terms of product structure, exports of long products and billets will continue to lead growth, while flat product exports will slow due to trade frictions. In terms of geographic structure, export destinations will become increasingly diversified, with expansion continuing toward emerging markets in Asia, the Middle East, Africa, and Latin America.

Feel free to contact us anytime for more information about the EAF Steel market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies