【Anode Materials】Low-Sulfur Coke Ends Its Continuous Rise — What Will Be the Next Trend...

The rapid growth of the EV and energy storage industries is boosting demand for high-performance lithium batteries, driving the market for quality petroleum coke and synthetic graphite. The quality and particle size of calcined petroleum coke directly affect synthetic graphite performance, especially in anode production.

【Anode Materials】Low-Sulfur Coke Ends Its Continuous Rise — What Will Be the Next Trend for the Anode Materials Market?

Since June 2025, the price of low-sulfur coke has been gradually rising, and by December the continuous increase has come to an end. Currently, the production cost of artificial graphite anode materials remains high, and profits are under pressure. But as the unstoppable rise of low-sulfur coke ends, what will be the next trend in the anode materials market?

I. The Price of Low-Sulfur Coke Has Ended Its Continuous Increase

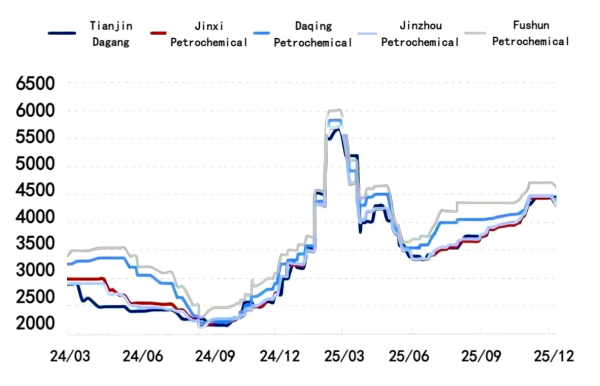

Figure 1 Low-Sulfur Petroleum Coke Price Trend (Unit: RMB/ton)

Data Source: Oilchem

The low-sulfur coke market experienced sharp rises and falls in the first half of the year, followed by a slow upward trend in the second half, reaching a high point in mid-November before slowly declining. After the rapid fluctuations, low-sulfur coke prices fell to the lowest level of 2025 in June, with 2A and No.1 regular-grade coke dropping to 3,300–3,400 RMB/ton.

After hitting the bottom, downstream purchasing enthusiasm quickly increased, and downstream buyers began to procure large volumes, driving a rebound in low-sulfur coke prices. Since then, low-sulfur coke entered a five-month upward cycle.

After half a year of increases, the average price of low-sulfur coke climbed to over 4,400 RMB/ton. Both graphite electrode and anode material enterprises found it difficult to accept these prices, resulting in slower refinery shipments. As a result, refineries slightly lowered prices to stimulate sales.

II. Artificial Graphite Costs Remain at High Levels

Table 1 Price Comparison Table of Artificial Graphite and Raw Materials (RMB/ton)

In December, graphitization processing fees increased by 200 RMB/ton, mainly because the flood season in Southwest China ended, electricity prices rose, and the prices of insulation materials and resistive materials continued to increase. These factors raised production pressure for processing enterprises, leading to a strong willingness to push processing prices upward.

Acheson-furnace graphitization costs rose to 8,500–9,500 RMB/ton, while box-furnace graphitization costs reached 7,500–8,500 RMB/ton.

Costs for artificial graphite continue to rise. In both power battery and energy storage applications, the market prices of new anode orders increased by about 2,000 RMB/ton compared with last month.

Mainstream prices:

Mid-range products: 25,500–34,500 RMB/ton

High-end power battery products: 31,500–36,500 RMB/ton

Consumer electronics: 45,000–65,000 RMB/ton

Low-end products: 19,500–25,500 RMB/ton。

III. Artificial Graphite Profits Are Recovering

Figure 2 Monthly Profit and Price Comparison of Artificial Graphite Anode Materials (Unit: RMB/ton)

Data Source: Oilchem

Both raw material costs and graphitization processing fees for mid-range artificial graphite anodes have increased. With the rising cost pressure, anode manufacturers have negotiated new contract prices with downstream battery enterprises. Some regions saw contract price increases in the anode materials market, enabling profit recovery for mid-range artificial graphite anode materials.

In the new energy vehicle sector, benefiting from the "Purchase Tax Reduction" policy window, production and sales are expected to rise further. The energy storage market continues to show explosive demand, directly driving an increase in orders for anode materials enterprises. Meanwhile, demand in the consumer electronics segment remains relatively stable.

Overall, demand-side growth combined with cost-side support has led anode material enterprises to maintain a generally bullish outlook. However, strong price suppression from downstream cell manufacturers continues to limit price increases. It is expected that anode material prices will remain stable throughout December.

Feel free to contact us anytime for more information about the Anode Material market. Our team is dedicated to providing you with in-depth insights and customized assistance based on your needs. Whether you have questions about product specifications, market trends, or pricing, we are here to help.

No related results found

0 Replies